Capital One 2015 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

179 Capital One Financial Corporation (COF)

NOTE 12—STOCKHOLDERS' EQUITY

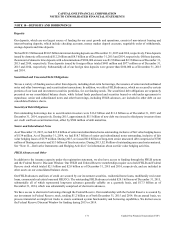

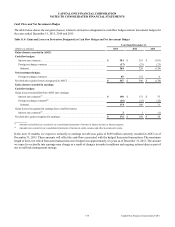

Preferred Stock

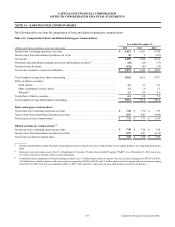

The following table summarizes the Company’s preferred stock issued and outstanding as of December 31, 2015 and 2014.

Table 12.1: Preferred Stock Issued and Outstanding

Redeemable

by Issuer

Beginning

Per Annum

Dividend Rate

Dividend

Frequency

Liquidation

Preference

per Share

Carrying Value

(in millions)

Series Description

Issuance

Date

Total Shares

Outstanding

December 31,

2015

December 31,

2014

Series B(1) 6.00%

Non-Cumulative

August 20,

2012

September 1,

2017

6.00% Quarterly $ 1,000 875,000 $ 853 $ 853

Series C(1) 6.25%

Non-Cumulative

June 12,

2014

September 1,

2019

6.25 Quarterly 1,000 500,000 484 484

Series D(1) 6.70%

Non-Cumulative

October 31,

2014

December 1,

2019

6.70 Quarterly 1,000 500,000 485 485

Series E Fixed-to-

Floating Rate

Non-Cumulative

May 14,

2015

June 1, 2020 5.55% through

5/31/2020;

3-mo. LIBOR+

380 bps

thereafter

Semi-

Annually

through

5/31/2020;

Quarterly

thereafter

1,000 1,000,000 988 N/A

Series F(1) 6.20%

Non-Cumulative

August 24,

2015

December 1,

2020

6.20 Quarterly 1,000 500,000 484 N/A

Total $ 3,294 $ 1,822

__________

(1) Ownership is held in the form of depositary shares, each representing a 1/40th interest in a share of fixed-rate non-cumulative perpetual preferred stock.

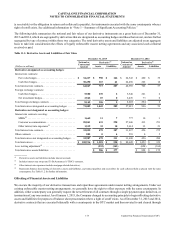

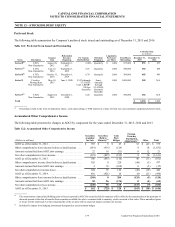

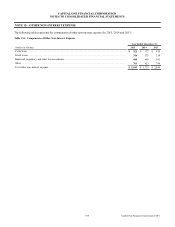

Accumulated Other Comprehensive Income

The following table presents the changes in AOCI by component for the years ended December 31, 2015, 2014 and 2013.

Table 12.2: Accumulated Other Comprehensive Income

(Dollars in millions)

Securities

Available

for Sale

Securities

Held to

Maturity(1)

Cash

Flow

Hedges

Foreign

Currency

Translation

Adjustments(2) Other Total

AOCI as of December 31, 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 703 $ 0 $ 45 $ 32 $ (41) $ 739

Other comprehensive (loss) income before reclassifications . . . . . (619) (915) (124) 8 18 (1,632)

Amounts reclassified from AOCI into earnings. . . . . . . . . . . . . . . 22 18 (31) 0 12 21

Net other comprehensive (loss) income . . . . . . . . . . . . . . . . . . . . . (597) (897) (155) 8 30 (1,611)

AOCI as of December 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . 106 (897) (110) 40 (11) (872)

Other comprehensive income (loss) before reclassifications . . . . . 302 0 228 (48) (5) 477

Amounts reclassified from AOCI into earnings. . . . . . . . . . . . . . . 2 76 (108) 0 (5) (35)

Net other comprehensive income (loss) . . . . . . . . . . . . . . . . . . . . . 304 76 120 (48) (10) 442

AOCI as of December 31, 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . 410 (821) 10 (8) (21) (430)

Other comprehensive (loss) income before reclassifications . . . . . (268) 0 284 (135) (5) (124)

Amounts reclassified from AOCI into earnings. . . . . . . . . . . . . . . 20 96 (174) 0 (4) (62)

Net other comprehensive (loss) income . . . . . . . . . . . . . . . . . . . . . (248) 96 110 (135) (9) (186)

AOCI as of December 31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 162 $ (725) $ 120 $ (143) $ (30) $ (616)

__________

(1) The amortization of unrealized holding gains or losses reported in AOCI for securities held to maturity will be offset by the amortization of the premium or

discount present at the date of transfer from securities available for sale to securities held to maturity, which occurred at fair value. These unrealized gains

or losses will be amortized over the remaining life of the security with no expected impact on future net income.

(2) Includes the impact from hedging instruments designated as net investment hedges.