Capital One 2015 Annual Report Download - page 250

Download and view the complete annual report

Please find page 250 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

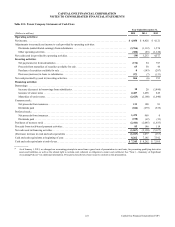

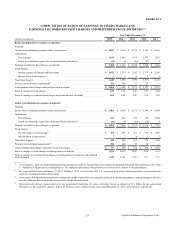

Exhibit 12.1

COMPUTATION OF RATIOS OF EARNINGS TO FIXED CHARGES AND

EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK DIVIDENDS(1)(2)

Year Ended December 31,

(Dollars in millions) 2015 2014 2013 2012 2011

Ratios (including interest expense on deposits):

Earnings:

Income from continuing operations before income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,881 $ 6,569 $ 6,578 $ 5,184 $ 4,688

Adjustments:

Fixed charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,632 1,586 1,796 2,377 2,251

Equity in undistributed (gain) loss of unconsolidated subsidiaries . . . . . . . . . . . . . . . . . . . . . (19) (1) (16) (22) 4

Earnings available for fixed charges, as adjusted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7,494 $ 8,154 $ 8,358 $ 7,539 $ 6,943

Fixed charges:

Interest expense on deposits and borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,625 $ 1,579 $ 1,792 $ 2,375 $ 2,246

Interest factor in rent expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77 4 2 5

Total fixed charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,632 1,586 1,796 2,377 2,251

Preferred stock dividend requirements(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 232 100 77 20 —

Total combined fixed charges and preferred stock dividends. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,864 $ 1,686 $ 1,873 $ 2,397 $ 2,251

Ratio of earnings to fixed charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.59 5.14 4.65 3.17 3.08

Ratio of earnings to combined fixed charges and preferred stock dividends . . . . . . . . . . . . . . . . . 4.02 4.84 4.46 3.15 3.08

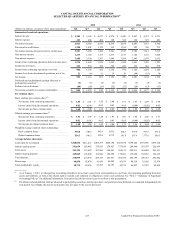

Ratios (excluding interest expense on deposits):

Earnings:

Income from continuing operations before income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,881 $ 6,569 $ 6,578 $ 5,184 $ 4,688

Adjustments:

Fixed charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 541 498 555 974 1,064

Equity in undistributed (gain) loss of unconsolidated subsidiaries . . . . . . . . . . . . . . . . . . . . . (19) (1) (16) (22) 4

Earnings available for fixed charges, as adjusted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,403 $ 7,066 $ 7,117 $ 6,136 $ 5,756

Fixed charges:

Interest expense on borrowings(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 534 $ 491 $ 551 $ 972 $ 1,059

Interest factor in rent expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77 4 2 5

Total fixed charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 541 498 555 974 1,064

Preferred stock dividend requirements(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 232 100 77 20 —

Total combined fixed charges and preferred stock dividends. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 773 $ 598 $ 632 $ 994 $ 1,064

Ratio of earnings to fixed charges, excluding interest on deposits. . . . . . . . . . . . . . . . . . . . . . . . . 11.84 14.19 12.82 6.30 5.41

Ratio of earnings to combined fixed charges, excluding interest on deposits, and preferred

stock dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.28 11.82 11.26 6.17 5.41

_________

(1) As of January 1, 2014, we adopted the proportional amortization method of accounting for Investments in Qualified Affordable Housing Projects. See “Note

1—Summary of Significant Accounting Policies” for additional information. Prior periods have been recast to conform to this presentation.

(2) We acquired ING Direct on February 17, 2012. On May 1, 2012, we closed the 2012 U.S. card acquisition. Each of these transactions was accounted for

under the acquisition method of accounting.

(3) Preferred stock dividends represent pre-tax earnings that would be required to cover any preferred stock dividends requirements, computed using our effective

tax rate, whenever there is an income tax provision, for the relevant periods

(4) Represents total interest expense reported on our consolidated statements of income, excluding interest on deposits of $1.1 billion for the years ended

December 31, 2015 and 2014, and $1.2 billion, $1.4 billion and $1.2 billion for the years ended December 31, 2013, 2012 and 2011, respectively.

231 Capital One Financial Corporation (COF)