Capital One 2015 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

188 Capital One Financial Corporation (COF)

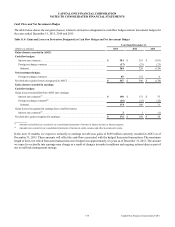

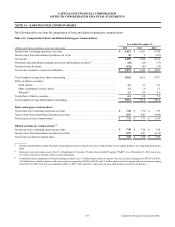

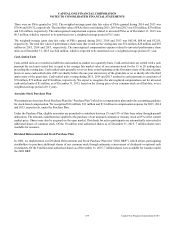

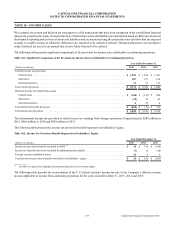

The following table presents a summary of 2015 activity for RSAs and RSUs.

Table 16.4: Summary of Restricted Stock Awards and Units

Restricted Stock Awards Restricted Stock Units

(Shares/units in thousands) Shares

Weighted-Average

Grant Date

Fair Value

per Share Units

Weighted-Average

Grant Date

Fair Value

per Unit

Unvested as of January 1, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 794 $ 57.28 1,486 $ 65.86

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0.00 1,316 76.15

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (375) 53.14 (341) 71.99

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (32) 57.46 (151) 73.17

Unvested as of December 31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 387 $ 61.28 2,310 $ 70.34

There were no new RSA grants in 2015 or 2014. The weighted-average grant date fair value of RSAs in 2013 was $58.93. The

total fair value of RSAs that vested during 2015, 2014, and 2013 was $28 million, $57 million and $56 million, respectively. The

unrecognized compensation expense related to unvested RSAs as of December 31, 2015 was $10 million, which is expected to be

amortized over a weighted-average period of 1.2 years.

The weighted-average grant date fair value of RSUs in 2015, 2014 and 2013 was $76.15, $72.12 and $58.10, respectively. The

total fair value of RSUs that vested during 2015, 2014 and 2013 was $27 million, $5 million and $6 million, respectively. The

unrecognized compensation expense related to unvested RSUs as of December 31, 2015 was $80 million, which is expected to be

amortized over a weighted-average period of 1.9 years.

Performance Share Awards and Units

PSAs and PSUs represent share-settled awards that contain performance conditions and are granted to certain employees at no

cost to the recipient. PSAs and PSUs generally vest over three years from the date of grant, however some PSUs cliff vest on or

shortly after the third anniversary of the grant date. Generally, the value of PSAs and PSUs will equal the fair market value of our

common stock on the date of grant and the expense is recognized over the vesting period. Certain PSAs and PSUs have discretionary

vesting conditions and are remeasured at fair value each reporting period. A recipient of a PSA is entitled to voting rights and is

generally entitled to dividends on the common stock. A recipient of a PSU is entitled to receive a share of common stock after the

applicable restrictions lapse. Additionally, a recipient of a PSU is generally entitled to receive cash payments or additional shares

of common stock equivalent to any dividends paid on the underlying common stock during the period the PSU is outstanding, but

is not entitled to voting rights.

The number of PSAs that vest each year, and PSUs that step vest over three years, can be reduced by 50% or 100% depending on

whether specific performance goals are met during the vesting period. The number of three-year cliff vesting PSUs that will

ultimately vest is contingent upon meeting specific performance goals over a three-year period. These PSUs also include an

opportunity to receive from 0% to 150% of the target number of common shares.

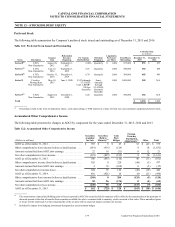

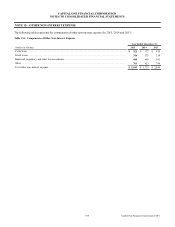

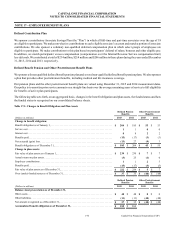

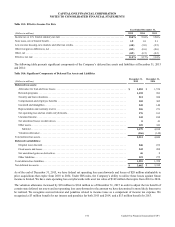

The following table presents a summary of 2015 activity for PSAs and PSUs.

Table 16.5: Summary of Performance Share Awards and Units

Performance Share Awards Performance Share Units

(Shares/units in thousands) Shares

Weighted-Average

Grant Date

Fair Value

per Share Units

Weighted-Average

Grant Date

Fair Value

per Unit

Unvested as of January 1, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 588 $ 53.33 1,524 $ 62.25

Granted(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0.00 1,213 65.98

Vested(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (395) 51.42 (947) 50.41

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10) 56.32 (84) 76.77

Unvested as of December 31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 183 $ 57.30 1,706 $ 70.95

__________

(1) Includes adjustments for achievement of specific performance goals for performance share units granted in prior periods.