Capital One 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75 Capital One Financial Corporation (COF)

Strategic Risk Management

We monitor external market and industry developments to identify potential areas of strategic opportunity or risk. These items

provide input for development of the Company’s strategy led by the Chief Executive Officer and other senior executives. Through

the ongoing development and vetting of the corporate strategy, the Chief Risk Officer identifies and assesses risks associated with

the strategy across all risk categories and monitors them throughout the year.

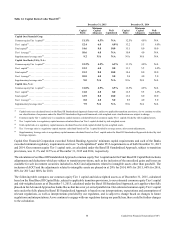

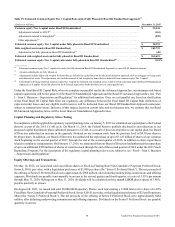

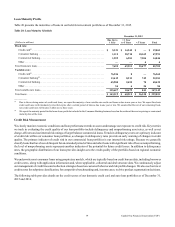

CREDIT RISK PROFILE

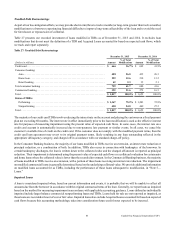

Our loan portfolio accounts for the substantial majority of our credit risk exposure. Our lending activities are governed under our

credit policy and are subject to independent review and approval. Below we provide information about the composition of our

loan portfolio, key concentrations and credit performance metrics.

We also engage in certain non-lending activities that may give rise to credit and counterparty settlement risk, including the purchase

of securities for our investment securities portfolio, entering into derivative transactions to manage our market risk exposure and

to accommodate customers, short-term advances on syndication activity, certain operational cash balances in other financial

institutions, foreign exchange transactions, and customer overdrafts. We provide additional information on credit risk related to

our investment securities portfolio under “Consolidated Balance Sheets Analysis—Investment Securities” and credit risk related

to derivative transactions in “Note 11—Derivative Instruments and Hedging Activities.”

Primary Loan Products

We provide a variety of lending products. Our primary loan products include credit cards, auto, home loans and commercial.

• Credit cards: We originate both prime and subprime credit cards through a variety of channels. Our credit cards generally

have variable interest rates. The majority of our credit card accounts are underwritten using an automated underwriting

system based on predictive models that we have developed. The underwriting criteria, which are customized for individual

products and marketing programs, are established based on an analysis of the net present value of expected revenues,

expenses and losses, subject to a further analysis using a variety of stress conditions. Underwriting decisions are generally

based on credit bureau information, including payment history, debt burden and credit scores, such as Fair Isaac Corporation

(credit rating) (“FICO”), and on other factors, such as applicant income. We also maintain a credit card securitization program

and selectively sell charged-off credit card loans.

• Auto: We originate both prime and subprime auto loans. Customers are acquired through a network of auto dealers and

direct marketing. Our auto loans generally have fixed interest rates. Loan terms are generally 75 months or less and can go

up to 84 months. Loan sizes are customized by program and are generally less than $75,000. The underwriting criteria are

customized for individual products and marketing programs and based on analysis of net present value of expected revenues,

expenses and losses, subject to maintaining resilience under a variety of stress conditions. Underwriting decisions are

generally based on application information and credit bureau information, along with collateral characteristics such as loan-

to-value (“LTV”) ratio. We generally retain all of our auto loans, though we have securitized and sold auto loans in the past

and may do so in the future.

• Home loans: Most of the existing home loans in our loan portfolio were originated by banks we acquired. Currently, we

originate residential mortgage and home equity loans through our branches, direct marketing, and dedicated home loan

officers. Our home loan products include conforming and non-conforming fixed rate and adjustable rate mortgage loans,

as well as first and second lien home equity loans and lines of credit. In general, our underwriting policy limits for these

loans include: (i) a maximum LTV ratio of 80% for loans without mortgage insurance; (ii) a maximum LTV ratio of 95%

for loans with mortgage insurance or for home equity products; (iii) a maximum debt-to-income ratio of 50%; and (iv) a

maximum loan amount of $3 million. Our underwriting procedures are intended to verify the income of applicants and

obtain appraisals to determine home values. We may, in limited instances, use automated valuation models to determine

home values. Our underwriting standards for conforming loans are designed to meet the underwriting standards required

by the agencies at a minimum, and we sell most of our conforming loans to the agencies. We generally retain non-conforming

mortgages and home equity loans and lines of credit.

• Commercial: We offer a range of commercial lending products, including loans secured by commercial real estate and loans

to middle market commercial and industrial companies. Our commercial loans may have a fixed or variable interest rate;

however, the majority of our commercial loans have variable rates. Our underwriting standards require an analysis of the