Capital One 2015 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

186 Capital One Financial Corporation (COF)

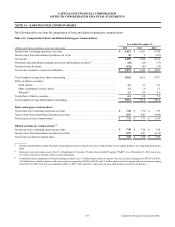

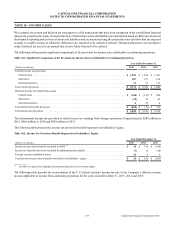

NOTE 16—STOCK-BASED COMPENSATION PLANS

Stock Plans

We have one active stock-based compensation plan available for the issuance of shares to employees, directors and third-party

service providers (if applicable). As of December 31, 2015, under the Amended and Restated 2004 Stock Incentive plan (the “2004

Plan”), we are authorized to issue 55 million common shares in various forms, including incentive stock options, nonstatutory

stock options, stock appreciation rights, restricted stock awards (“RSAs”), share-settled restricted stock units (“RSUs”),

performance share awards (“PSA”), and performance share units (“PSU”). Of this amount, 20 million shares remain available for

future issuance as of December 31, 2015. The 2004 Plan permits the use of newly issued shares or treasury shares upon the

settlement of options and stock-based incentive awards, and we generally settle by issuing new shares.

We also issue cash-settled restricted stock units (and in the past issued cash equity units). These cash-settled units are not counted

against the common shares authorized for issuance or available for issuance under the 2004 Plan.

Total compensation expense recognized for stock-based compensation for 2015, 2014 and 2013 was $161 million, $205 million

and $240 million, respectively. The total income tax benefit recognized in the consolidated statements of income for stock-based

compensation for 2015, 2014 and 2013 was $61 million, $77 million and $91 million, respectively.

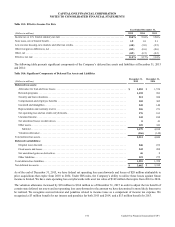

Stock Options

Stock options have a maximum contractual term of ten years. Generally, the exercise price of stock options will equal the fair

market value of our common stock on the date of grant. Option vesting is determined at the time of grant and may be subject to

the achievement of any applicable performance conditions. Options generally become exercisable over three years beginning on

the first anniversary of the date of grant, however some option grants cliff-vest on or shortly after the first or third anniversary of

the grant date.

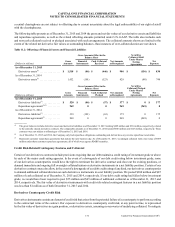

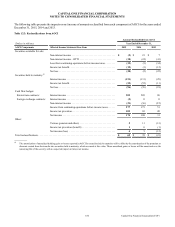

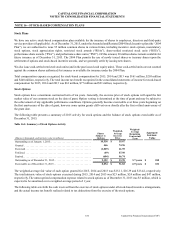

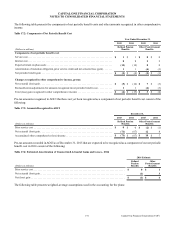

The following table presents a summary of 2015 activity for stock options and the balance of stock options exercisable as of

December 31, 2015.

Table 16.1: Summary of Stock Options Activity

(Shares in thousands, and intrinsic value in millions)

Shares

Subject to

Options

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

Outstanding as of January 1, 2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,538 $ 55.87

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 466 74.96

Exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,029) 61.95

Forfeited. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (49) 87.98

Expired. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (604) 86.74

Outstanding as of December 31, 2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,322 $ 53.98 3.7 years $ 188

Exercisable as of December 31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,054 $ 51.82 2.9 years $ 181

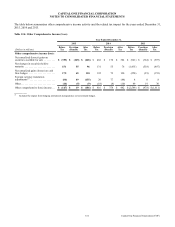

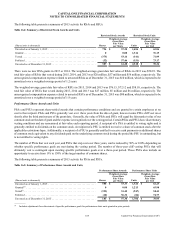

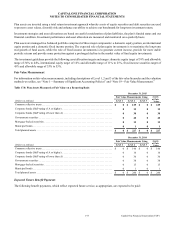

The weighted-average fair value of each option granted for 2015, 2014 and 2013 was $15.11, $16.39 and $13.42, respectively.

The total intrinsic value of stock options exercised during 2015, 2014 and 2013 was $23 million, $24 million and $47 million,

respectively. The unrecognized compensation expense related to stock options as of December 31, 2015 was $3 million, which is

expected to be amortized over a weighted-average period of 1 year.

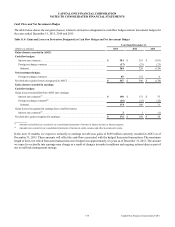

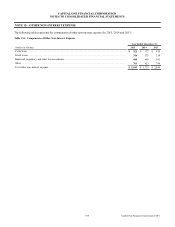

The following table sets forth the cash received from the exercise of stock options under all stock-based incentive arrangements,

and the actual income tax benefit realized related to tax deductions from the exercise of the stock options.