Capital One 2015 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

200 Capital One Financial Corporation (COF)

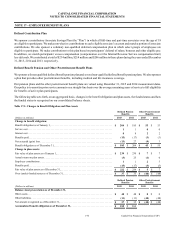

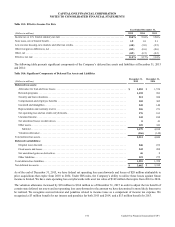

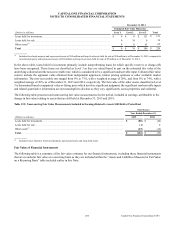

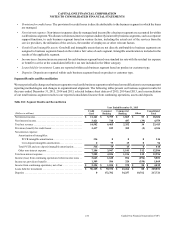

December 31, 2014

Fair Value Measurements Using

(Dollars in millions) Level 1 Level 2 Level 3 Total

Assets:

Securities available for sale:

U.S. Treasury securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,117 $ 1 $ 0 $ 4,118

Corporate debt securities guaranteed by U.S. government agencies . . . . . . . . . . . . . . 0 467 333 800

RMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 24,820 561 25,381

CMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 5,291 228 5,519

Other ABS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 2,597 65 2,662

Other securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111 899 18 1,028

Total securities available for sale. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,228 34,075 1,205 39,508

Other assets:

Consumer MSRs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 53 53

Derivative assets(1)(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 1,382 66 1,452

Retained interests in securitizations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 221 221

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,232 $ 35,457 $ 1,545 $ 41,234

Liabilities:

Other liabilities:

Derivative liabilities(1)(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3 $ 293 $ 43 $ 339

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3 $ 293 $ 43 $ 339

__________

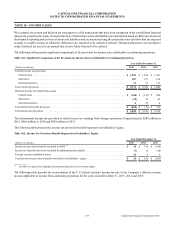

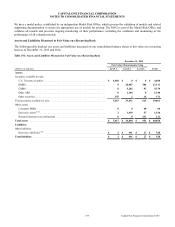

(1) As of January 1, 2015, we changed our accounting principle to move from a gross basis of presentation to a net basis, for presenting qualifying derivative

assets and liabilities, as well as the related right to reclaim cash collateral or obligation to return cash collateral. See “Note 1—Summary of Significant

Accounting Policies” for additional information. Prior period results have been recast to conform to this presentation.

The balances represent gross derivative amounts and are not reduced by the impact of legally enforceable master netting agreements that allow us to net

positive and negative positions and the related payables and receivables for cash collateral held or placed with the same counterparty. The net derivative

assets were $986 million and $828 million, and the net derivative liabilities were $377 million and $175 million as of December 31, 2015 and December 31,

2014, respectively. See “Note 11—Derivative Instruments and Hedging Activities” for further information.

(2) Does not reflect $4 million recognized as a net valuation allowance on derivative assets and liabilities for non-performance risk as of both December 31,

2015 and 2014. Non-performance risk is reflected in other assets and liabilities on the consolidated balance sheets and offset through non-interest income in

the consolidated statements of income.

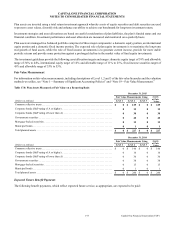

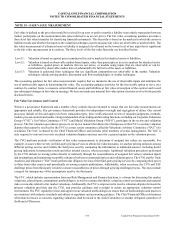

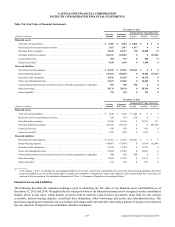

The determination of the classification of financial instruments in the fair value hierarchy is performed at the end of each reporting

period. We consider all available information, including observable market data, indications of market liquidity and orderliness,

and our understanding of the valuation techniques and significant inputs. Based upon the specific facts and circumstances of each

instrument or instrument category, judgments are made regarding the significance of the unobservable inputs to the instruments’

fair value measurement in its entirety. If unobservable inputs are considered significant, the instrument is classified as Level 3.

The process for determining fair value using unobservable inputs is generally more subjective and involves a high degree of

management judgment and assumptions. During 2015, we had minimal movements between Levels 1 and 2.

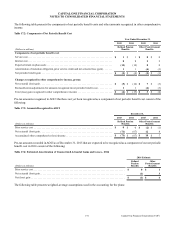

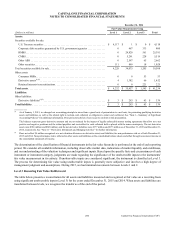

Level 3 Recurring Fair Value Rollforward

The table below presents a reconciliation for all assets and liabilities measured and recognized at fair value on a recurring basis

using significant unobservable inputs (Level 3) for the years ended December 31, 2015 and 2014. When assets and liabilities are

transferred between levels, we recognize the transfer as of the end of the period.