MetLife 2013 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

18. Employee Benefit Plans (continued)

U.S. Plans

The U.S. Subsidiaries provide employees with benefits under various Employee Retirement Income Security Act of 1974 (“ERISA”) benefit plans.

These include qualified pension plans, postretirement medical plans and certain retiree life insurance coverage. The assets of the U.S. Subsidiaries’

qualified pension plans are held in insurance group annuity contracts, and the vast majority of the assets of the postretirement medical plan and

backing the retiree life coverage are held in insurance contracts. All of these contracts are issued by Company insurance affiliates, and the assets

under the contracts are held in insurance separate accounts that have been established by the Company. The underlying assets of the separate

accounts are principally comprised of cash and cash equivalents, short-term investments, fixed maturity and equity securities, derivatives, real estate,

private equity investments and hedge fund investments.

The insurance contract provider engages investment management firms (“Managers”) to serve as sub-advisors for the separate accounts based

on the specific investment needs and requests identified by the plan fiduciary. These Managers have portfolio management discretion over the

purchasing and selling of securities and other investment assets pursuant to the respective investment management agreements and guidelines

established for each insurance separate account. The assets of the qualified pension plans and postretirement medical plans (the “Invested Plans”)

are well diversified across multiple asset categories and across a number of different Managers, with the intent of minimizing risk concentrations within

any given asset category or with any given Manager.

The Invested Plans, other than those held in participant directed investment accounts, are managed in accordance with investment policies

consistent with the longer-term nature of related benefit obligations and within prudent risk parameters. Specifically, investment policies are oriented

toward (i) maximizing the Invested Plan’s funded status; (ii) minimizing the volatility of the Invested Plan’s funded status; (iii) generating asset returns

that exceed liability increases; and (iv) targeting rates of return in excess of a custom benchmark and industry standards over appropriate reference

time periods. These goals are expected to be met through identifying appropriate and diversified asset classes and allocations, ensuring adequate

liquidity to pay benefits and expenses when due and controlling the costs of administering and managing the Invested Plan’s investments.

Independent investment consultants are periodically used to evaluate the investment risk of Invested Plan’s assets relative to liabilities, analyze the

economic and portfolio impact of various asset allocations and management strategies and to recommend asset allocations.

Derivative contracts may be used to reduce investment risk, to manage duration and to replicate the risk/return profile of an asset or asset class.

Derivatives may not be used to leverage a portfolio in any manner, such as to magnify exposure to an asset, asset class, interest rates or any other

financial variable. Derivatives are also prohibited for use in creating exposures to securities, currencies, indices or any other financial variable that is

otherwise restricted.

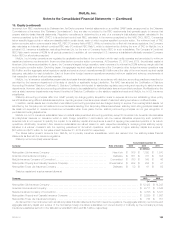

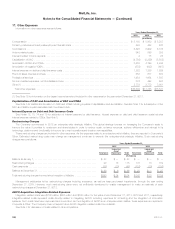

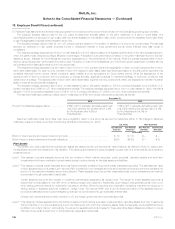

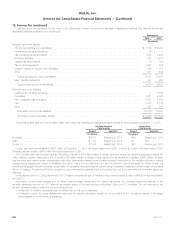

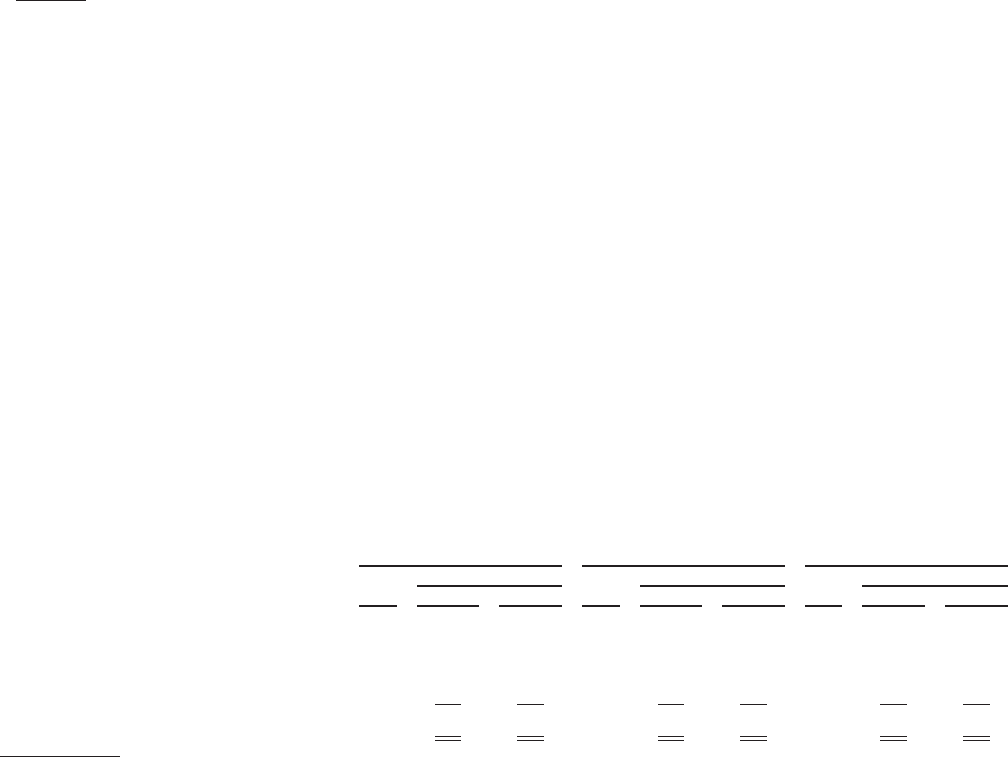

The table below summarizes the actual weighted average allocation of the fair value of total plan assets by asset class at December 31 for the

years indicated and the approved target allocation by major asset class at December 31, 2013 for the Invested Plans:

Pension Postretirement Medical Postretirement Life

Target

Actual Allocation

Target

Actual Allocation

Target

Actual Allocation

2013 2012 2013 2012 2013 2012

Asset Class:

Fixed maturity securities (1) ................... 75% 64% 69% 70% 52% 63% —% —% —%

Equity securities (2) ......................... 12% 23% 21% 30% 47% 37% —% —% —%

Alternative securities (3) ..................... 13% 13% 10% —% 1% —% 100% 100% 100%

Total assets ............................. 100% 100% 100% 100% 100% 100%

(1) Fixed maturity securities include primarily ABS, collateralized mortgage obligations, corporate, federal agency, foreign bonds, mortgage-backed

securities, municipals, preferred stocks and U.S. government bonds.

(2) Equity securities primarily include common stock of U.S. companies.

(3) Alternative securities primarily include derivative assets, money market securities, short-term investments and other investments. Postretirement life’s

target and actual allocation of plan assets are all in short-term investments.

MetLife, Inc. 193