Capital One 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 Capital One Financial Corporation (COF)

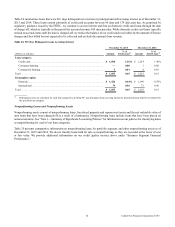

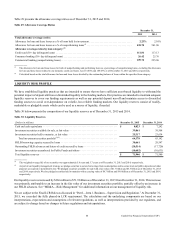

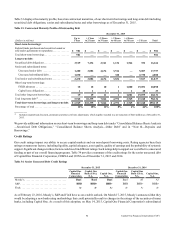

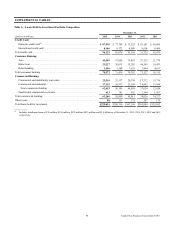

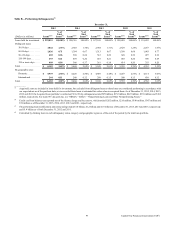

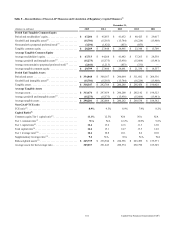

Table 33 displays the maturity profile, based on contractual maturities, of our short-term borrowings and long-term debt including

securitized debt obligations, senior and subordinated notes and other borrowings as of December 31, 2015.

Table 33: Contractual Maturity Profile of Outstanding Debt

December 31, 2015

(Dollars in millions)

Up to

1 Year

> 1 Year

to 2 Years

> 2 Years

to 3 Years

> 3 Years

to 4 Years

> 4 Years

to 5 Years > 5 Years Total

Short-term borrowings:

Federal funds purchased and securities loaned or

sold under agreements to repurchase . . . . . . . . . . . . . $ 981 $ — $ — $ — $ — $ — $ 981

Total short-term borrowings . . . . . . . . . . . . . . . . . . . 981 — — — — — 981

Long-term debt:

Securitized debt obligations. . . . . . . . . . . . . . . . . . . . 3,519 7,234 2,361 1,136 1,564 352 16,166

Senior and subordinated notes:

Unsecured senior debt . . . . . . . . . . . . . . . . . . . . . 1,400 3,082 4,674 3,514 — 5,087 17,757

Unsecured subordinated debt . . . . . . . . . . . . . . . . 1,030 — — 320 — 2,730 4,080

Total senior and subordinated notes. . . . . . . . . . . . . . 2,430 3,082 4,674 3,834 — 7,817 21,837

Other long-term borrowings:

FHLB advances . . . . . . . . . . . . . . . . . . . . . . . . . . 18 18 10 1 1,000 19,051 20,098

Capital lease obligations. . . . . . . . . . . . . . . . . . . . 1 1 1 1 1 28 33

Total other long-term borrowings . . . . . . . . . . . . . . . 19 19 11 2 1,001 19,079 20,131

Total long-term debt(1) . . . . . . . . . . . . . . . . . . . . . . . . 5,968 10,335 7,046 4,972 2,565 27,248 58,134

Total short-term borrowings and long-term debt.$ 6,949 $10,335 $ 7,046 $ 4,972 $ 2,565 $27,248 $59,115

Percentage of total . . . . . . . . . . . . . . . . . . . . . . . . . . . 12% 18% 12% 8% 4% 46% 100%

__________

(1) Includes unamortized discounts, premiums and other cost basis adjustments, which together resulted in a net reduction of $224 million as of December 31,

2015.

We provide additional information on our short-term borrowings and long-term debt under “Consolidated Balance Sheets Analysis

—Securitized Debt Obligations,” “Consolidated Balance Sheets Analysis—Other Debt” and in “Note 10—Deposits and

Borrowings.”

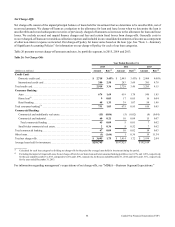

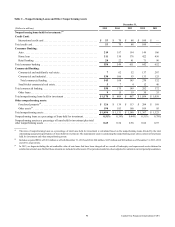

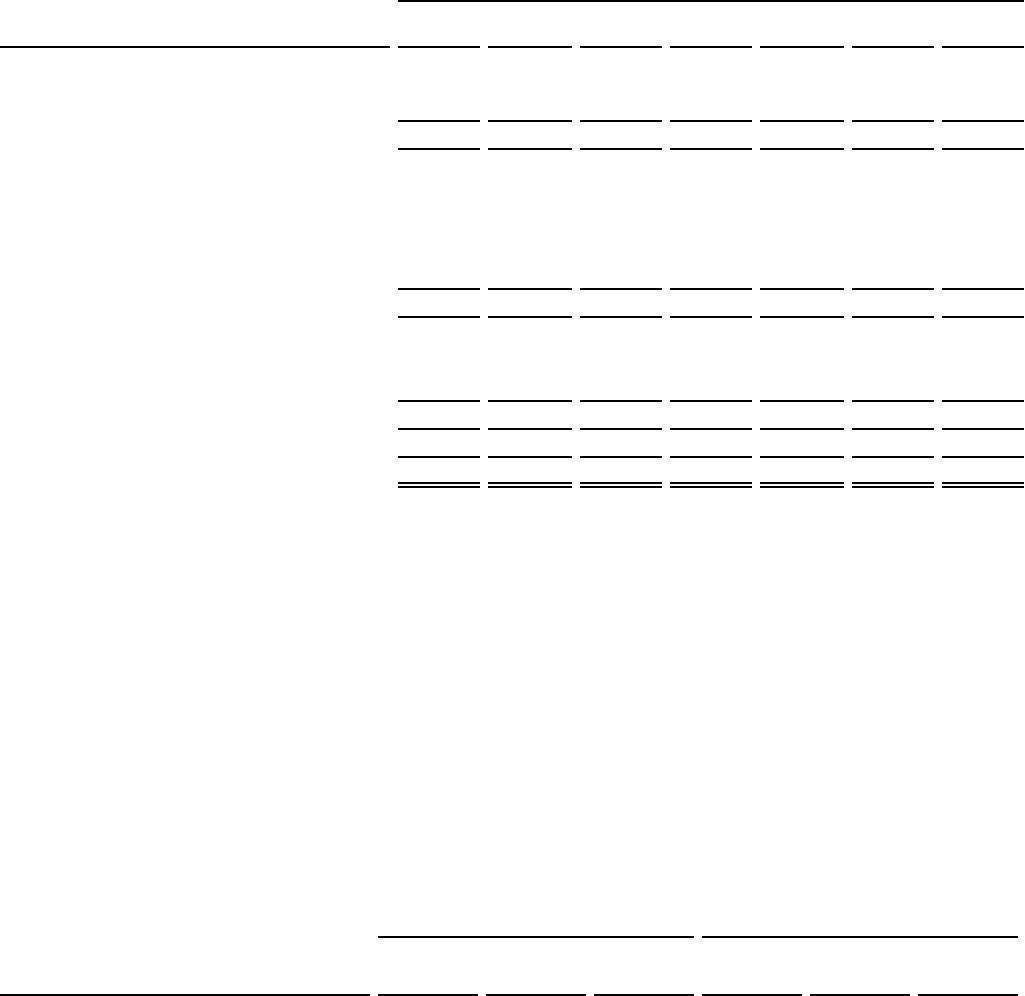

Credit Ratings

Our credit ratings impact our ability to access capital markets and our non-deposit borrowing costs. Rating agencies base their

ratings on numerous factors, including liquidity, capital adequacy, asset quality, quality of earnings and the probability of systemic

support. Significant changes in these factors could result in different ratings. Such ratings help to support our cost effective unsecured

funding as part of our overall financing programs. Table 34 provides a summary of the credit ratings for the senior unsecured debt

of Capital One Financial Corporation, COBNA and CONA as of December 31, 2015 and 2014.

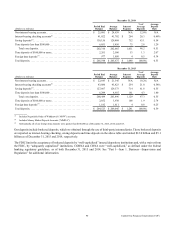

Table 34: Senior Unsecured Debt Credit Ratings

December 31, 2015 December 31, 2014

Capital One

Financial

Corporation

Capital One

Bank (USA),

N.A.

Capital One,

N.A.

Capital One

Financial

Corporation

Capital One

Bank (USA),

N.A.

Capital One,

N.A.

Moody’s. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Baa1 Baa1 Baa1 Baa1 A3 A3

S&P . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . BBB BBB+ BBB+ BBB BBB+ BBB+

Fitch. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A- A- A- A- A- A-

As of February 23, 2016, Moody’s, S&P and Fitch have us on a stable outlook. On March 17, 2015, Moody’s announced that they

would be adopting a new bank rating methodology that could potentially result in changes in the ratings of the securities of many

banks, including Capital One. As a result of this adoption, on May 14, 2015, Capital One Financial Corporation’s subordinated