MetLife 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

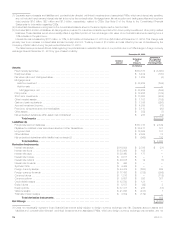

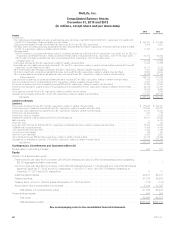

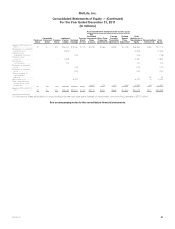

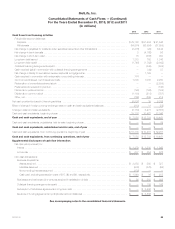

MetLife, Inc.

Consolidated Balance Sheets

December 31, 2013 and 2012

(In millions, except share and per share data)

2013 2012

Assets

Investments:

Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $333,599 and $340,870, respectively; includes $4,005

and $3,378, respectively, relating to variable interest entities) .............................................................. $ 350,187 $ 374,266

Equity securities available-for-sale, at estimated fair value (cost: $3,012 and $2,838, respectively) ................................... 3,402 2,891

Fair value option and trading securities, at estimated fair value (includes $662 and $659, respectively, of actively traded securities; and $92

and $112, respectively, relating to variable interest entities) ................................................................ 17,423 16,348

Mortgage loans:

Held-for-investment, principally at amortized cost (net of valuation allowances of $322 and $347, respectively; includes $1,621 and $2,715,

respectively, at estimated fair value, relating to variable interest entities; includes $338 and $0, respectively, under the fair value option) . . . 57,703 56,592

Held-for-sale, principally at estimated fair value (includes $0 and $49, respectively, under the fair value option) ........................ 3 414

Mortgage loans, net ............................................................................................. 57,706 57,006

Policy loans (includes $2 and $0, respectively, relating to variable interest entities) ............................................... 11,764 11,884

Real estate and real estate joint ventures (includes $1,141 and $10, respectively, relating to variable interest entities; includes $186 and $1,

respectively, of real estate held-for-sale) .............................................................................. 10,712 9,918

Other limited partnership interests (includes $53 and $274, respectively, relating to variable interest entities) ........................... 7,401 6,688

Short-term investments, principally at estimated fair value (includes $8 and $0, respectively, relating to variable interest entities) ............ 13,955 16,906

Other invested assets, principally at estimated fair value (includes $78 and $81, respectively, relating to variable interest entities) ........... 16,229 21,145

Total investments ............................................................................................ 488,779 517,052

Cash and cash equivalents, principally at estimated fair value (includes $70 and $99, respectively, relating to variable interest entities) ........ 7,585 15,738

Accrued investment income (includes $26 and $13, respectively, relating to variable interest entities) .................................. 4,255 4,374

Premiums, reinsurance and other receivables (includes $22 and $5, respectively, relating to variable interest entities) ..................... 21,859 21,634

Deferred policy acquisition costs and value of business acquired (includes $255 and $0, respectively, relating to variable interest entities) ..... 26,706 24,761

Goodwill ......................................................................................................... 10,542 9,953

Other assets (includes $152 and $5, respectively, relating to variable interest entities) .............................................. 8,369 7,876

Separate account assets (includes $1,033 and $0, respectively, relating to variable interest entities) .................................. 317,201 235,393

Total assets ................................................................................................. $ 885,296 $ 836,781

Liabilities and Equity

Liabilities

Future policy benefits (includes $516 and $0, respectively, relating to variable interest entities) ....................................... $ 187,942 $ 192,351

Policyholder account balances (includes $56 and $0, respectively, relating to variable interest entities) ................................. 212,885 225,821

Other policy-related balances (includes $123 and $0, respectively, relating to variable interest entities) ................................. 15,214 15,463

Policyholder dividends payable ........................................................................................ 675 728

Policyholder dividend obligation ........................................................................................ 1,771 3,828

Payables for collateral under securities loaned and other transactions .......................................................... 30,411 33,687

Bank deposits ..................................................................................................... — 6,416

Short-term debt .................................................................................................... 175 100

Long-term debt (includes $1,868 and $2,527, respectively, at estimated fair value, relating to variable interest entities) .................... 18,653 19,062

Collateral financing arrangements ...................................................................................... 4,196 4,196

Junior subordinated debt securities ..................................................................................... 3,193 3,192

Current income tax payable ........................................................................................... 186 401

Deferred income tax liability ........................................................................................... 6,643 8,693

Other liabilities (includes $88 and $40, respectively, relating to variable interest entities) ............................................ 23,168 22,492

Separate account liabilities (includes $1,033 and $0, respectively, relating to variable interest entities) ................................. 317,201 235,393

Total liabilities ................................................................................................ 822,313 771,823

Contingencies, Commitments and Guarantees (Note 21)

Redeemable noncontrolling interests ...................................................................... 887 121

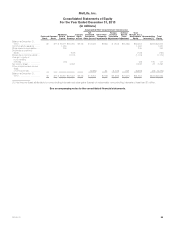

Equity

MetLife, Inc.’s stockholders’ equity: .......................................................................

Preferred stock, par value $0.01 per share; 200,000,000 shares authorized: 84,000,000 shares issued and outstanding;

$2,100 aggregate liquidation preference ............................................................... 1 1

Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 1,125,224,024 and 1,094,880,623 shares

issued at December 31, 2013 and 2012, respectively; 1,122,030,137 and 1,091,686,736 shares outstanding at

December 31, 2013 and 2012, respectively ............................................................ 11 11

Additional paid-in capital .............................................................................. 29,277 28,011

Retained earnings ................................................................................... 27,332 25,205

Treasury stock, at cost; 3,193,887 shares at December 31, 2013 and 2012 ..................................... (172) (172)

Accumulated other comprehensive income (loss) .......................................................... 5,104 11,397

Total MetLife, Inc.’s stockholders’ equity .............................................................. 61,553 64,453

Noncontrolling interests ................................................................................ 543 384

Total equity .................................................................................... 62,096 64,837

Total liabilities and equity .......................................................................... $885,296 $836,781

See accompanying notes to the consolidated financial statements.

82 MetLife, Inc.