Capital One 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93 Capital One Financial Corporation (COF)

debt and preferred stock ratings received upgrades, while on June 19, 2015, COBNA and CONA’s senior unsecured debt ratings

received a downgrade of one level.

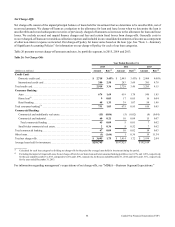

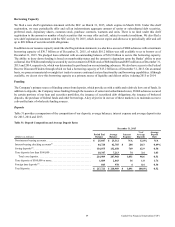

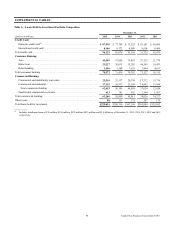

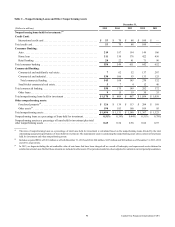

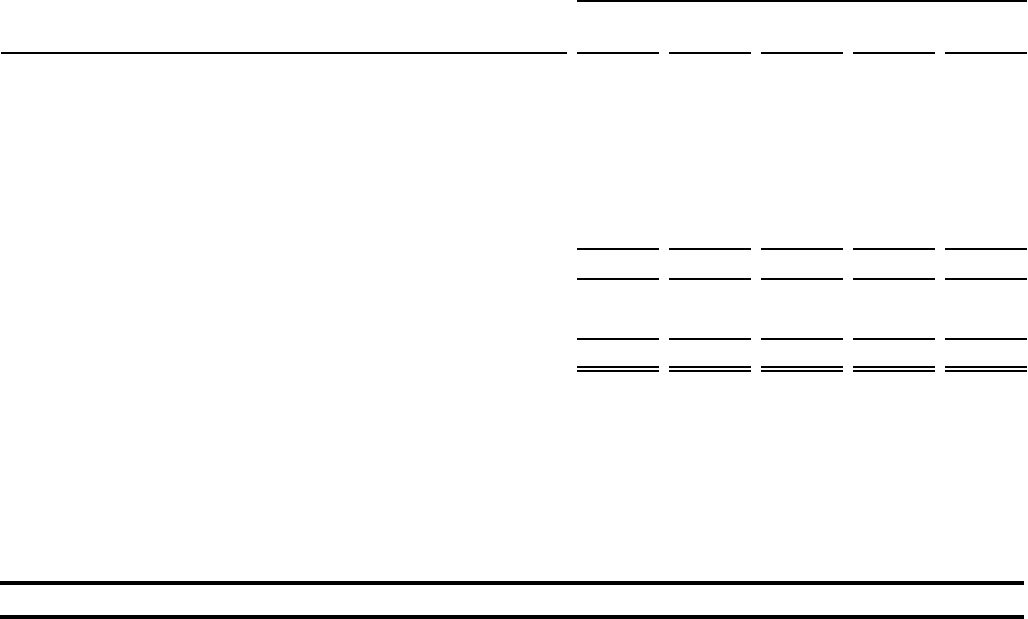

Contractual Obligations

In the normal course of business, we enter into various contractual obligations that may require future cash payments that affect

our short- and long-term liquidity and capital resource needs. Our future cash outflows primarily relate to deposits, borrowings

and operating leases. Table 35 summarizes, by remaining contractual maturity, our significant contractual cash obligations based

on the undiscounted future cash payments as of December 31, 2015. The actual timing and amounts of future cash payments may

differ from the amounts presented below due to a number of factors, such as discretionary debt repurchases. Table 35 excludes

certain obligations where the obligation is short-term or subject to valuation based on market factors, such as trade payables and

trading liabilities. The table also excludes the representation and warranty reserve of $610 million as of December 31, 2015 and

obligations for pension and post-retirement benefit plans, which are discussed in more detail in “Note 17—Employee Benefit

Plans.”

Table 35: Contractual Obligations

December 31, 2015

(Dollars in millions)

Up to

1 Year

> 1 Years

to 3 Years

> 3 Years

to 5 Years > 5 Years Total

Interest-bearing time deposits(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,864 $ 4,072 $ 4,023 $ 121 $ 13,080

Securitized debt obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,519 9,595 2,700 352 16,166

Other debt:

Federal funds purchased and securities loaned or sold under agreements

to repurchase . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 981 — — — 981

Senior and subordinated notes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,430 7,756 3,834 7,817 21,837

Other borrowings(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 30 1,003 19,079 20,131

Total other debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,430 7,786 4,837 26,896 42,949

Operating leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 292 547 435 1,027 2,301

Purchase obligations(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 175 241 66 — 482

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,280 $ 22,241 $ 12,061 $ 28,396 $ 74,978

_________

(1) Includes only those interest-bearing deposits which have a contractual maturity date.

(2) Other borrowings include FHLB advances and capital lease obligations.

(3) Represents substantial agreements to purchase goods or services that are enforceable and legally binding and specify all significant terms. The purchase

obligations are included through the termination date of the agreements even if the contract is renewable. These include capital expenditures, contractual

commitments to purchase equipment and services, software acquisition/license commitments, contractual minimum media commitments and any contractually

required cash payments for acquisitions, and exclude funding commitments entered into in the ordinary course of business. See “Note 21—Commitments,

Contingencies, Guarantees and Others” for further details.

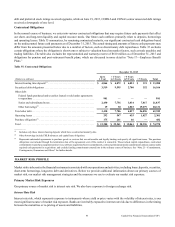

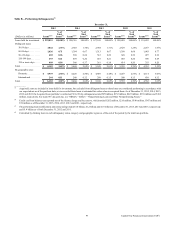

MARKET RISK PROFILE

Market risk is inherent in the financial instruments associated with our operations and activities, including loans, deposits, securities,

short-term borrowings, long-term debt and derivatives. Below we provide additional information about our primary sources of

market risk, our market risk management strategies and the measures we use to evaluate our market risk exposure.

Primary Market Risk Exposures

Our primary source of market risk is interest rate risk. We also have exposure to foreign exchange risk.

Interest Rate Risk

Interest rate risk, which represents exposure to instruments whose yield or price varies with the volatility of interest rates, is our

most significant source of market risk exposure. Banks are inevitably exposed to interest rate risk due to differences in the timing

between the maturities or re-pricing of assets and liabilities.