Capital One 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89 Capital One Financial Corporation (COF)

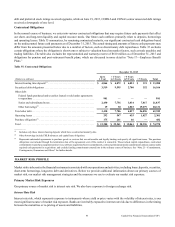

Borrowing Capacity

We filed a new shelf registration statement with the SEC on March 31, 2015, which expires in March 2018. Under this shelf

registration, we may periodically offer and sell an indeterminate aggregate amount of senior or subordinated debt securities,

preferred stock, depositary shares, common stock, purchase contracts, warrants and units. There is no limit under this shelf

registration to the amount or number of such securities that we may offer and sell, subject to market conditions. We also filed a

new shelf registration statement with the SEC on July 30, 2015, which does not expire and allows us to periodically offer and sell

up to $20 billion of securitized debt obligations.

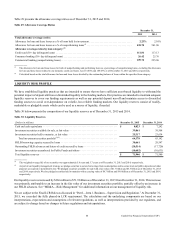

In addition to our issuance capacity under the shelf registration statements, we also have access to FHLB advances with a maximum

borrowing capacity of $30.7 billion as of December 31, 2015, of which $10.2 billion was still available to us to borrow as of

December 31, 2015. We pledged loan collateral with an outstanding balance of $36.9 billion to secure this borrowing capacity.

The ability to draw down funding is based on membership status and the amount is dependent upon the Banks’ ability to post

collateral. Our FHLB membership is secured by our investment in FHLB stock of $884 million and $807 million as of December 31,

2015 and 2014, respectively, which was determined in part based on our outstanding advances. We also have access to the Federal

Reserve Discount Window through which we had a borrowing capacity of $13.2 billion as of December 31, 2015. On an annual

basis, we process immaterial overnight test trades to ensure continued system functionality and borrowing capabilities. Although

available, we do not view this borrowing capacity as a primary source of liquidity and did not utilize it during 2015 or 2014.

Funding

The Company’s primary source of funding comes from deposits, which provide us with a stable and relatively low cost of funds. In

addition to deposits, the Company raises funding through the issuance of senior and subordinated notes, FHLB advances secured

by certain portions of our loan and securities portfolios, the issuance of securitized debt obligations, the issuance of brokered

deposits, the purchase of federal funds and other borrowings. A key objective in our use of these markets is to maintain access to

a diversified mix of wholesale funding sources.

Deposits

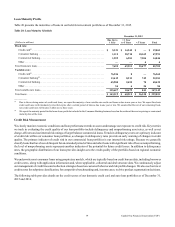

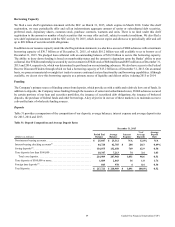

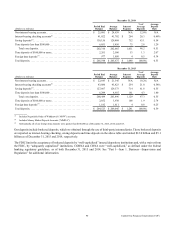

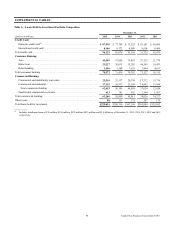

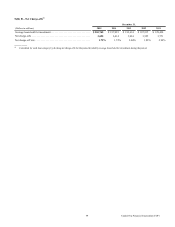

Table 31 provides a comparison of the composition of our deposits, average balances, interest expense and average deposit rates

for 2015, 2014 and 2013.

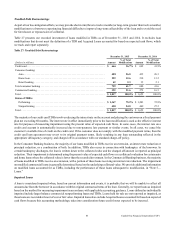

Table 31: Deposit Composition and Average Deposit Rates

December 31, 2015

(Dollars in millions)

Period End

Balance

Average

Balance

Interest

Expense

% of

Average

Deposits

Average

Deposit

Rate

Non-interest bearing accounts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 25,847 $ 25,312 N/A 12.0% N/A

Interest-bearing checking accounts(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44,720 42,785 $ 208 20.3 0.49%

Saving deposits(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 134,075 132,658 769 62.9 0.58

Time deposits less than $100,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,347 7,213 74 3.4 1.03

Total core deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 214,989 207,968 1,051 98.6 0.51

Time deposits of $100,000 or more. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,889 2,043 36 1.0 1.76

Foreign time deposits(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 843 978 4 0.4 0.34

Total deposits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 217,721 $ 210,989 $ 1,091 100.0% 0.52