MetLife 2013 Annual Report Download - page 47

Download and view the complete annual report

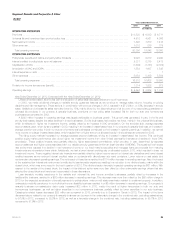

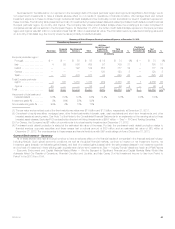

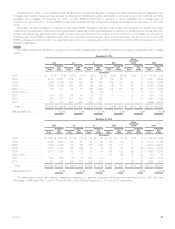

Please find page 47 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net investment income decreased $31 million, excluding the FHLB which is discussed below and the divested MetLife Bank operations, driven by

an increase in the amount credited to the segments due to growth in the economic capital managed by Corporate & Other on their behalf and lower

returns from our alternative investments, partially offset by higher returns on real estate joint ventures.

Operating earnings on invested assets that were funded using the FHLB advances decreased $35 million, reflected by decreases in net

investment income and interest expense on debt, due to the transfer of $3.8 billion of FHLB advances and underlying assets from MetLife Bank to

Corporate Benefit Funding in April 2012.

Corporate & Other benefits from the impact of certain permanent tax differences, including non-taxable investment income and tax credits for

investments in low income housing. As a result, our effective tax rates differ from the U.S. statutory rate of 35%. In 2012, we benefited primarily from

higher utilization of tax preferenced investments which improved operating earnings by $32 million over 2011.

Interest expense on debt, excluding the FHLB which is discussed above, decreased $25 million primarily due to maturity of $750 million in long-

term debt in December 2011.

Effects of Inflation

Management believes that inflation has not had a material effect on the Company’s consolidated results of operations, except insofar as inflation may

affect interest rates.

An increase in inflation could affect our business in several ways. During inflationary periods, the value of fixed income investments falls which could

increase realized and unrealized losses. Inflation also increases expenses for labor and other materials, potentially putting pressure on profitability if such

costs cannot be passed through in our product prices. Inflation could also lead to increased costs for losses and loss adjustment expenses in certain of

our businesses, which could require us to adjust our pricing to reflect our expectations for future inflation. Prolonged and elevated inflation could

adversely affect the financial markets and the economy generally, and dispelling it may require governments to pursue a restrictive fiscal and monetary

policy, which could constrain overall economic activity, inhibit revenue growth and reduce the number of attractive investment opportunities.

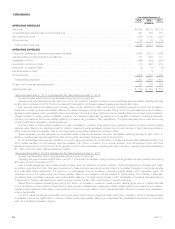

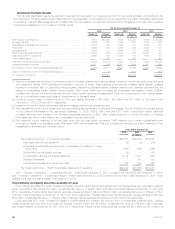

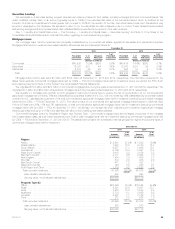

Investments

Investment Risks

Our primary investment objective is to optimize, net of income tax, risk-adjusted investment income and risk-adjusted total return while ensuring that

assets and liabilities are managed on a cash flow and duration basis. The Investments Department, led by the Chief Investment Officer, manages

investment risks using a risk control framework comprised of policies, procedures and limits, as discussed further below. The Investments Risk

Committee of our Global Risk Management (“GRM”) Department reviews, monitors and reports investment risk limits and tolerances. We are exposed to

the following primary sources of investment risks:

‰credit risk, relating to the uncertainty associated with the continued ability of a given obligor to make timely payments of principal and interest;

‰interest rate risk, relating to the market price and cash flow variability associated with changes in market interest rates. Changes in market interest

rates will impact the net unrealized gain or loss position of our fixed income investment portfolio and the rates of return we receive on both new

funds invested and reinvestment of existing funds;

‰liquidity risk, relating to the diminished ability to sell certain investments, in times of strained market conditions;

‰market valuation risk, relating to the variability in the estimated fair value of investments associated with changes in market factors such as credit

spreads. A widening of credit spreads will adversely impact the net unrealized gain (loss) position of the fixed income investment portfolio, will

increase losses associated with credit-based non-qualifying derivatives where we assume credit exposure, and, if credit spreads widen

significantly or for an extended period of time, will likely result in higher OTTI. Credit spread tightening will reduce net investment income

associated with purchases of fixed maturity securities and will favorably impact the net unrealized gain (loss) position of the fixed income

investment portfolio;

‰currency risk, relating to the variability in currency exchange rates for foreign denominated investments. This risk relates to potential decreasesin

estimated fair value and net investment income resulting from changes in currency exchange rates versus the U.S. dollar. In general, the

weakening of foreign currencies versus the U.S. dollar will adversely affect the estimated fair value of our foreign denominated investments; and

‰real estate risk, relating to commercial, agricultural and residential real estate, and stemming from factors, which include, but are not limited to,

market conditions, including the demand and supply of leasable commercial space, creditworthiness of tenants and partners, capital markets

volatility and the inherent interest rate movement.

We manage investment risk through in-house fundamental credit analysis of the underlying obligors, issuers, transaction structures and real estate

properties. We also manage credit risk, market valuation risk and liquidity risk through industry and issuer diversification and asset allocation. Risk limits

to promote diversification by asset sector, avoid concentrations in any single issuer and limit overall aggregate credit exposure as measured by our

economic capital framework are approved annually by a committee of directors that oversees our investment portfolio. For real estate assets, we

manage credit risk and market valuation risk through geographic, property type and product type diversification and asset allocation. We manage

interest rate risk as part of our ALM strategies. These strategies include maintaining an investment portfolio with diversified maturities that has a weighted

average duration that is approximately equal to the duration of our estimated liability cash flow profile, and utilizing product design, such as the use of

market value adjustment features and surrender charges, to manage interest rate risk. We also manage interest rate risk through proactive monitoring

and management of certain non-guaranteed elements of our products, such as the resetting of credited interest and dividend rates for policies that

permit such adjustments. In addition to hedging with foreign currency derivatives, we manage currency risk by matching much of our foreign currency

liabilities in our foreign subsidiaries with their respective foreign currency assets, thereby reducing our risk to foreign currency exchange rate fluctuation.

We also use certain derivatives in the management of credit, interest rate, and equity market risks.

We use purchased credit default swaps to mitigate credit risk in our investment portfolio. Generally, we purchase credit protection by entering into

credit default swaps referencing the issuers of specific assets we own. In certain cases, basis risk exists between these credit default swaps and the

specific assets we own. For example, we may purchase credit protection on a macro basis to reduce exposure to specific industries or other portfolio

concentrations. In such instances, the referenced entities and obligations under the credit default swaps may not be identical to the individual obligors or

securities in our investment portfolio. In addition, our purchased credit default swaps may have shorter tenors than the underlying investments they are

hedging. However, we dynamically hedge this risk through the rebalancing and rollover of its credit default swaps at their most liquid tenors. We believe

that our purchased credit default swaps serve as effective economic hedges of our credit exposure.

We generally enter into market standard purchased and written credit default swap contracts. Payout under such contracts is triggered by certain

credit events experienced by the referenced entities. For credit default swaps covering North American corporate issuers, credit events typically include

MetLife, Inc. 39