Capital One 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43 Capital One Financial Corporation (COF)

three-level fair value hierarchy for classifying financial instruments. This hierarchy is based on the markets in which the assets or

liabilities trade and whether the inputs to the valuation techniques used to measure fair value are observable or unobservable. Fair

value measurement of a financial asset or liability is assigned a level based on the lowest level of any input that is significant to the

fair value measurement in its entirety. The three levels of the fair value hierarchy are described below:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities

Level 2: Observable market-based inputs, other than quoted prices in active markets for identical assets or liabilities

Level 3: Unobservable inputs

The degree of management judgment involved in determining the fair value of a financial instrument is dependent upon the

availability of quoted prices in active markets or observable market parameters. When quoted prices and observable data in active

markets are not fully available, management judgment is necessary to estimate fair value. Changes in market conditions, such as

reduced liquidity in the capital markets or changes in secondary market activities, may reduce the availability and reliability of

quoted prices or observable data used to determine fair value.

We have developed policies and procedures to determine when markets for our financial assets and liabilities are inactive if the

level and volume of activity has declined significantly relative to normal conditions. If markets are determined to be inactive, it

may be appropriate to adjust price quotes received. When significant adjustments are required to price quotes or inputs, it may be

appropriate to utilize an estimate based primarily on unobservable inputs.

Significant judgment may be required to determine whether certain financial instruments measured at fair value are classified as

Level 2 or Level 3. In making this determination, we consider all available information that market participants use to measure

the fair value of the financial instrument, including observable market data, indications of market liquidity and orderliness, and

our understanding of the valuation techniques and significant inputs used. Based upon the specific facts and circumstances of each

instrument or instrument category, judgments are made regarding the significance of the Level 3 inputs to the instruments’ fair

value measurement in its entirety. If Level 3 inputs are considered significant, the instrument is classified as Level 3. The process

for determining fair value using unobservable inputs is generally more subjective and involves a high degree of management

judgment and assumptions.

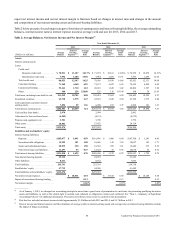

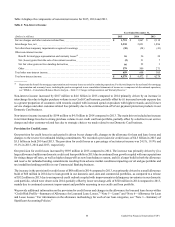

Our financial instruments recorded at fair value on a recurring basis represented approximately 12% and 13% of our total assets

as of December 31, 2015 and 2014, respectively. Financial assets for which the fair value was determined using significant Level

3 inputs represented approximately 2% and 4% of these financial instruments as of December 31, 2015 and 2014, respectively.

We discuss changes in the valuation inputs and assumptions used in determining the fair value of our financial instruments, including

the extent to which we have relied on significant unobservable inputs to estimate fair value and our process for corroborating these

inputs, in “Note 19—Fair Value Measurement.”

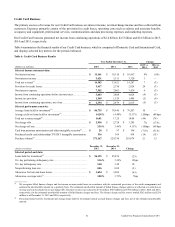

Fair Value Measurement

We have a governance framework and a number of key controls that are intended to ensure that our fair value measurements are

appropriate and reliable. Our governance framework provides for independent oversight and segregation of duties. Our control

processes include review and approval of new transaction types, price verification and review of valuation judgments, methods,

models, process controls and results. Groups independent from our trading and investing functions, including our Corporate

Valuations Group (“CVG”), Fair Value Committee (“FVC”) and Model Validation Group, participate in the review and validation

process. The fair valuation governance process is set up in a manner that allows the Chairperson of the FVC to escalate valuation

disputes that cannot be resolved at the FVC to a more senior committee called the Valuations Advisory Committee (“VAC”) for

resolution. The VAC is chaired by the Chief Financial Officer and includes other senior management. The VAC is only required

to convene to review escalated valuation disputes; however, it met once during 2015 for a general update on the valuation process.

The CVG performs periodic verification of fair value measurements to determine if assigned fair values are reasonable. For

example, in cases where we rely on third party pricing services to obtain fair value measures, we analyze pricing variances among

different pricing sources and validate the final price used by comparing the information to additional sources, including dealer

pricing indications in transaction results and other internal sources, where necessary. Additional validation procedures performed

by the CVG include reviewing (either directly or indirectly through the reasonableness of assigned fair values) valuation inputs

and assumptions, and monitoring acceptable variances between recommended prices and validation prices. The CVG and the Trade

Analytics and Valuation team (“TAV”) perform due diligence reviews of the third party pricing services by comparing their prices