Capital One 2015 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

212 Capital One Financial Corporation (COF)

NOTE 21—COMMITMENTS, CONTINGENCIES, GUARANTEES AND OTHERS

Letters of Credit and Loss Sharing Agreements

We issue letters of credit (financial standby, performance standby and commercial) to meet the financing needs of our customers.

Standby letters of credit are conditional commitments issued by us to guarantee the performance of a customer to a third party in

a borrowing arrangement. Commercial letters of credit are short-term commitments issued primarily to facilitate trade finance

activities for customers and are generally collateralized by the goods being shipped to the client. These collateral requirements are

similar to those for funded transactions and are established based on management’s credit assessment of the customer. Management

conducts regular reviews of all outstanding letters of credit and customer acceptances, and the results of these reviews are considered

in assessing the adequacy of our allowance for loan and lease losses.

Within our Commercial Banking business, we originate multifamily commercial real estate loans with the intent to sell them to a

GSE. We enter into loss sharing agreements with the GSE upon the sale of the loans. At inception, we record a liability representing

the fair value of our obligation which is subsequently amortized as we are released from risk of payment under the loss sharing

agreement. If payment under the loss sharing agreement becomes probable and estimable, an additional liability may be recorded

on the consolidated balance sheets and a non-interest expense may be recognized in the consolidated statements of income. The

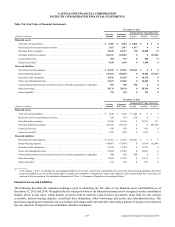

amount of liability recognized on our consolidated balance sheets for our loss sharing agreements was $40 million and $36 million

as of December 31, 2015 and 2014, respectively.

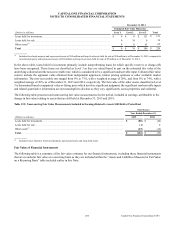

We had standby letters of credit and commercial letters of credit with contractual amounts of $1.9 billion and $2.1 billion as of

December 31, 2015 and 2014, respectively. The carrying value of outstanding letters of credit, which we include in other liabilities

on our consolidated balance sheets was $3 million as of both December 31, 2015 and 2014. These financial guarantees had expiration

dates ranging from 2016 to 2025 as of December 31, 2015.

U.K. Cross Sell

In the U.K., we previously sold payment protection insurance (“PPI”) and other ancillary cross sell products. In response to an

elevated level of customer complaints across the industry, heightened media coverage and pressure from consumer advocacy

groups, the U.K. Financial Conduct Authority (“FCA”), formerly the Financial Services Authority, investigated and raised concerns

about the way the industry has handled complaints related to the sale of these insurance policies. For the past several years, the

U.K.’s Financial Ombudsman Service (“FOS”) has been adjudicating customer complaints relating to PPI, escalated to it by

consumers who disagree with the rejection of their complaint by firms, leading to customer remediation payments by us and others

within the industry. On October 2, 2015, the FCA issued a Statement on PPI (“FCA Proposal”) announcing it has decided to consult,

by the end of 2015, on the introduction of a time bar for PPI complaints and on new rules and guidance about how banks should

handle PPI complaints covered by s. 140A of the Consumer Credit Act of 1974 (“Consumer Credit Act”) in light of the U.K.

Supreme Court’s 2014 ruling in Plevin v. Paragon Personal Finance Limited (“Plevin”). The consultation began on November

26, 2015 and will run into early 2016.

In determining our best estimate of incurred losses for future remediation payments, management considers numerous factors,

including: (i) the number of customer complaints we expect in the future; (ii) our expectation of upholding those complaints; (iii)

the expected number of complaints customers escalate to the FOS; (iv) our expectation of the FOS upholding such escalated

complaints; (v) the number of complaints that fall under the s.140A of the Consumer Credit Act; and (vi) the estimated remediation

payout to customers. We monitor these factors each quarter and adjust our reserves to reflect the latest data.

Management’s best estimate of incurred losses related to U.K. cross sell products, including PPI, totaled $176 million and $116

million as of December 31, 2015 and 2014, respectively. In the year ended December 31, 2015, we increased reserves by $147

million primarily because of an increase of our claims rate assumption. Our best estimate of reasonably possible future losses

beyond our reserve as of December 31, 2015 is approximately $250 million.