Capital One 2015 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

153 Capital One Financial Corporation (COF)

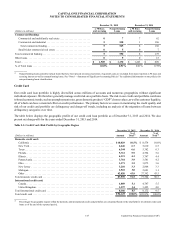

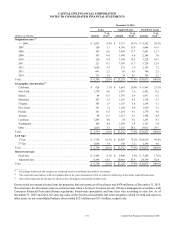

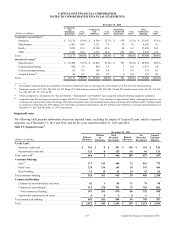

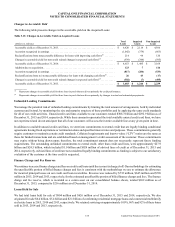

December 31, 2014

(Dollars in millions)

Commercial

and

Multifamily

Real Estate

% of

Total(1)

Commercial

and

Industrial

% of

Total(1)

Small-ticket

Commercial

Real Estate

% of

Total(1)

Total

Commercial

Banking

% of

Total(1)

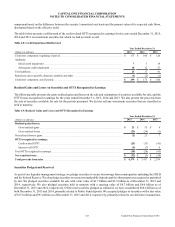

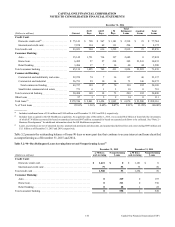

Geographic concentration:(2)

Northeast. . . . . . . . . . . . . . . . . . . . . . . . . . $ 15,135 65.4% $ 6,384 23.7% $ 478 61.2% $ 21,997 43.2%

Mid-Atlantic . . . . . . . . . . . . . . . . . . . . . . . 2,491 10.8 2,121 7.9 30 3.8 4,642 9.1

South. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,070 13.3 12,310 45.6 48 6.2 15,428 30.3

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,441 10.5 6,157 22.8 225 28.8 8,823 17.4

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 23,137 100.0% $ 26,972 100.0% $ 781 100.0% $ 50,890 100.0%

Internal risk rating:(3)

Noncriticized . . . . . . . . . . . . . . . . . . . . . . $ 22,489 97.2% $ 25,836 95.8% $ 767 98.2% $ 49,092 96.5%

Criticized performing . . . . . . . . . . . . . . . . 540 2.3 884 3.3 7 0.9 1,431 2.8

Criticized nonperforming . . . . . . . . . . . . . 62 0.3 106 0.4 7 0.9 175 0.3

Acquired Loans(4) . . . . . . . . . . . . . . . . . . . 46 0.2 146 0.5 0 0.0 192 0.4

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 23,137 100.0% $ 26,972 100.0% $ 781 100.0% $ 50,890 100.0%

__________

(1) Percentages calculated based on total held for investment commercial loans in each respective loan category as of the end of the reported period.

(2) Northeast consists of CT, MA, ME, NH, NJ, NY, PA and VT. Mid-Atlantic consists of DC, DE, MD, VA and WV. South consists of AL, AR, FL, GA, KY,

LA, MS, MO, NC, SC, TN and TX.

(3) Criticized exposures correspond to the “Special Mention,” “Substandard” and “Doubtful” asset categories defined by banking regulatory authorities.

(4) Acquired Loans that are being accounted for under ASC310-30 (formerly “SOP 03-3”) are classified as noncriticized. From a managed perspective, we

evaluate loans based on their actual risk ratings. Were these Acquired Loans to be classified based on their risk ratings, $128 million and $171 million would

be classified as Noncriticized, $793 million and $18 million as Criticized performing, and $37 million and $3 million as Criticized nonperforming as of

December 31, 2015 and December 31, 2014, respectively.

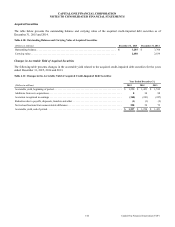

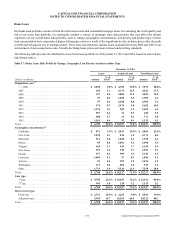

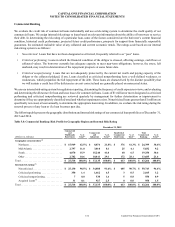

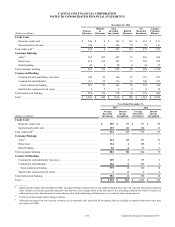

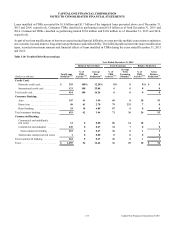

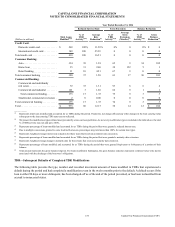

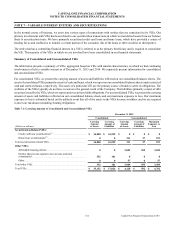

Impaired Loans

The following table presents information about our impaired loans, excluding the impact of Acquired Loans, which is reported

separately as of December 31, 2015 and 2014, and for the years ended December 31, 2015 and 2014:

Table 5.9: Impaired Loans(1)

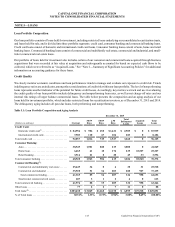

December 31, 2015

(Dollars in millions)

With an

Allowance

Without

an

Allowance

Total

Recorded

Investment

Related

Allowance

Net

Recorded

Investment

Unpaid

Principal

Balance

Credit Card:

Domestic credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 541 $ 0 $ 541 $ 150 $ 391 $ 526

International credit card. . . . . . . . . . . . . . . . . . . . . . . . . . . . 125 0 125 59 66 121

Total credit card(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 666 0 666 209 457 647

Consumer Banking:

Auto(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 273 215 488 22 466 772

Home loan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 229 136 365 18 347 456

Retail banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51 10 61 14 47 62

Total consumer banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 553 361 914 54 860 1,290

Commercial Banking:

Commercial and multifamily real estate . . . . . . . . . . . . . . . 82 3 85 11 74 88

Commercial and industrial. . . . . . . . . . . . . . . . . . . . . . . . . . 515 278 793 75 718 862

Total commercial lending . . . . . . . . . . . . . . . . . . . . . . . . . 597 281 878 86 792 950

Small-ticket commercial real estate. . . . . . . . . . . . . . . . . . . 6 0 6 0 6 7

Total commercial banking. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 603 281 884 86 798 957

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,822 $ 642 $ 2,464 $ 349 $ 2,115 $ 2,894