Capital One 2015 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

210 Capital One Financial Corporation (COF)

• Provision for credit losses: The provision for credit losses is directly attributable to the business segment in which the loans

are managed.

• Non-interest expense: Non-interest expenses directly managed and incurred by a business segment are accounted for within

each business segment. We allocate certain non-interest expenses indirectly incurred by business segments, such as corporate

support functions, to each business segment based on various factors, including the actual cost of the services from the

service providers, the utilization of the services, the number of employees or other relevant factors.

• Goodwill and intangible assets: Goodwill and intangible assets that are not directly attributable to business segments are

assigned to business segments based on the relative fair value of each segment. Intangible amortization is included in the

results of the applicable segment.

• Income taxes: Income taxes are assessed for each business segment based on a standard tax rate with the residual tax expense

or benefit to arrive at the consolidated effective tax rate included in the Other category.

• Loans held for investment: Loans are reported within each business segment based on product or customer type.

• Deposits: Deposits are reported within each business segment based on product or customer type.

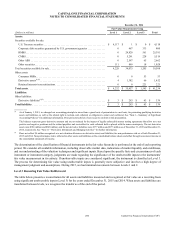

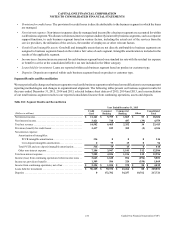

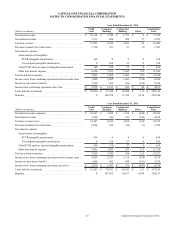

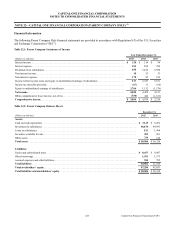

Segment Results and Reconciliation

We may periodically change our business segments or reclassify business segment results based on modifications to our management

reporting methodologies and changes in organizational alignment. The following tables present our business segment results for

the years ended December 31, 2015, 2014 and 2013, selected balance sheet data as of 2015, 2014 and 2013, and a reconciliation

of our total business segment results to our reported consolidated income from continuing operations, assets and deposits.

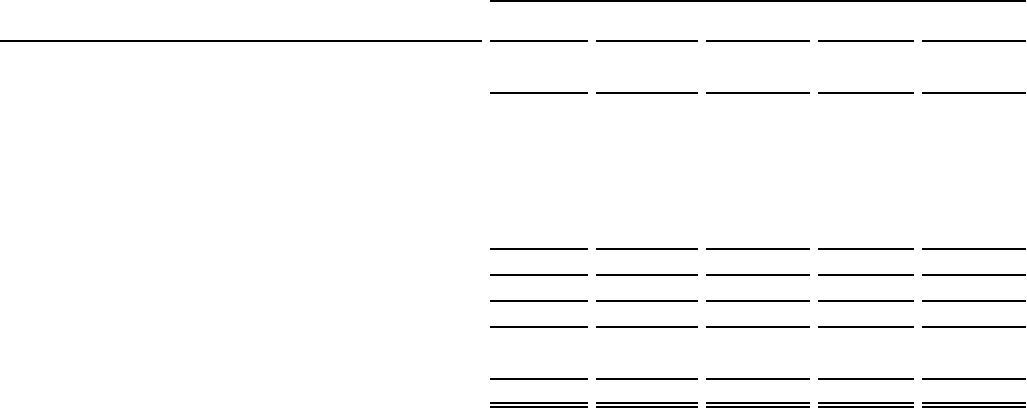

Table 20.1: Segment Results and Reconciliation

Year Ended December 31, 2015

(Dollars in millions)

Credit

Card

Consumer

Banking

Commercial

Banking Other

Consolidated

Total

Net interest income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 11,161 $ 5,755 $ 1,865 $ 53 $ 18,834

Non-interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,421 710 487 (39) 4,579

Total net revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,582 6,465 2,352 14 23,413

Provision (benefit) for credit losses . . . . . . . . . . . . . . . . . . . . . . . . 3,417 819 302 (2) 4,536

Non-interest expense:

Amortization of intangibles:

PCCR intangible amortization. . . . . . . . . . . . . . . . . . . . . . . 316 0 0 0 316

Core deposit intangible amortization. . . . . . . . . . . . . . . . . . 0 79 15 0 94

Total PCCR and core deposit intangible amortization . . . . . . . 316 79 15 0 410

Other non-interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,186 3,947 1,141 312 12,586

Total non-interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,502 4,026 1,156 312 12,996

Income (loss) from continuing operations before income taxes . . 3,663 1,620 894 (296) 5,881

Income tax provision (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,309 586 324 (350) 1,869

Income from continuing operations, net of tax . . . . . . . . . . . . . . . $ 2,354 $ 1,034 $ 570 $ 54 $ 4,012

Loans held for investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 96,125 $ 70,372 $ 63,266 $ 88 $ 229,851

Deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 172,702 34,257 10,762 217,721