MetLife 2013 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

18. Employee Benefit Plans

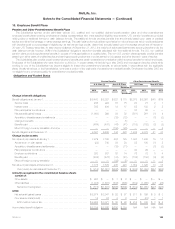

Pension and Other Postretirement Benefit Plans

The Subsidiaries sponsor and/or administer various U.S. qualified and non-qualified defined benefit pension plans and other postretirement

employee benefit plans covering employees and sales representatives who meet specified eligibility requirements. U.S. pension benefits are provided

utilizing either a traditional formula or cash balance formula. The traditional formula provides benefits that are primarily based upon years of credited

service and either final average or career average earnings. The cash balance formula utilizes hypothetical or notional accounts which credit participants

with benefits equal to a percentage of eligible pay, as well as earnings credits, determined annually based upon the average annual rate of interest on

30-year U.S. Treasury securities, for each account balance. At December 31, 2013, the majority of active participants were accruing benefits under the

cash balance formula; however, 90% of the Subsidiaries’ obligations result from benefits calculated with the traditional formula. The U.S. non-qualified

pension plans provide supplemental benefits in excess of limits applicable to a qualified plan. The non-U.S. pension plans generally provide benefits

based upon either years of credited service and earnings preceding-retirement or points earned on job grades and other factors in years of service.

The Subsidiaries also provide certain postemployment benefits and certain postretirement medical and life insurance benefits for retired employees.

Employees of the Subsidiaries who were hired prior to 2003 (or, in certain cases, rehired during or after 2003) and meet age and service criteria while

working for one of the Subsidiaries may become eligible for these other postretirement benefits, at various levels, in accordance with the applicable

plans. Virtually all retirees, or their beneficiaries, contribute a portion of the total costs of postretirement medical benefits. Employees hired after 2003 are

not eligible for any employer subsidy for postretirement medical benefits.

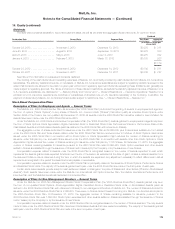

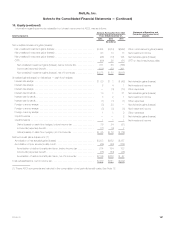

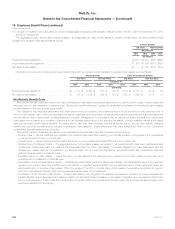

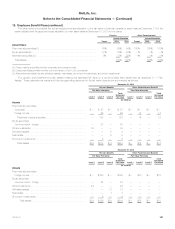

Obligations and Funded Status

Pension Benefits Other Postretirement Benefits

U.S. Plans (1) Non-U.S. Plans U.S. Plans Non-U.S. Plans

December 31,

2013 2012 2013 2012 2013 2012 2013 2012

(In millions)

Change in benefit obligations:

Benefit obligations at January 1, .................................. $9,480 $ 8,327 $ 823 $ 773 $2,375 $ 2,093 $ 43 $ 39

Service costs .............................................. 236 224 67 75 20 21 2 1

Interest costs ............................................... 389 406 14 17 92 103 2 2

Plan participants’ contributions ................................. — — — — 30 29 — —

Net actuarial (gains) losses .................................... (1,050) 999 34 32 (551) 261 (1) 4

Acquisition, divestitures and curtailments ......................... — — (19) (12) — — (3) (3)

Change in benefits .......................................... — — — (1) — — — —

Benefits paid ............................................... (464) (476) (41) (41) (132) (132) (2) (2)

Effect of foreign currency translation and other ..................... — — (134) (20) — — — 2

Benefit obligations at December 31, ............................... 8,591 9,480 744 823 1,834 2,375 41 43

Change in plan assets:

Fair value of plan assets at January 1, ............................. 7,879 7,108 224 185 1,320 1,240 15 13

Actual return on plan assets ................................... (22) 740 34 20 58 105 (1) 2

Acquisition, divestitures and settlements .......................... — — (19) (11) — — (3) (3)

Plan participants’ contributions ................................. — — — — 30 29 — —

Employer contributions ....................................... 383 507 83 74 76 78 5 4

Benefits paid ............................................... (464) (476) (41) (41) (132) (132) (2) (2)

Effect of foreign currency translation ............................. — — (33) (3) — — — 1

Fair value of plan assets at December 31, .......................... 7,776 7,879 248 224 1,352 1,320 14 15

Over (under) funded status at December 31, .................... $ (815) $(1,601) $(496) $(599) $ (482) $(1,055) $(27) $(28)

Amounts recognized in the consolidated balance sheets

consist of:

Other assets ............................................... $ 223 $ — $ 7 $ 6 $ — $ — $ — $ —

Other liabilities .............................................. (1,038) (1,601) (503) (605) (482) (1,055) (27) (28)

Net amount recognized ..................................... $ (815) $(1,601) $(496) $(599) $ (482) $(1,055) $(27) $(28)

AOCI:

Net actuarial (gains) losses .................................... $2,274 $ 3,047 $ 28 $ 27 $ 211 $ 799 $ 2 $ 3

Prior service costs (credit) ..................................... 18 24 2 2 1 (74) 1 1

AOCI, before income tax .................................... $2,292 $ 3,071 $ 30 $ 29 $ 212 $ 725 $ 3 $ 4

Accumulated benefit obligation ................................... $8,104 $ 8,866 $ 636 $ 724 N/A N/A N/A N/A

MetLife, Inc. 189