Capital One 2015 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

215 Capital One Financial Corporation (COF)

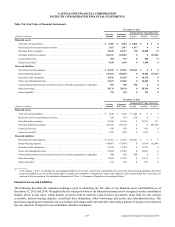

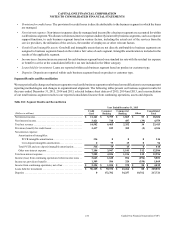

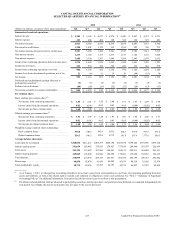

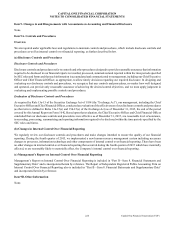

The following table summarizes changes in our representation and warranty reserve for the years ended December 31, 2015 and

2014:

Table 21.3: Changes in Representation and Warranty Reserve(1)

Year Ended December 31,

(Dollars in millions) 2015 2014

Representation and warranty reserve, beginning of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 731 $ 1,172

Benefit for mortgage representation and warranty losses:

Recorded in continuing operations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16) (26)

Recorded in discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (64) (7)

Total benefit for mortgage representation and warranty losses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (80) (33)

Net realized losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (41) (408)

Representation and warranty reserve, end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 610 $ 731

__________

(1) Reported on our consolidated balance sheets as a component of other liabilities.

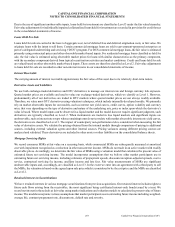

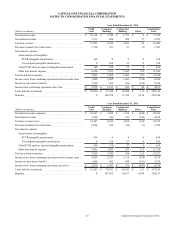

The following table summarizes the allocation of our representation and warranty reserve as December 31, 2015 and 2014.

Table 21.4: Allocation of Representation and Warranty Reserve

Reserve Liability

Loans Sold

2005 to 2008(1)

December 31, 2015

(Dollars in millions, except for loans sold) 2015 2014

Selected period-end data:

Active Insured Securitizations and GSEs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 480 $ 499 $ 27

Inactive Insured Securitizations and Others. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130 232 84

Total(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 610 $ 731 $ 111

__________

(1) Reflects, in billions, the total original principal balance of loans originated by our subsidiaries and sold to third-party investors between 2005 and 2008.

(2) The total reserve liability includes an immaterial amount related to loans that were originated after 2008.

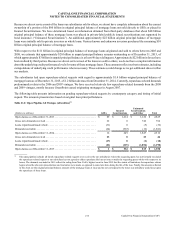

We established reserves for the $11 billion original principal balance of GSE loans, based on open claims and historic repurchase

rates. We have entered into and completed repurchase or settlement agreements with respect to the majority of our repurchase

exposure within this category.

Our reserves could also be impacted by any claims which may be brought by governmental agencies under the Financial Institutions

Reform, Recovery, and Enforcement Act (“FIRREA”), the False Claims Act, or other federal or state statutes. For example,

GreenPoint and Capital One have received requests for information and/or subpoenas from various governmental regulators and

law enforcement authorities, including members of the RMBS Working Group, relating to the origination of loans for sale to the

GSEs and to RMBS participants. We are cooperating with these regulators and other authorities in responding to such requests.

For the $16 billion original principal balance in Active Insured Securitizations, our reserving approach is based upon the expected

resolution of litigation with the monoline bond insurers. Accordingly, our representation and warranty reserves for this category

are litigation reserves. In establishing litigation reserves for this category, we consider the current and future monoline insurer

losses inherent within the securitization and apply legal judgment to the developing factual and legal record to estimate the liability

for each securitization. We consider as factors within the analysis our own past monoline settlements in addition to publicly available

industry monoline settlements. Our reserves with respect to the U.S. Bank Litigation, referenced below, are contained within the

Active Insured Securitization reserve category. Further, to the extent we have litigation reserves with respect to indemnification

risks from certain representation and warranty lawsuits brought by monoline bond insurers against third-party securitizations

sponsors, where one of our subsidiaries provided some or all of the mortgage collateral within the securitization but is not a

defendant in the litigation, such reserves are also contained within this category.