Capital One 2015 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

162 Capital One Financial Corporation (COF)

NOTE 7—VARIABLE INTEREST ENTITIES AND SECURITIZATIONS

In the normal course of business, we enter into various types of transactions with entities that are considered to be VIEs. Our

primary involvement with VIEs has been related to our securitization transactions in which we transferred assets from our balance

sheet to securitization trusts. We have primarily securitized credit card loans and home loans, which have provided a source of

funding for us and enabled us to transfer a certain portion of the economic risk of the loans or debt securities to third parties.

The entity that has a controlling financial interest in a VIE is referred to as the primary beneficiary and is required to consolidate

the VIE. The majority of the VIEs in which we are involved have been consolidated in our financial statements.

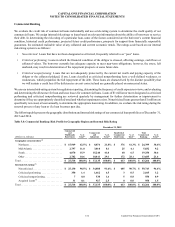

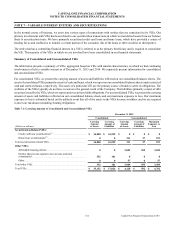

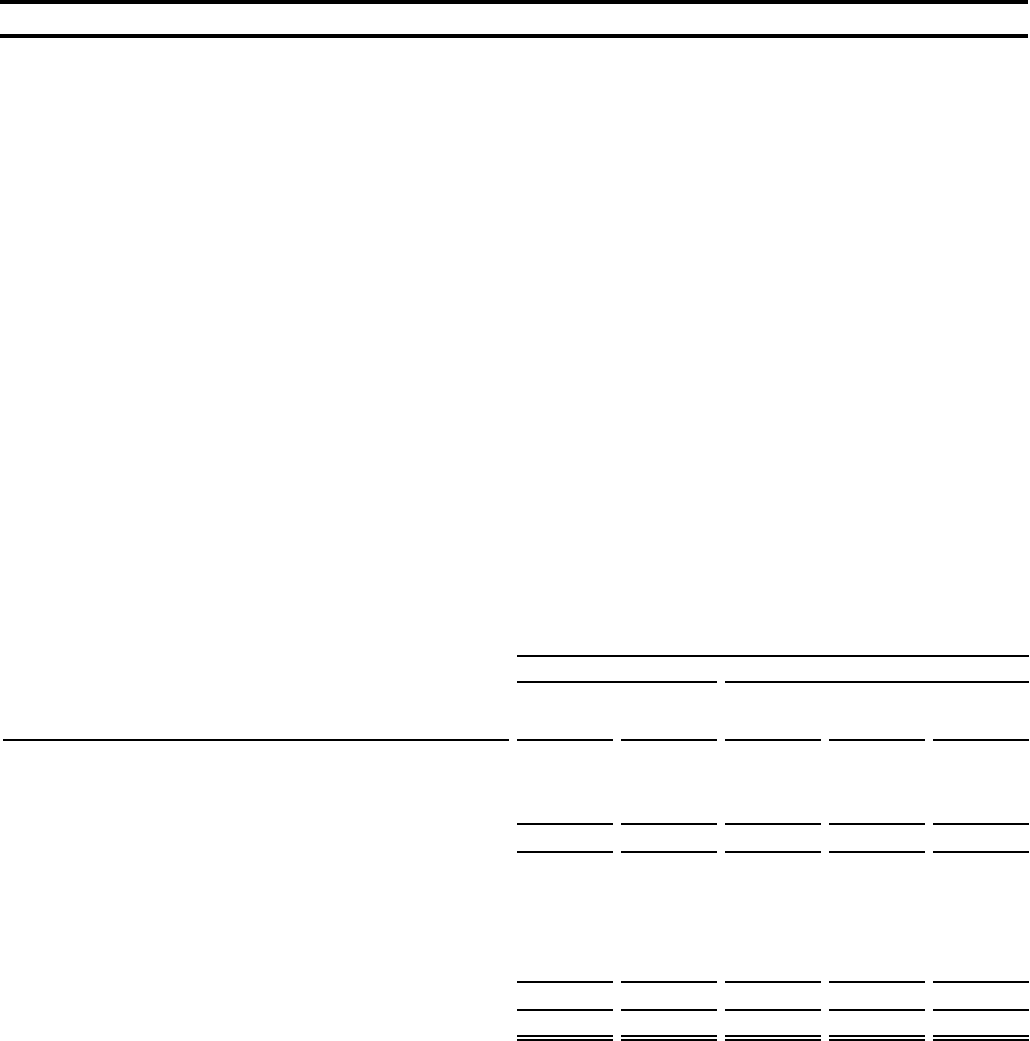

Summary of Consolidated and Unconsolidated VIEs

The table below presents a summary of VIEs, aggregated based on VIEs with similar characteristics, in which we had continuing

involvement or held a variable interest as of December 31, 2015 and 2014. We separately present information for consolidated

and unconsolidated VIEs.

For consolidated VIEs, we present the carrying amount of assets and liabilities reflected on our consolidated balance sheets. The

assets of consolidated VIEs primarily consist of cash and loans, which we report on our consolidated balance sheets under restricted

cash and restricted loans, respectively. The assets of a particular VIE are the primary source of funds to settle its obligations. The

creditors of the VIEs typically do not have recourse to the general credit of the Company. The liabilities primarily consist of debt

securities issued by the VIEs, which we report under securitized debt obligations. For unconsolidated VIEs, we present the carrying

amount of assets and liabilities reflected on our consolidated balance sheets and our maximum exposure to loss. Our maximum

exposure to loss is estimated based on the unlikely event that all of the assets in the VIEs become worthless and we are required

to meet our maximum remaining funding obligations.

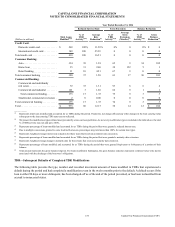

Table 7.1: Carrying Amount of Consolidated and Unconsolidated VIEs

December 31, 2015

Consolidated Unconsolidated

(Dollars in millions)

Carrying

Amount

of Assets

Carrying

Amount of

Liabilities

Carrying

Amount

of Assets

Carrying

Amount of

Liabilities

Maximum

Exposure to

Loss

Securitization-Related VIEs:

Credit card loan securitizations(1) . . . . . . . . . . . . . . . . . . . . . . . . . . $ 34,800 $ 16,925 $ 0 $ 0 $ 0

Home loan securitizations(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 211 27 873

Total securitization-related VIEs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34,800 16,925 211 27 873

Other VIEs:

Affordable housing entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 3,852 555 3,852

Entities that provide capital to low-income and rural

communities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 352 101 0 0 0

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 57 0 57

Total other VIEs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 352 101 3,909 555 3,909

Total VIEs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 35,152 $ 17,026 $ 4,120 $ 582 $ 4,782