Capital One 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

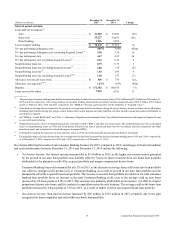

50 Capital One Financial Corporation (COF)

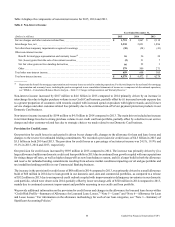

Income Taxes

We recorded income tax provisions of $1.9 billion (31.8% effective income tax rate), $2.1 billion (32.7% effective income tax

rate), $2.2 billion (33.8% effective income tax rate) in 2015, 2014 and 2013, respectively. Our effective tax rate on income from

continuing operations varies between periods due, in part, to fluctuations in our pre-tax earnings, which affects the relative tax

benefit of tax-exempt income, tax credits and other permanent tax items.

The decrease in our effective income tax rate in 2015, from 2014, was primarily due to lower income before taxes, higher discrete

tax benefits and increased net tax credits. This decrease was partially offset by a reduced benefit of lower taxed foreign earnings.

The decrease in our effective income tax rate in 2014, from 2013, was primarily attributable to increased net tax credits and tax

exempt income, and reductions in state rates, partially offset by increased discrete tax expenses.

We recorded net discrete tax benefits of $15 million in 2015, and net discrete tax expenses of $33 million and $16 million in 2014

and 2013, respectively. Our effective income tax rate, excluding the impact of discrete tax items discussed above, was 32.0%,

32.2% and 33.6% in 2015, 2014 and 2013, respectively.

We provide additional information on items affecting our income taxes and effective tax rate under “Note 18—Income Taxes.”

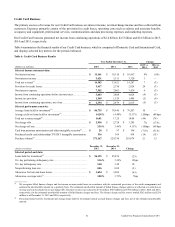

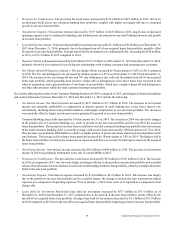

BUSINESS SEGMENT FINANCIAL PERFORMANCE

Our principal operations are currently organized into three major business segments, which are defined based on the products and

services provided or the type of customer served: Credit Card, Consumer Banking and Commercial Banking. The operations of

acquired businesses have been integrated into our existing business segments. Certain activities that are not part of a segment,

such as management of our corporate investment portfolio and asset/liability management by our centralized Corporate Treasury

group, are included in the Other category.

The results of our individual businesses, which we report on a continuing operations basis, reflect the manner in which management

evaluates performance and makes decisions about funding our operations and allocating resources. We may periodically change

our business segments or reclassify business segment results based on modifications to our management reporting methodologies

and changes in organizational alignment. Our business segment results are intended to reflect each segment as if it were a stand-

alone business. We use an internal management and reporting process to derive our business segment results. Our internal

management and reporting process employs various allocation methodologies, including funds transfer pricing, to assign certain

balance sheet assets, deposits and other liabilities and their related revenue and expenses directly or indirectly attributable to each

business segment. Total interest income and net fees are directly attributable to the segment in which they are reported. The net

interest income of each segment reflects the results of our funds transfer pricing process, which is primarily based on a matched

maturity method that takes into consideration market rates. Our funds transfer pricing process provides a funds credit for sources

of funds, such as deposits generated by our Consumer Banking and Commercial Banking businesses, and a funds charge for the

use of funds by each segment. The allocation process is unique to each business segment and acquired businesses. We regularly

assess the assumptions, methodologies and reporting classifications used for segment reporting, which may result in the

implementation of refinements or changes in future periods.

We refer to the business segment results derived from our internal management accounting and reporting process as our “managed”

presentation, which differs in some cases from our reported results prepared based on U.S. GAAP. There is no comprehensive

authoritative body of guidance for management accounting equivalent to U.S. GAAP; therefore, the managed presentation of our

business segment results may not be comparable to similar information provided by other financial services companies. In addition,

our individual business segment results should not be used as a substitute for comparable results determined in accordance with

U.S. GAAP.

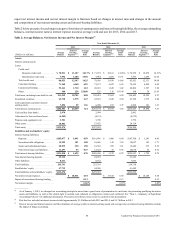

Below we summarize our business segment results for 2015, 2014 and 2013 and provide a comparative discussion of these results.

We also discuss changes in our financial condition and credit performance statistics as of December 31, 2015, compared to

December 31, 2014. We provide a reconciliation of our total business segment results to our reported consolidated results in

“Note 20—Business Segments.” Additionally, we provide information on the outlook for each of our business segments as described

above under “Executive Summary and Business Outlook.”