Capital One 2015 Annual Report Download - page 236

Download and view the complete annual report

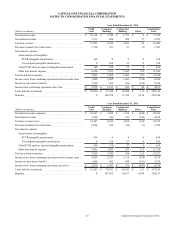

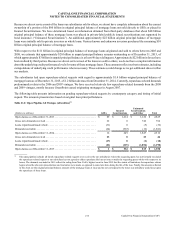

Please find page 236 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

217 Capital One Financial Corporation (COF)

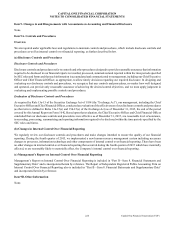

Litigation

In accordance with the current accounting standards for loss contingencies, we establish reserves for litigation related matters that

arise from the ordinary course of our business activities when it is probable that a loss associated with a claim or proceeding has

been incurred and the amount of the loss can be reasonably estimated. None of the amounts we currently have recorded individually

or in the aggregate are considered to be material to our financial condition. Litigation claims and proceedings of all types are

subject to many uncertain factors that generally cannot be predicted with assurance. Below we provide a description of potentially

material legal proceedings and claims.

For some of the matters disclosed below, we are able to determine estimates of potential future outcomes that are not probable and

reasonably estimable outcomes justifying either the establishment of a reserve or an incremental reserve build, but which are

reasonably possible outcomes. For other disclosed matters, such an estimate is not possible at this time. For those matters below

where an estimate is possible (excluding the reasonably possible future losses relating to the U.S. Bank Litigation, the FHFA

Litigation, and the LXS Trust Litigation, because reasonably possible losses with respect to those litigations are included within

the reasonably possible representation and warranty liabilities discussed above) management currently estimates the reasonably

possible future losses beyond our reserves as of December 31, 2015 is approximately $200 million. Notwithstanding our attempt

to estimate a reasonably possible range of loss beyond our current accrual levels for some litigation matters based on current

information, it is possible that actual future losses will exceed both the current accrual level and the range of reasonably possible

losses disclosed here. Given the inherent uncertainties involved in these matters, especially those involving governmental actors,

and the very large or indeterminate damages sought in some of these matters, there is significant uncertainty as to the ultimate

liability we may incur from these litigation matters and an adverse outcome in one or more of these matters could be material to

our results of operations or cash flows for any particular reporting period.

Interchange Litigation

In 2005, a number of entities, each purporting to represent a class of retail merchants, filed antitrust lawsuits (the “Interchange

Lawsuits”) against MasterCard and Visa and several member banks, including our subsidiaries and us, alleging among other things,

that the defendants conspired to fix the level of interchange fees. The complaints seek injunctive relief and civil monetary damages,

which could be trebled. Separately, a number of large merchants have asserted similar claims against Visa and MasterCard only.

In October 2005, the class and merchant Interchange Lawsuits were consolidated before the U.S. District Court for the Eastern

District of New York for certain purposes, including discovery. In July 2012, the parties executed and filed with the court a

Memorandum of Understanding agreeing to resolve the litigation on certain terms set forth in a settlement agreement attached to

the Memorandum. The class settlement provides for, among other things, (i) payments by defendants to the class and individual

plaintiffs totaling approximately $6.6 billion; (ii) a distribution to the class merchants of an amount equal to 10 basis points of

certain interchange transactions for a period of eight months; and (iii) modifications to certain Visa and MasterCard rules regarding

point of sale practices. In December 2013, the court granted final approval of the proposed class settlement, which was appealed

to the Second Circuit Court of Appeals in January 2014 and argued before the court on September 28, 2015. Several merchant

plaintiffs have also opted out of the class settlement, some of which have sued MasterCard, Visa and various member banks,

including Capital One. The opt-out cases were consolidated before the U.S. District Court for the Eastern District of New York

for certain purposes, including discovery. These consolidated cases are in their preliminary stages, and Visa and MasterCard have

settled a number of individual opt-out cases, requiring non-material payments from all banks. Separate settlement and judgment

sharing agreements between Capital One and MasterCard and Visa allocate the liabilities of any judgment or settlement arising

from the Interchange Lawsuits and associated opt-out cases. Visa created a litigation escrow account following its IPO of stock

in 2008, which funds any settlements for its member banks, and any settlements related to MasterCard allocated losses are reflected

in Capital One’s reserves.

In March 2011, a furniture store owner named Mary Watson filed a proposed class action in the Supreme Court of British Columbia

against Visa, MasterCard, and several banks, including Capital One (the “Watson Litigation”). The lawsuit asserts, among other

things, that the defendants conspired to fix the merchant discount fees that merchants pay on credit card transactions in violation

of Section 45 of the Competition Act and seeks unspecified damages and injunctive relief. In addition, Capital One has been named

as a defendant in similar proposed class action claims filed in other jurisdictions in Canada. In March 2014, the court granted a

partial motion for class certification. Both parties appealed the decision to the Court of Appeal for British Columbia, which heard

oral argument in December 2014. In April 2015, the merchant plaintiffs and Capital One agreed to settle all matters filed in Canada

as to Capital One and the courts across the different provinces approved the class settlement in the fourth quarter of 2015.