Capital One 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67 Capital One Financial Corporation (COF)

Our continuing involvement in unconsolidated VIEs primarily consists of certain mortgage loan trusts and community reinvestment

and development entities. We provide a discussion of our activities related to these VIEs in “Note 7—Variable Interest Entities

and Securitizations.”

CAPITAL MANAGEMENT

The level and composition of our capital are determined by multiple factors, including our consolidated regulatory capital

requirements and internal risk-based capital assessments such as internal stress testing and economic capital. The level and

composition of our capital may also be influenced by rating agency guidelines, subsidiary capital requirements, the business

environment, conditions in the financial markets and assessments of potential future losses due to adverse changes in our business

and market environments.

Capital Standards and Prompt Corrective Action

We are subject to capital adequacy standards adopted by the Federal Banking Agencies, including the Final Basel III Capital Rule.

Moreover, the Banks, as insured depository institutions, are subject to PCA capital regulations.

In July 2013, the Federal Banking Agencies finalized new capital rules that implemented the Basel III capital framework (“Final

Basel III Capital Rule”) developed by the Basel Committee on Banking Supervision and certain Dodd-Frank Act and other capital

provisions, and that updated the PCA capital framework to reflect the new regulatory capital minimums. The Final Basel III Capital

Rule amended both the Basel I and Basel II Advanced Approaches frameworks, establishing a new common equity Tier 1 capital

requirement and setting higher minimum capital ratio requirements. We refer to the amended Basel I framework as the “Basel III

Standardized Approach,” and the amended Advanced Approaches framework as the “Basel III Advanced Approaches.”

At the end of 2012, we met one of the two independent eligibility criteria set by banking regulators for becoming subject to the

Advanced Approaches capital rules. As a result, we have undertaken a multi-year process of implementing the Advanced Approaches

regime for calculating risk-weighted assets and regulatory capital levels. We entered parallel run under Advanced Approaches on

January 1, 2015, during which we will calculate capital ratios under both the Basel III Standardized Approach and the Basel III

Advanced Approaches, though we will continue to use the Standardized Approach for purposes of meeting regulatory capital

requirements.

In addition, beginning in the first quarter of 2015, as an Advanced Approaches banking organization, we are required to calculate

and publicly disclose our supplementary leverage ratio.

For additional information about the capital adequacy guidelines we are subject to, see “Part 1—Item 1. Business—Supervision

and Regulation.”

Separately, we also disclose a non-GAAP TCE ratio in “Part II—Item 6. Summary of Selected Financial Data.” While the TCE

ratio is a capital measure widely used by investors, analysts, rating agencies, and bank regulatory agencies to assess the capital

position of financial services companies, it may not be comparable to similarly titled measures reported by other companies. We

provide information on the calculation of this ratio in “MD&A—Table F—Reconciliation of Non-GAAP Measures and Calculation

of Regulatory Capital Measures.”

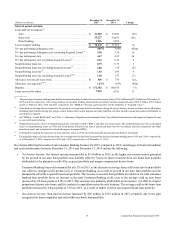

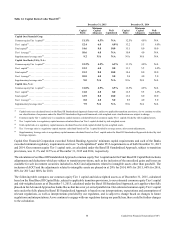

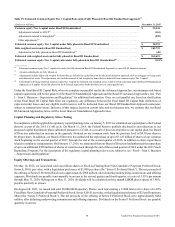

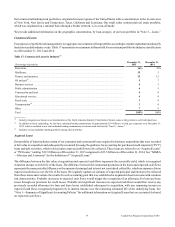

Table 14 provides a comparison of our regulatory capital ratios under the Basel III Standardized Approach subject to transition

provisions, the regulatory minimum capital adequacy ratios and the PCA well-capitalized targets as of December 31, 2015 and

2014.