Capital One 2015 Annual Report Download - page 148

Download and view the complete annual report

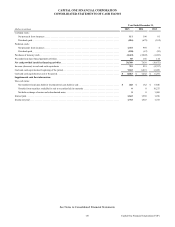

Please find page 148 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

129 Capital One Financial Corporation (COF)

Mortgage Servicing Rights

Mortgage servicing rights (“MSRs”) are initially recorded at fair value when mortgage loans are sold or securitized in the secondary

market and the right to service these loans is retained for a fee. Subsequently, our consumer MSRs are carried at fair value on our

consolidated balance sheets with changes in fair value recognized in non-interest income. Our commercial MSRs are subsequently

accounted for under the amortization method and are periodically evaluated for impairment, which is recognized as a reduction

in non-interest income. See “Note 8—Goodwill and Intangible Assets” and “Note 19—Fair Value Measurement” for additional

information.

Foreclosed Property and Repossessed Assets

Foreclosed property and repossessed assets obtained through our lending activities typically include commercial and residential

real estate or personal property, such as automobiles, and are recorded at net realizable value. For home loans collateralized by

residential real estate, we reclassify loans to foreclosed property at the earlier of when we obtain legal title to the residential real

estate property or when the borrower conveys all interest in the property to us. For all other foreclosed property and repossessed

assets, we reclassify the loan to repossessed assets upon repossession of the property in satisfaction of the loan. Net realizable

value is the estimated fair value of the underlying collateral less estimated selling costs and is based on appraisals, when available.

We routinely monitor and update the net realizable value of acquired property, adjusting our accounting to be equal to the lower

of cost or net realizable value. Any changes in net realizable value and gains or losses realized from disposition of the property

are recorded in non-interest expense. See “Note 19—Fair Value Measurement” for details.

Restricted Equity Investments

We have investments in Federal Home Loan Banks (“FHLB”) stock and in the Board of Governors of the Federal Reserve System

(the “Federal Reserve”) stock. These investments, which are included in other assets on our consolidated balance sheets, are not

marketable and are carried at cost. We assess these investments for OTTI in accordance with applicable accounting guidance for

evaluating impairment. See “Note 10—Deposits and Borrowings” for details.

Representation and Warranty Reserve

In connection with the sales of mortgage loans, certain of our subsidiaries entered into agreements containing varying representations

and warranties about, among other things, the ownership of the loan, the validity of the lien securing the loan, the loan’s compliance

with any applicable loan criteria established by the purchaser, including underwriting guidelines and the ongoing existence of

mortgage insurance, and the loan’s compliance with applicable federal, state and local laws. We may be required to repurchase

the mortgage loan, indemnify the investor or insurer, or reimburse the investor for loan losses incurred on the loan in the event of

a material breach of contractual representations or warranties.

We have established representation and warranty reserves for losses that we consider to be both probable and reasonably estimable

associated with the mortgage loans sold by each subsidiary, including both litigation and non-litigation liabilities. The reserve-

setting process relies heavily on estimates, which are inherently uncertain, and requires the application of judgment. We evaluate

these estimates on a quarterly basis.

Losses incurred on loans that we are required to either repurchase or make payments to the investor under indemnification provisions

are charged against the representation and warranty reserve. The representation and warranty reserve is included in other liabilities

on our consolidated balance sheets. Changes to the representation and warranty reserve related to GreenPoint Mortgage Funding,

Inc. (“GreenPoint”) are reported as discontinued operations for all periods presented. See “Note 21—Commitments, Contingencies,

Guarantees and Others” for additional information related to our representation and warranty reserve.