Capital One 2015 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

145 Capital One Financial Corporation (COF)

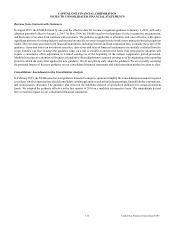

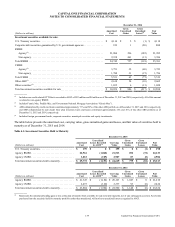

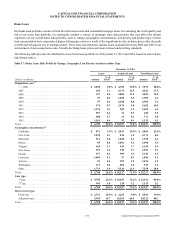

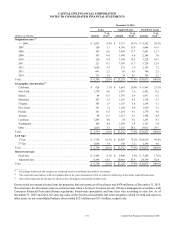

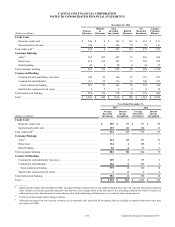

NOTE 5—LOANS

Loan Portfolio Composition

Our loan portfolio consists of loans held for investment, including restricted loans underlying our consolidated securitization trusts,

and loans held for sale, and is divided into three portfolio segments: credit card, consumer banking and commercial banking loans.

Credit card loans consist of domestic and international credit card loans. Consumer banking loans consist of auto, home and retail

banking loans. Commercial banking loans consist of commercial and multifamily real estate, commercial and industrial, and small-

ticket commercial real estate loans.

Our portfolio of loans held for investment also includes certain of our consumer and commercial loans acquired through business

acquisitions that were recorded at fair value at acquisition and subsequently accounted for based on expected cash flows to be

collected, which were referred to as “Acquired Loans.” See “Note 1—Summary of Significant Accounting Policies” for additional

information on accounting guidance for these loans.

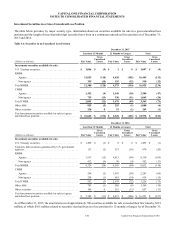

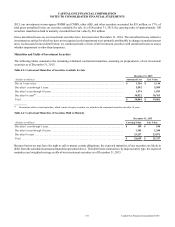

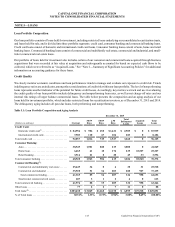

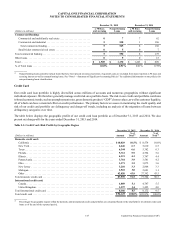

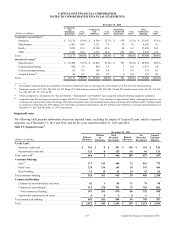

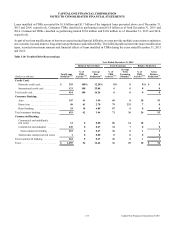

Credit Quality

We closely monitor economic conditions and loan performance trends to manage and evaluate our exposure to credit risk. Trends

in delinquency ratios are an indicator, among other considerations, of credit risk within our loan portfolio. The level of nonperforming

loans represents another indicator of the potential for future credit losses. Accordingly, key metrics we track and use in evaluating

the credit quality of our loan portfolio include delinquency and nonperforming loan rates, as well as net charge-off rates and our

internal risk ratings of larger balance commercial loans. The table below presents the composition and an aging analysis of our

loans held for investment portfolio, which includes restricted loans for securitization investors, as of December 31, 2015 and 2014.

The delinquency aging includes all past due loans, both performing and nonperforming.

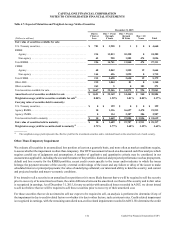

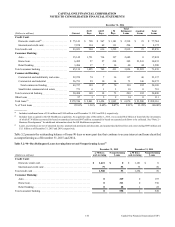

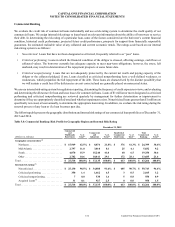

Table 5.1: Loan Portfolio Composition and Aging Analysis

December 31, 2015

(Dollars in millions) Current

30-59

Days

60-89

Days

> 90

Days

Total

Delinquent

Loans

Acquired

Loans

Total

Loans

Credit Card:

Domestic credit card(1). . . . . . . . . . . . . . . . . . . . $ 84,954 $ 906 $ 658 $ 1,421 $ 2,985 $ 0 $ 87,939

International credit card. . . . . . . . . . . . . . . . . . . 7,903 110 67 106 283 0 8,186

Total credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . 92,857 1,016 725 1,527 3,268 0 96,125

Consumer Banking:

Auto . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38,549 1,901 880 219 3,000 0 41,549

Home loan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,465 41 18 176 235 18,527 25,227

Retail banking . . . . . . . . . . . . . . . . . . . . . . . . . . 3,514 21 8 20 49 33 3,596

Total consumer banking . . . . . . . . . . . . . . . . . . . . . 48,528 1,963 906 415 3,284 18,560 70,372

Commercial Banking(2):

Commercial and multifamily real estate . . . . . . 25,449 34 0 4 38 31 25,518

Commercial and industrial . . . . . . . . . . . . . . . . 35,920 51 34 203 288 927 37,135

Total commercial lending . . . . . . . . . . . . . . . . 61,369 85 34 207 326 958 62,653

Small-ticket commercial real estate. . . . . . . . . . 607 3 1 2 6 0 613

Total commercial banking . . . . . . . . . . . . . . . . . . . 61,976 88 35 209 332 958 63,266

Other loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77 2 2 7 11 0 88

Total loans(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 203,438 $ 3,069 $1,668 $ 2,158 $ 6,895 $ 19,518 $ 229,851

% of Total loans . . . . . . . . . . . . . . . . . . . . . . . . . . . 88.51% 1.33% 0.73% 0.94% 3.00% 8.49% 100.00%