Capital One 2015 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

175 Capital One Financial Corporation (COF)

(a receivable) or the obligation to return cash collateral (a payable), for instruments executed with the same counterparty where a

right of setoff exists. See additional information in “Note 1—Summary of Significant Accounting Policies.”

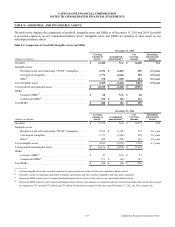

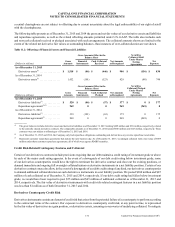

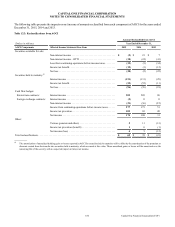

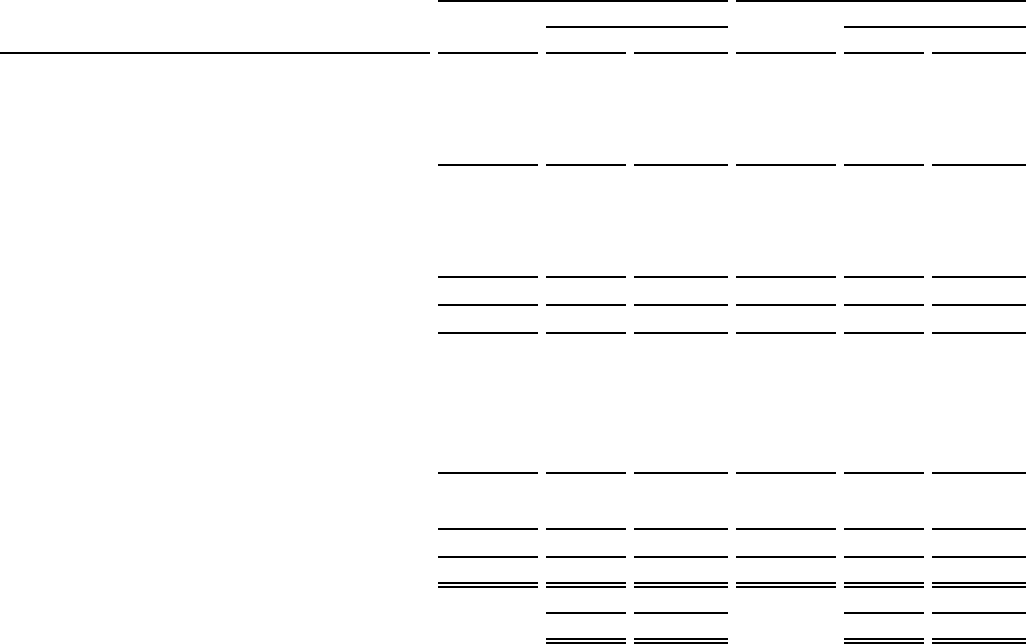

The following table summarizes the notional and fair values of our derivative instruments on a gross basis as of December 31,

2015 and 2014, which are segregated by derivatives that are designated as accounting hedges and those that are not, and are further

segregated by type of contract within those two categories. The total derivative assets and liabilities are adjusted on an aggregate

basis to take into consideration the effects of legally enforceable master netting agreements and any associated cash collateral

received or paid.

Table 11.1: Derivative Assets and Liabilities at Fair Value

December 31, 2015 December 31, 2014

Notional or

Contractual

Amount

Derivative(1) Notional or

Contractual

Amount

Derivative(1)

(Dollars in millions) Assets Liabilities Assets Liabilities

Derivatives designated as accounting hedges:

Interest rate contracts:

Fair value hedges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 34,417 $ 550 $ 146 $ 24,543 $ 480 $ 39

Cash flow hedges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,450 167 61 24,450 222 18

Total interest rate contracts. . . . . . . . . . . . . . . . . . . . . . . . . 64,867 717 207 48,993 702 57

Foreign exchange contracts:

Cash flow hedges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,580 239 2 5,546 221 2

Net investment hedges. . . . . . . . . . . . . . . . . . . . . . . . . . 2,562 87 0 2,476 73 0

Total foreign exchange contracts . . . . . . . . . . . . . . . . . . . . 8,142 326 2 8,022 294 2

Total derivatives designated as accounting hedges. . . . . . . 73,009 1,043 209 57,015 996 59

Derivatives not designated as accounting hedges:

Interest rate contracts covering:

MSRs(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,665 11 7 777 10 3

Customer accommodation. . . . . . . . . . . . . . . . . . . . . . . 28,841 431 290 27,646 413 251

Other interest rate exposures(3) . . . . . . . . . . . . . . . . . . . 1,519 33 10 2,614 33 21

Total interest rate contracts. . . . . . . . . . . . . . . . . . . . . . . . . 32,025 475 307 31,037 456 275

Other contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 882 0 4 593 0 5

Total derivatives not designated as accounting hedges . . . 32,907 475 311 31,630 456 280

Total derivatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 105,916 $ 1,518 $ 520 $ 88,645 $ 1,452 $ 339

Less: netting adjustment(4) . . . . . . . . . . . . . . . . . . . . . . . . . (532) (143) (624) (164)

Total derivative assets/liabilities. . . . . . . . . . . . . . . . . . . . . $ 986 $ 377 $ 828 $ 175

__________

(1) Derivative assets and liabilities include interest accruals.

(2) Includes interest rate swaps and To Be Announced (“TBA”) contracts.

(3) Other interest rate exposures include mortgage-related derivatives.

(4) Represents balance sheet netting of derivative assets and liabilities, and related payables and receivables for cash collateral held or placed with the same

counterparty. See Table 11.2 for further information.

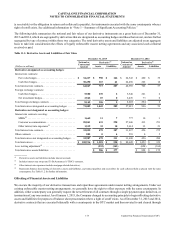

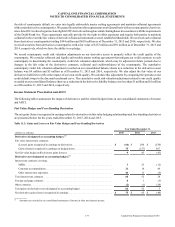

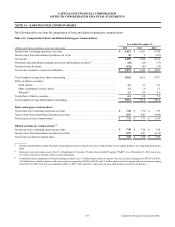

Offsetting of Financial Assets and Liabilities

We execute the majority of our derivative transactions and repurchase agreements under master netting arrangements. Under our

existing enforceable master netting arrangements, we generally have the right to offset exposure with the same counterparty. In

addition, either counterparty can generally request the net settlement of all contracts through a single payment upon default on, or

termination of, any one contract. As of January 1, 2015, the Company changed its accounting principle to begin offsetting derivative

assets and liabilities for purposes of balance sheet presentation where a right of setoff exists. As of December 31, 2015 and 2014,

derivative contracts that are executed bilaterally with a counterparty in the OTC market and then novated to and cleared through