Capital One 2015 Annual Report Download - page 235

Download and view the complete annual report

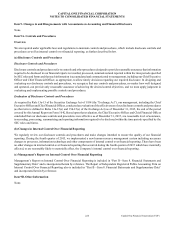

Please find page 235 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

216 Capital One Financial Corporation (COF)

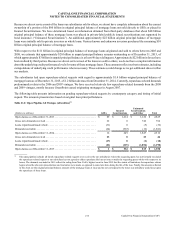

For the $4 billion original principal balance of mortgage loans in the Inactive Insured Securitizations category and the $48 billion

original principal balance of mortgage loans in the Uninsured Securitizations category, we establish reserves based on an assessment

of probable and estimable legal liability, if any, utilizing both our own experience and publicly available industry settlement

information to estimate lifetime liability. In contrast with the bond insurers in the Insured Securitizations, investors in Uninsured

Securitizations often face a number of legal and logistical hurdles before they can force a securitization trustee to pursue mortgage

repurchases, including the need to coordinate with a certain percentage of investors holding the securities and to indemnify the

trustee for any litigation it undertakes. Accordingly, we only reserve for such exposures when a trustee or investor with standing

brings claims and it is probable we have incurred a loss. Some Uninsured Securitization investors from this category are currently

suing investment banks and securitization sponsors under federal and/or state securities laws. Although we face some indirect

indemnity risks from these litigations, we generally have not established reserves with respect to these indemnity risks because

we do not consider them to be both probable and reasonably estimable liabilities. In addition, to the extent we have litigation

reserves with respect to indemnification risks from certain representation and warranty lawsuits brought by parties who purchased

loans from our subsidiaries and subsequently re-sold the loans into securitizations, such reserves are also contained within this

category.

For the $22 billion original principal balance of mortgage loans sold to private investors as whole loans, we establish reserves

based on open claims and historical repurchase rates.

The aggregate reserve for all three subsidiaries totaled $610 million as of December 31, 2015, compared to $731 million as of

December 31, 2014. We recorded a net benefit for mortgage representation and warranty losses of $80 million (which includes a

benefit of $16 million before taxes in continuing operations and a benefit of $64 million before taxes in discontinued operations)

in 2015. The decrease in the representation and warranty reserve was primarily driven by settlements and favorable industry legal

developments, including a ruling from New York’s highest court that the statute of limitations for repurchase claims begins when

the relevant representations and warranties were made, as opposed to some later date during the life of the loan.

As part of our business planning processes, we have considered various outcomes relating to the future representation and warranty

liabilities of our subsidiaries that are possible but do not rise to the level of being both probable and reasonably estimable outcomes

justifying an incremental accrual under applicable accounting standards. Our current best estimate of reasonably possible future

losses from representation and warranty claims beyond our reserves as of December 31, 2015 is approximately $1.6 billion, a

decrease from our $2.1 billion estimate at December 31, 2014. The decrease in this estimate was primarily driven by favorable

industry legal developments, including the statute of limitations ruling from New York’s highest court mentioned above. The

estimate as of December 31, 2015 covers all reasonably possible losses relating to representation and warranty claim activity,

including those relating to the U.S. Bank Litigation, the FHFA Litigation, and the LXS Trust Litigation described below.

In estimating reasonably possible future losses in excess of our current reserves, we assume a portion of the inactive securitizations

become active and for all Insured Securitizations, we assume loss rates on the high end of those observed in monoline settlements

or court rulings. For our remaining GSE exposures, Uninsured Securitizations and whole loan exposures, our reasonably possible

risk estimates assume lifetime loss rates and claims rates at the highest levels of our past experience and also consider the limited

instances of observed settlements. We do not assume claim rates or loss rates for these risk categories will be as high as those

assumed for the Active Insured Securitizations, however, based on industry precedent. Should the number of claims or the loss

rates on these claims increase significantly, our estimate of reasonably possible risk would increase materially. We also assume

that repurchase-related requests will be resolved at discounts reflecting the nature of the claims, the vintage of the underlying loans

and evolving legal precedents.

Notwithstanding our ongoing attempts to estimate a reasonably possible amount of future losses beyond our current accrual levels

based on current information, it is possible that actual future losses will exceed both the current accrual level and our current

estimate of the amount of reasonably possible losses. Our reserve and reasonably possible estimates involve considerable judgment

and reflect that there is still significant uncertainty regarding numerous factors that may impact the ultimate loss levels, including,

but not limited to: litigation outcomes; court rulings; governmental enforcement decisions; future repurchase and indemnification

claim levels; securitization trustees pursuing mortgage repurchase litigation unilaterally or in coordination with investors; investors

successfully pursuing repurchase litigation independently and without the involvement of the trustee as a party; ultimate repurchase

and indemnification rates; future mortgage loan performance levels; actual recoveries on the collateral; and macroeconomic

conditions (including unemployment levels and housing prices). In light of the significant uncertainty as to the ultimate liability

our subsidiaries may incur from these matters, an adverse outcome in one or more of these matters could be material to our results

of operations or cash flows for any particular reporting period.