MetLife 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

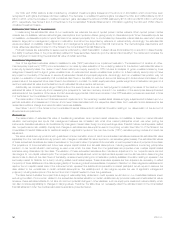

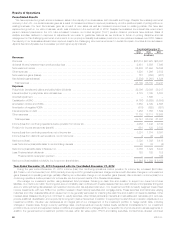

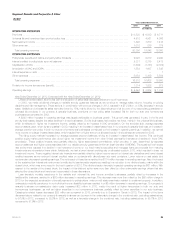

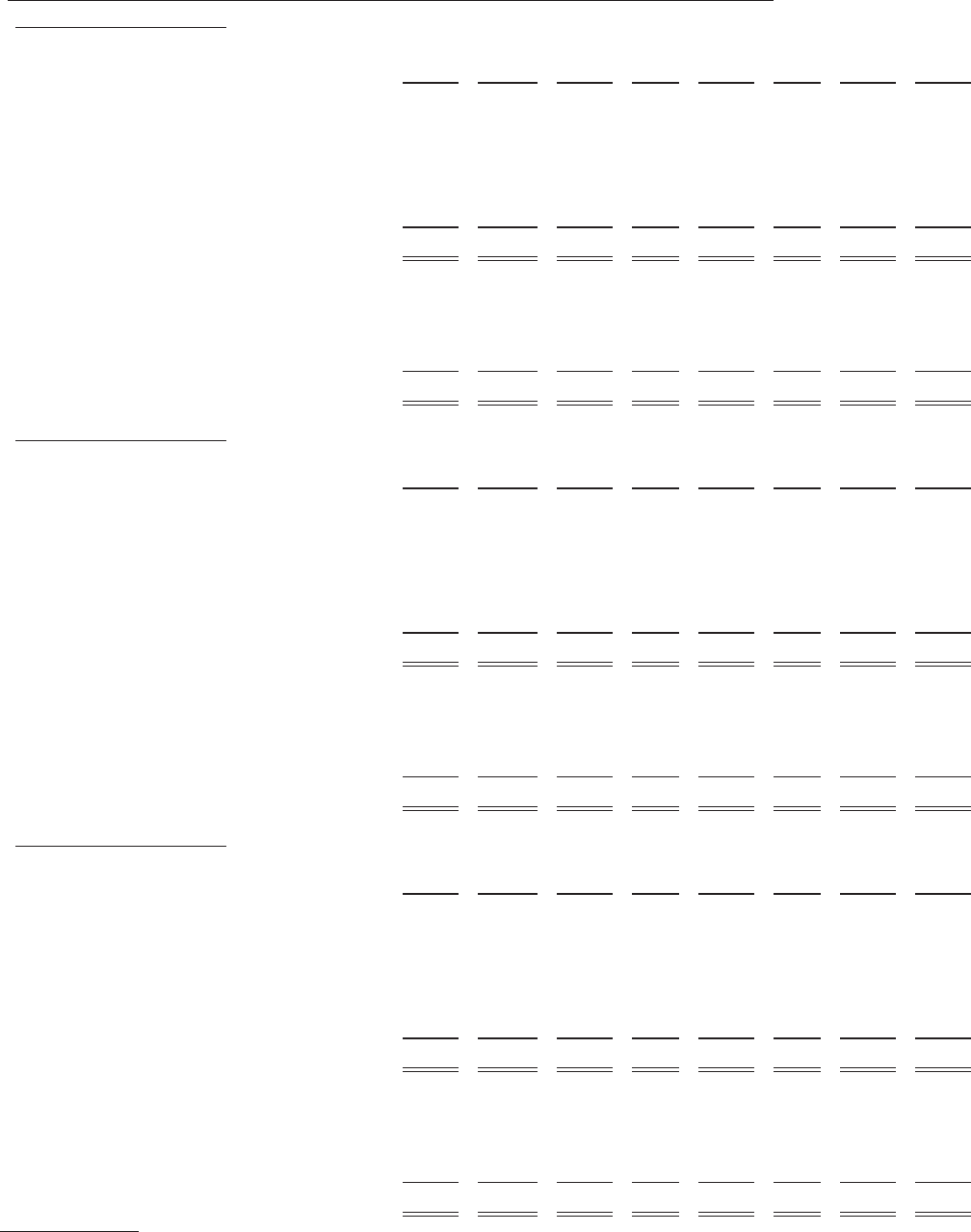

Reconciliation of GAAP revenues to operating revenues and GAAP expenses to operating expenses

Year Ended December 31, 2013

Retail

Group,

Voluntary

& Worksite

Benefits

Corporate

Benefit

Funding Latin

America Asia EMEA Corporate

& Other Total

(In millions)

Total revenues ................................... $19,574 $17,343 $8,946 $5,165 $13,204 $3,937 $ 30 $68,199

Less: Net investment gains (losses) ................... 70 (21) (8) 20 343 (16) (227) 161

Less: Net derivative gains (losses) .................... (724) (676) (235) (24) (1,057) (6) (517) (3,239)

Less: Adjustments related to net investment gains (losses)

and net derivative gains (losses) .................... (9) — — — 2 14 — 7

Less: Other adjustments to revenues (1) ............... (119) (172) 15 85 1,386 667 110 1,972

Total operating revenues ........................... $20,356 $18,212 $9,174 $5,084 $12,530 $3,278 $ 664 $69,298

Total expenses ................................... $17,316 $16,762 $7,132 $4,285 $12,552 $3,477 $ 2,623 $64,147

Less: Adjustments related to net investment gains (losses)

and net derivative gains (losses) .................... (197) — — — (15) 16 — (196)

Less: Goodwill impairment .......................... — — — — — — — —

Less: Other adjustments to expenses (1) ............... 995 — (31) (82) 1,838 590 503 3,813

Total operating expenses ........................... $16,518 $16,762 $7,163 $4,367 $10,729 $2,871 $ 2,120 $60,530

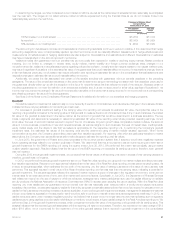

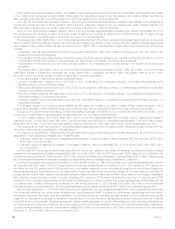

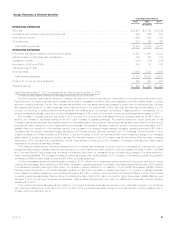

Year Ended December 31, 2012

Retail

Group,

Voluntary

& Worksite

Benefits

Corporate

Benefit

Funding Latin

America Asia EMEA Corporate

& Other Total

(In millions)

Total revenues ................................... $19,939 $17,436 $9,436 $4,845 $12,793 $4,279 $ (578) $68,150

Less: Net investment gains (losses) ................... 212 (7) 107 (2) (342) 31 (351) (352)

Less: Net derivative gains (losses) .................... 162 (63) (157) 38 (170) 61 (1,790) (1,919)

Less: Adjustments related to net investment gains (losses)

and net derivative gains (losses) .................... —————15—15

Less: Other adjustments to revenues (1) ............... (77) (140) 62 232 549 813 616 2,055

Total operating revenues ........................... $19,642 $17,646 $9,424 $4,577 $12,756 $3,359 $ 947 $68,351

Total expenses ................................... $19,483 $16,206 $7,584 $4,289 $11,746 $3,792 $ 3,608 $66,708

Less: Adjustments related to net investment gains (losses)

and net derivative gains (losses) .................... 19 — — — 4 18 — 41

Less: Goodwill impairment .......................... 1,692 — — — — — 176 1,868

Less: Other adjustments to expenses (1) ............... 1,164 1 43 425 577 832 1,537 4,579

Total operating expenses ........................... $16,608 $16,205 $7,541 $3,864 $11,165 $2,942 $ 1,895 $60,220

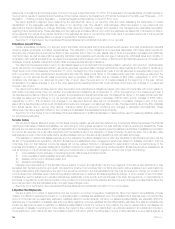

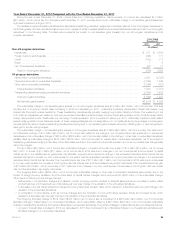

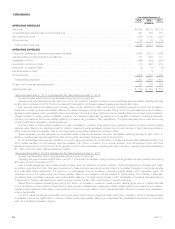

Year Ended December 31, 2011

Retail

Group,

Voluntary

& Worksite

Benefits

Corporate

Benefit

Funding Latin

America Asia EMEA Corporate

& Other Total

(In millions)

Total revenues ................................... $21,491 $17,777 $9,413 $4,448 $10,959 $2,956 $ 3,197 $70,241

Less: Net investment gains (losses) ................... 158 (26) 19 (6) (305) (525) (182) (867)

Less: Net derivative gains (losses) .................... 2,321 1,203 426 (36) 202 32 676 4,824

Less: Adjustments related to net investment gains (losses)

and net derivative gains (losses) .................... 14 — — — — — — 14

Less: Other adjustments to revenues (1) ............... (2) (137) 133 179 (508) (28) 1,546 1,183

Total operating revenues ........................... $19,000 $16,737 $8,835 $4,311 $11,570 $3,477 $ 1,157 $65,087

Total expenses ................................... $17,714 $15,401 $7,178 $4,166 $ 9,727 $3,117 $ 3,754 $61,057

Less: Adjustments related to net investment gains (losses)

and net derivative gains (losses) .................... 507 — — — 19 — — 526

Less: Goodwill impairment .......................... — — — — — — — —

Less: Other adjustments to expenses (1) ............... 214 — 54 519 (541) 47 1,829 2,122

Total operating expenses ........................... $16,993 $15,401 $7,124 $3,647 $10,249 $3,070 $ 1,925 $58,409

(1) See definitions of operating revenues and operating expenses under “— Non-GAAP and Other Financial Disclosures” for the components of such

adjustments.

26 MetLife, Inc.