Capital One 2015 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

202 Capital One Financial Corporation (COF)

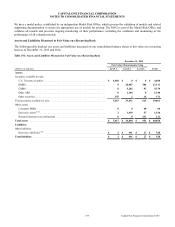

(3) The amount presented for unrealized gains (losses) for assets still held as of the reporting date primarily represents impairments of securities available for

sale, accretion on certain fixed maturity securities, changes in fair value of derivative instruments and mortgage servicing rights transactions. Impairment is

reported in total OTTI, which is a component of non-interest income, in our consolidated statements of income.

(4) All Level 3 derivative assets and liabilities are presented on a gross basis and are not reduced by the impact of legally enforceable master netting agreements

that allow us to net positive and negative positions and the related payables and receivables for cash collateral held or placed with the same counterparty.

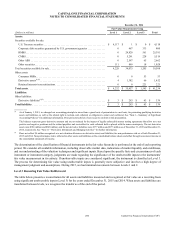

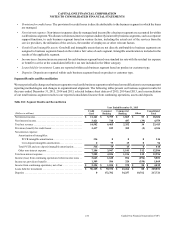

Significant Level 3 Fair Value Asset and Liability Input Sensitivity

Changes in unobservable inputs may have a significant impact on fair value. Certain of these unobservable inputs will, in isolation,

have a directionally consistent impact on the fair value of the instrument for a given change in that input. Alternatively, the fair

value of the instrument may move in an opposite direction for a given change in another input. In general, an increase in the

discount rate, default rates, loss severity and credit spreads, in isolation, would result in a decrease in the fair value measurement.

In addition, an increase in default rates would generally be accompanied by a decrease in recovery rates, slower prepayment rates

and an increase in liquidity spreads.

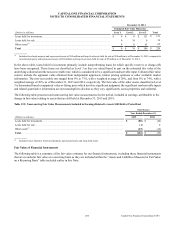

Techniques and Inputs for Level 3 Fair Value Measurements

The following table presents the significant unobservable inputs relied upon to determine the fair values of our Level 3 financial

instruments on a recurring basis. We utilize multiple third-party pricing services to obtain fair value measures for our securities.

Several of our third-party pricing services are only able to provide unobservable input information for a limited number of securities

due to software licensing restrictions. Other third-party pricing services are able to provide unobservable input information for all

securities for which they provide a valuation. As a result, the unobservable input information for the securities available for sale

presented below represents a composite summary of all information we are able to obtain for a majority of our securities. The

unobservable input information for all other Level 3 financial instruments is based on the assumptions used in our internal valuation

models.

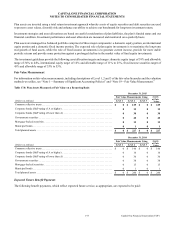

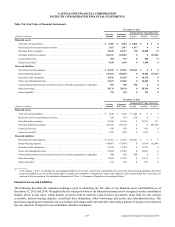

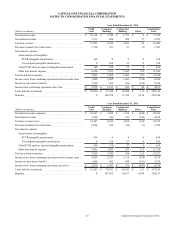

Table 19.3: Quantitative Information about Level 3 Fair Value Measurements

Quantitative Information about Level 3 Fair Value Measurements

(Dollars in millions)

Fair Value at

December 31,

2015

Significant

Valuation

Techniques

Significant

Unobservable

Inputs Range

Weighted

Average

Assets:

Securities available for sale:

RMBS . . . . . . . . . . . . . . . . . . . . . . $ 504 Discounted cash flows

(3rd party pricing)

Yield

Constant prepayment rate

Default rate

Loss severity

0-12%

0-28%

0-8%

16-85%

6%

4%

4%

55%

CMBS . . . . . . . . . . . . . . . . . . . . . . 97 Discounted cash flows

(3rd party pricing)

Yield

Constant prepayment rate

2-3%

0-15%

3%

9%

Other securities . . . . . . . . . . . . . . . 14 Discounted cash flows Yield 1% 1%

Other assets:

Consumer MSRs . . . . . . . . . . . . . . 68 Discounted cash flows Total prepayment rate

Discount rate

Option-adjusted spread rate

Servicing cost ($ per loan)

11-18%

12%

435-1,500 bps

$93-$201

16%

12%

474 bps

$98

Derivative assets(1) . . . . . . . . . . . . 57 Discounted cash flows Swap rates 2% 2%

Retained interests in

securitization(2) . . . . . . . . . . . . . . .

211 Discounted cash flows Life of receivables (months)

Constant prepayment rate

Discount rate

Default rate

Loss severity

16-75

1-13%

4-9%

2-6%

15-94%

N/A

Liabilities:

Derivative liabilities(1). . . . . . . . . . $ 27 Discounted cash flows Swap rates 2% 2%

Quantitative Information about Level 3 Fair Value Measurements