Capital One 2015 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

133 Capital One Financial Corporation (COF)

as of the acquisition date, with limited exceptions. Transaction costs and costs to restructure the acquired company are expensed

as incurred. Goodwill is recognized as the excess of the acquisition price over the estimated fair value of the net assets acquired.

Likewise, if the fair value of the net assets acquired is greater than the acquisition price, a bargain purchase gain is recognized and

recorded in non-interest income.

If the acquired set of activities and assets does not meet the accounting definition of a business, the transaction is accounted for

as an asset acquisition. In an asset acquisition, the assets acquired are recorded at the purchase price plus any transaction costs

incurred and no goodwill is recognized.

Change in Accounting Principle

Accounting for Derivative Assets and Liabilities

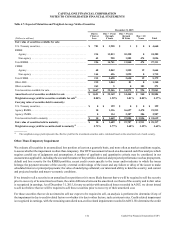

As of January 1, 2015, we changed our accounting principle to move from a gross basis of presentation to a net basis for presenting

qualifying derivative assets and liabilities, as well as the related fair value amounts recognized for the right to reclaim cash collateral

(a receivable) or the obligation to return cash collateral (a payable), for instruments executed with the same counterparty where a

right of setoff exists. This newly adopted policy is preferable as it more accurately reflects the Company’s counterparty credit risk

as well as our contractual rights and obligations under these arrangements. Further, this change aligned our presentation with that

of the majority of our peer institutions.

We retrospectively adopted this change in accounting principle and our consolidated balance sheet has been recast for all prior

periods presented. As a result, our interest receivable, other assets and total assets as of December 31, 2014 were reduced by $356

million, $331 million and $687 million, respectively. Interest payable, other liabilities and total liabilities decreased as of

December 31, 2014 by $63 million, $624 million and $687 million, respectively. There was no impact to operating activities in

the consolidated statement of cash flows or any line item within the consolidated statements of income. See “Note 11—Derivative

Instruments and Hedging Activities” for additional detail on the accounting for derivative instruments.

New Accounting Standards Adopted

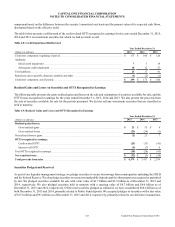

Business Combinations: Simplifying the Accounting for Measurement-Period Adjustments

In September 2015, the Financial Accounting Standards Board (“FASB”) issued guidance on the recognition and presentation of

changes to the provisional amounts recognized in a business combination. An acquirer should recognize adjustments to provisional

amounts with a corresponding adjustment of goodwill, as well as the effect on income of changes in depreciation, amortization or

other income effects, in the reporting period in which the adjustments are identified as if the accounting had been completed at

the acquisition date. Disclosure is required, by line item, of the amount recorded in current period income that would have been

recorded in previous reporting periods. We early adopted the guidance in the fourth quarter of 2015 on a prospective basis with

no impact to our consolidated financial statements in the period of adoption. The accounting for business combinations after

adoption will be subject to this new guidance if the initial accounting is incomplete by the end of the reporting period in which

the combination occurs.

Simplifying the Presentation of Debt Issuance Costs

In April 2015, the FASB issued guidance simplifying the presentation of debt issuance costs. Under the new guidance, the debt

issuance costs related to a recognized debt liability will be presented on the balance sheet as a direct deduction from the carrying

amount of that debt liability, consistent with debt discounts. We early adopted the guidance in the fourth quarter of 2015. Our

adoption did not have a material impact on our consolidated balance sheets.