MetLife 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

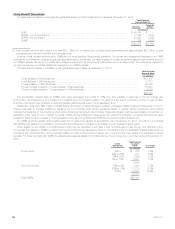

Credit and Committed Facilities

We maintain unsecured credit facilities and committed facilities, which aggregated $4.0 billion and $12.4 billion, respectively, at December 31,

2013. When drawn upon, these facilities bear interest at varying rates in accordance with the respective agreements.

The unsecured credit facilities are used for general corporate purposes, to support the borrowers’ commercial paper programs and for the

issuance of letters of credit. At December 31, 2013, we had outstanding $192 million in letters of credit and no drawdowns against these facilities.

Remaining availability was $3.8 billion at December 31, 2013. In connection with the October 2013 re-domestication of Exeter to Delaware and the

related redistribution of assets held in trust at Exeter, $1.9 billion of outstanding letters of credit were no longer required and therefore canceledby

the Company. Accordingly, remaining availability under the unsecured credit facilities increased by $1.9 billion in October 2013. See “— Executive

Summary” for further information regarding the re-domestication of Exeter and the Mergers.

The committed facilities are used for collateral for certain of our affiliated reinsurance liabilities. At December 31, 2013, $6.7 billion in lettersof

credit and $2.8 billion in aggregate drawdowns under collateral financing arrangements were outstanding against these facilities. Remaining

availability was $2.9 billion at December 31, 2013.

See Note 12 of the Notes to the Consolidated Financial Statements for further information about these facilities.

We have no reason to believe that our lending counterparties will be unable to fulfill their respective contractual obligations under these facilities.

As commitments associated with letters of credit and financing arrangements may expire unused, these amounts do not necessarily reflect our

actual future cash funding requirements.

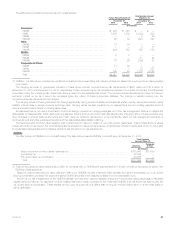

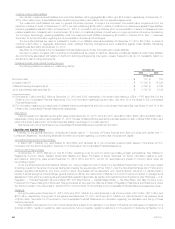

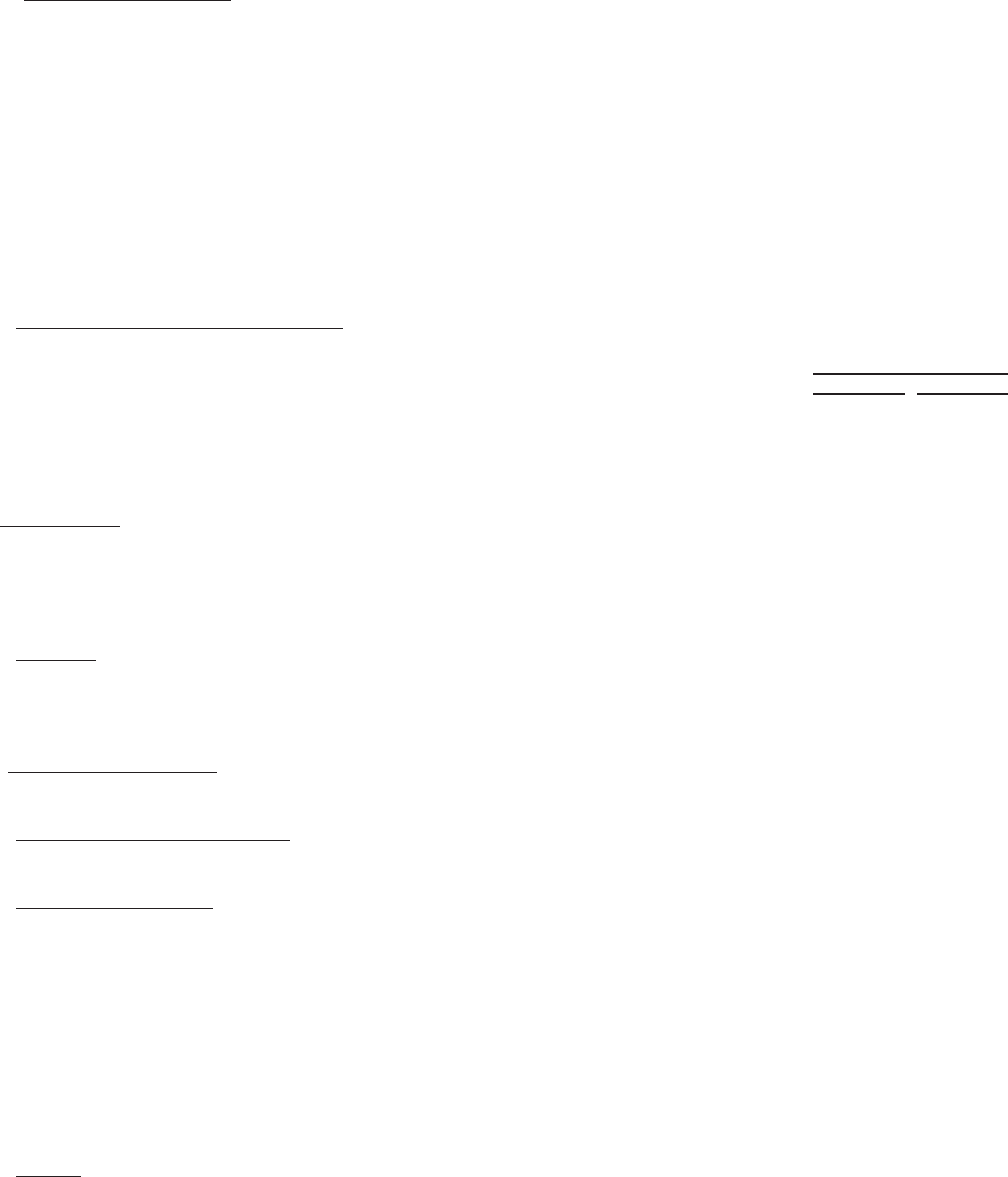

Outstanding Debt Under Global Funding Sources

The following table summarizes our outstanding debt at:

December 31,

2013 2012

(In millions)

Short-term debt .................................................................................. $ 175 $ 100

Long-term debt (1) ................................................................................ $ 17,198 $ 16,535

Collateral financing arrangements (2) .................................................................. $ 4,196 $ 4,196

Junior subordinated debt securities (2) ................................................................. $ 3,193 $ 3,192

(1) Excludes $1.5 billion and $2.5 billion at December 31, 2013 and 2012, respectively, of long-term debt relating to CSEs — FVO (see Note 8 of the

Notes to the Consolidated Financial Statements). For more information regarding long-term debt, see Note 12 of the Notes to the Consolidated

Financial Statements.

(2) For information regarding prior issuances of collateral financing arrangements and junior subordinated debt securities, see Notes 13 and 14 of the

Notes to the Consolidated Financial Statements, respectively.

Dispositions

Cash proceeds from dispositions during the years ended December 31, 2013, 2012 and 2011 were $407 million, $605 million and $449 million,

respectively. During the year ended December 31, 2013, the sale of MetLife Bank’s depository business resulted in cash outflows of $6.4 billion as a

result of the buyer’s assumption of the bank deposits liability in exchange for our cash payment.

See Notes 3 and 23 of the Notes to the Consolidated Financial Statements for additional information.

Liquidity and Capital Uses

In addition to the general description of liquidity and capital uses in “— Summary of Primary Sources and Uses of Liquidity and Capital” and “—

Contractual Obligations,” the following additional information is provided regarding our primary uses of liquidity and capital:

Convertible Preferred Stock Repurchases

In March 2011, MetLife, Inc. repurchased for $2.9 billion and canceled all of the convertible preferred stock issued in November 2010 in

connection with the ALICO Acquisition. See Note 16 of the Notes to the Consolidated Financial Statements.

Common Stock Repurchases

At December 31, 2013, MetLife, Inc. had $1.3 billion remaining under its common stock repurchase program authorizations. See “Market for

Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” for further information relating to such

authorizations. During the years ended December 31, 2013, 2012 and 2011, we did not repurchase any shares of common stock under the

repurchase program.

Under the aforementioned authorizations, MetLife, Inc. may purchase its common stock from the MetLife Policyholder Trust, in the open market

(including pursuant to the terms of a pre-set trading plan meeting the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934) and in

privately negotiated transactions. Any future common stock repurchases will be dependent upon several factors, including our capital position,

liquidity, financial strength and credit ratings, general market conditions, the market price of MetLife, Inc.’s common stock compared to management’s

assessment of the stock’s underlying value and applicable regulatory approvals, as well as other legal and accounting factors. See “Business — U.S.

Regulation — Potential Regulation as a Non-Bank SIFI” and “Risk Factors — Capital-Related Risks — We Have Been, and May Continue to be,

Prevented from Repurchasing Our Stock and Paying Dividends at the Level We Wish as a Result of Regulatory Restrictions and Restrictions Under

the Terms of Certain of Our Securities” in the 2013 Form 10-K and Note 16 of the Notes to the Consolidated Financial Statements elsewhere herein.

Dividends

During the years ended December 31, 2013, 2012 and 2011, MetLife, Inc. paid dividends on its common stock of $1.1 billion, $811 million and

$787 million, respectively. During each of the years ended December 31, 2013, 2012 and 2011, MetLife, Inc. paid dividends on its preferred stock

of $122 million. See Note 16 of the Notes to the Consolidated Financial Statements for information regarding the calculation and timing of these

dividend payments.

The declaration and payment of common stock dividends is subject to the discretion of our Board of Directors, and will depend on MetLife, Inc.’s

financial condition, results of operations, cash requirements, future prospects, regulatory restrictions on the payment of dividends by MetLife, Inc.’s

64 MetLife, Inc.