Capital One 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5 Capital One Financial Corporation (COF)

dealers regulated by the SEC and the Financial Industry Regulatory Authority. Our broker-dealer subsidiaries are subject to, among

other things, net capital rules designed to measure the general financial condition and liquidity of a broker-dealer. Under these

rules, broker-dealers are required to maintain the minimum net capital deemed necessary to meet their continuing commitments

to customers and others, and are required to keep a substantial portion of their assets in relatively liquid form. These rules also

limit the ability of broker-dealers to transfer capital to parent companies and other affiliates. Broker-dealers are also subject to

other regulations covering their business operations, including sales and trading practices, public offerings, publication of research

reports, use and safekeeping of client funds and securities, capital structure, record-keeping and the conduct of directors, officers

and employees.

Capital One Asset Management LLC and Capital One Advisors, LLC (formerly known as ShareBuilder Advisors, LLC) are SEC-

registered investment advisers regulated under the Investment Advisers Act of 1940. Capital One Asset Management LLC, whose

sole client is CONA, provides investment advice to CONA’s private banking customers, including trusts, high net worth individuals,

institutions, foundations, endowments and other organizations,

Finally, Capital One Agency LLC is a licensed insurance agency that provides both personal and business insurance services to

retail and commercial clients and is regulated by the New York State Department of Financial Services in its home state and by

the state insurance regulatory agencies in the states in which it operates.

Derivative Activities

In 2012, the Commodity Futures Trading Commission (“CFTC”) and the SEC jointly issued final rules further defining the Dodd-

Frank Act’s “swap dealer” definitions. Based on the final rules, no Capital One entity will be required to register with the CFTC

or SEC as a swap dealer; however, this may change in the future. If such registration occurs, the registered entity is required to

comply with additional regulatory requirements relating to its derivatives activities. The Dodd-Frank Act also requires all swap

market participants to keep swap transaction data records and report certain information to swap data repositories on a real-time

and on-going basis. Further, each swap, group, category, type or class of swap that the CFTC or SEC determines must be cleared

will need to be cleared through a derivatives clearinghouse unless the swap is eligible for a clearing exemption and executed on

a designated contract market (“DCM”), exchange or swap execution facility (“SEF”), unless no DCM, exchange or SEF has made

the swap available for trading.

Volcker Rule

We and each of our subsidiaries, including the Banks, are subject to the “Volcker Rule,” a provision of the Dodd-Frank Act that

contains prohibitions on proprietary trading and certain investments in, and relationships with, covered funds (hedge funds, private

equity funds, and similar funds), subject to certain exemptions and in each case as those terms are defined in the rule. The

implementing regulations require that we maintain a robust compliance program in accordance with the requirements of the rule.

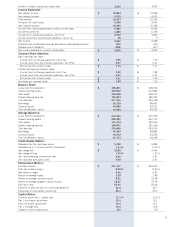

Capital Adequacy

The Company and the Banks are subject to capital adequacy guidelines adopted by the Federal Reserve and OCC. For a further

discussion of the capital adequacy guidelines, see “MD&A—Capital Management” and “Note 13—Regulatory and Capital

Adequacy.” The Company and the Banks exceeded minimum regulatory requirements under these guidelines as of December 31,

2015.

Basel III and U.S. Capital and Liquidity Rules

In December 2010, the Basel Committee on Banking Supervision (“Basel Committee”) published a final framework on additional

capital and liquidity requirements (“Basel III”), which included detailed capital ratios and buffers, subject to transition periods

through 2018. In November 2011, the Basel Committee adopted a framework that would impose an additional common equity

Tier 1 capital buffer on globally systemically important banking organizations (“G-SIBs”), which surcharge would vary based on

the company’s systemic importance as determined using five criteria: size, interconnectedness, cross-jurisdictional activity,

substitutability and complexity (“G-SIB Surcharge”). As discussed further below, Capital One is currently not identified as a G-

SIB. In January 2014, the Basel Committee made changes to the leverage ratio rules to account for differences in national accounting

frameworks. The Basel Committee continues to evaluate further modifications to these and other capital standards, which, if

finalized, would require rulemaking in the United States prior to their effectiveness for U.S. banking organizations.

The Federal Reserve, OCC and FDIC (collectively, the “Federal Banking Agencies”) issued a rule in July 2013 that implemented

the Basel III capital framework developed by the Basel Committee and certain Dodd-Frank Act and other capital provisions, and