Capital One 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63 Capital One Financial Corporation (COF)

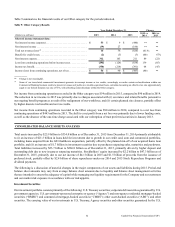

government or agencies of the U.S. government represented 90% and 86% of our total investment securities portfolio as of

December 31, 2015 and 2014, respectively.

The fair value of our securities available for sale portfolio was $39.1 billion as of December 31, 2015, a decrease of $447 million

from $39.5 billion as of December 31, 2014. The decrease was primarily due to higher interest rates. The fair value of our securities

held to maturity portfolio was $25.3 billion as of December 31, 2015, an increase of $1.7 billion from $23.6 billion as of

December 31, 2014. The increase was primarily due to growth in this portfolio as purchases outpaced maturities and paydowns,

slightly offset by decreases in fair value due to higher interest rates.

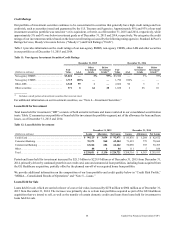

Gross unrealized gains on available for sale investment securities decreased to $578 million as of December 31, 2015 compared

to $886 million as of December 31, 2014 primarily driven by an increase in interest rates. Gross unrealized losses on available for

sale investment securities increased to $321 million as of December 31, 2015 compared to $237 million as of December 31, 2014.

Of the $321 million as of December 31, 2015, $165 million was related to securities that had been in a loss position for 12 months

or longer. We provide information on OTTI recognized in earnings on our investment securities above in “Consolidated Results

of Operations—Non-Interest Income.”

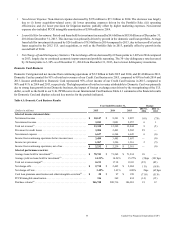

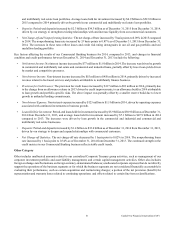

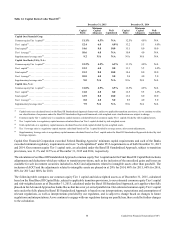

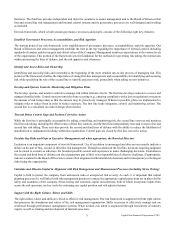

Table 10 presents the amortized cost, carrying value and fair value for the major categories of our portfolio of investment securities

as of December 31, 2015, 2014 and 2013.

Table 10: Investment Securities

December 31,

2015 2014 2013

(Dollars in millions)

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Investment securities available for sale

U.S. Treasury securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,664 $ 4,660 $ 4,114 $ 4,118 $ 832 $ 834

Corporate debt securities guaranteed by U.S. government

agencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 819 800 1,282 1,234

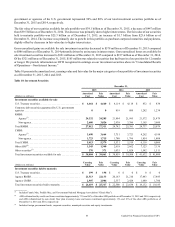

RMBS:

Agency(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,332 24,285 21,804 21,995 21,572 21,479

Non-agency. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,680 3,026 2,938 3,386 3,165 3,600

Total RMBS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27,012 27,311 24,742 25,381 24,737 25,079

CMBS:

Agency(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,690 3,664 3,751 3,723 4,262 4,198

Non-agency. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,723 1,715 1,780 1,796 1,854 1,808

Total CMBS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,413 5,379 5,531 5,519 6,116 6,006

Other ABS(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,345 1,340 2,618 2,662 7,123 7,136

Other securities(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 370 371 1,035 1,028 1,542 1,511

Total investment securities available for sale . . . . . . . . . . . . . . $ 38,804 $ 39,061 $ 38,859 $ 39,508 $ 41,632 $ 41,800

(Dollars in millions)

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

Investment securities held to maturity

U.S. Treasury securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 199 $ 198 $ 0 $ 0 $ 0 $ 0

Agency RMBS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,513 22,133 20,163 21,210 17,443 17,485

Agency CMBS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,907 2,986 2,337 2,424 1,689 1,700

Total investment securities held to maturity . . . . . . . . . . . . . . . $ 24,619 $ 25,317 $ 22,500 $ 23,634 $ 19,132 $ 19,185

__________

(1) Includes Fannie Mae, Freddie Mac, and Government National Mortgage Association (“Ginnie Mae”).

(2) ABS collateralized by credit card loans constituted approximately 71% and 56% of the other ABS portfolio as of December 31, 2015 and 2014, respectively,

and ABS collateralized by auto dealer floor plan inventory loans and leases constituted approximately 11% and 16% of the other ABS portfolio as of

December 31, 2015 and 2014, respectively.

(3) Includes foreign government bonds, corporate securities, municipal securities and equity investments.