Capital One 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 Capital One Financial Corporation (COF)

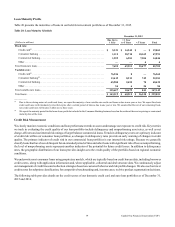

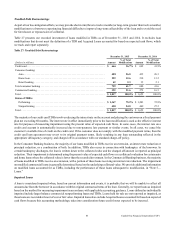

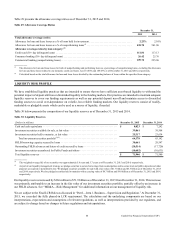

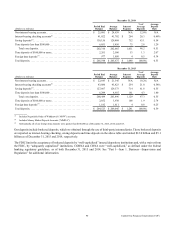

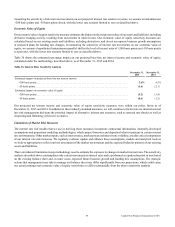

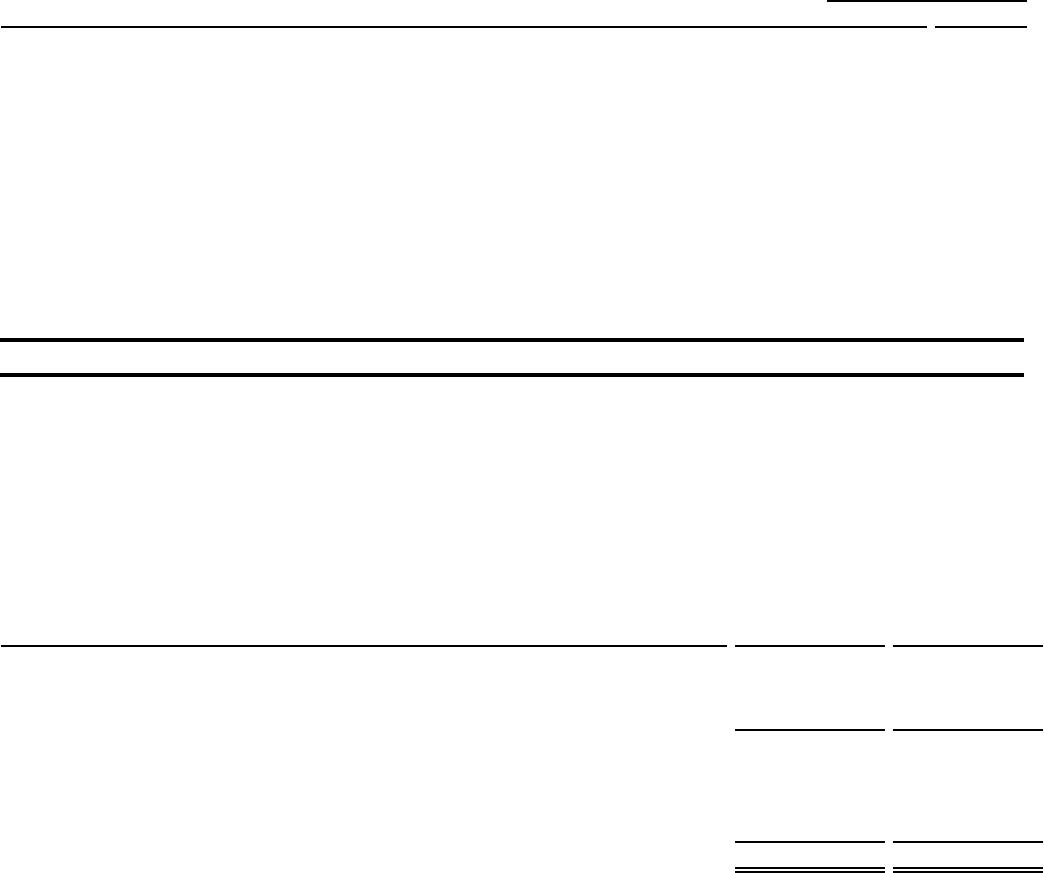

Table 29 presents the allowance coverage ratios as of December 31, 2015 and 2014.

Table 29: Allowance Coverage Ratios

December 31,

2015 2014

Total allowance coverage ratios:

Allowance for loan and lease losses as a % of loans held for investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.23% 2.10%

Allowance for loan and lease losses as a % of nonperforming loans(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 438.70 541.86

Allowance coverage ratios by loan category:(2)

Credit card (30+ day delinquent loans) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111.81 113.13

Consumer banking (30+ day delinquent loans) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.42 25.76

Commercial banking (nonperforming loans) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 109.76 225.86

__________

(1) The allowance for loan and lease losses for both of nonperforming and performing loans as a percentage of nonperforming loans, excluding the allowance

for loan and lease losses related to our domestic credit card loans, was 151.80% and 186.07% as of December 31, 2015 and 2014, respectively.

(2) Calculated based on the total allowance for loan and lease losses divided by the outstanding balance of loans within the specified loan category.

LIQUIDITY RISK PROFILE

We have established liquidity practices that are intended to ensure that we have sufficient asset-based liquidity to withstand the

potential impact of deposit attrition or diminished liquidity in the funding markets. Our practices are intended to maintain adequate

liquidity reserves to cover our funding requirements as well as any potential deposit run-off and maintain access to diversified

funding sources to avoid over-dependence on volatile, less reliable funding markets. Our liquidity reserves consist of readily-

marketable or pledgable assets which can be used as a source of liquidity, if needed.

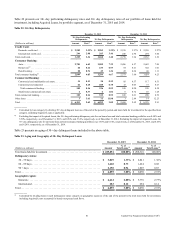

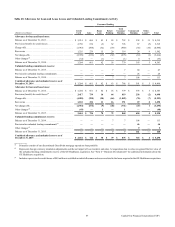

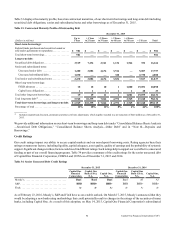

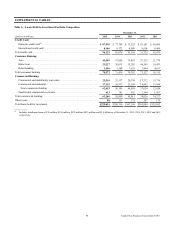

Table 30 below presents the composition of our liquidity reserves as of December 31, 2015 and 2014.

Table 30: Liquidity Reserves

(Dollars in millions) December 31, 2015 December 31, 2014

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,023 $ 7,242

Investment securities available for sale, at fair value. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39,061 39,508

Investment securities held to maturity, at fair value. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,317 23,634

Total investment securities portfolio(1)(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64,378 63,142

FHLB borrowing capacity secured by loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,661 29,547

Outstanding FHLB advances and letters of credit secured by loans . . . . . . . . . . . . . . . . . . . . . . . . . . (20,514) (17,720)

Investment securities encumbered for Public Funds and others. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10,602) (10,631)

Total liquidity reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 71,946 $ 71,580

__________

(1) The weighted-average life of our securities was approximately 5.8 years and 5.7 years as of December 31, 2015 and 2014, respectively.

(2) As part of our liquidity management strategy, we pledge securities to secure borrowings from counterparties and to secure trust and public deposits and other

purposes as required or permitted by law. We pledged securities available for sale with a fair value of $1.7 billion and $3.5 billion as of December 31, 2015

and 2014, respectively. We also pledged securities held to maturity with a carrying value of $8.7 billion and $9.0 billion as of December 31, 2015 and 2014,

respectively.

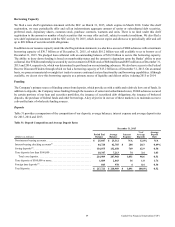

Our liquidity reserves increased by $366 million to $71.9 billion as of December 31, 2015 from December 31, 2014. This increase

was primarily attributable to an increase in the fair value of our investment securities portfolio, partially offset by an increase in

our FHLB advances. See “MD&A—Risk Management” for additional information on our management of liquidity risk.

We are subject to the Final LCR Rules as discussed in “Part I—Item 1. Business—Supervision and Regulation.” At December 31,

2015, we exceeded the fully phased-in LCR requirement. The calculation and the underlying components are based on our

interpretations, expectations and assumptions of relevant regulations, as well as interpretations provided by our regulators, and

are subject to change based on changes to future regulations and interpretations.