Capital One 2015 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

146 Capital One Financial Corporation (COF)

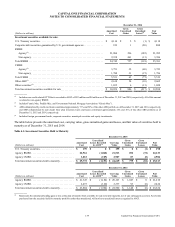

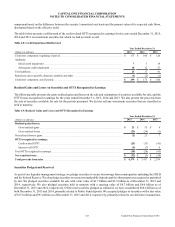

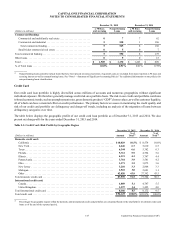

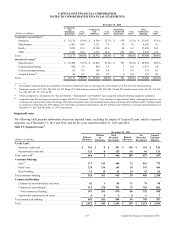

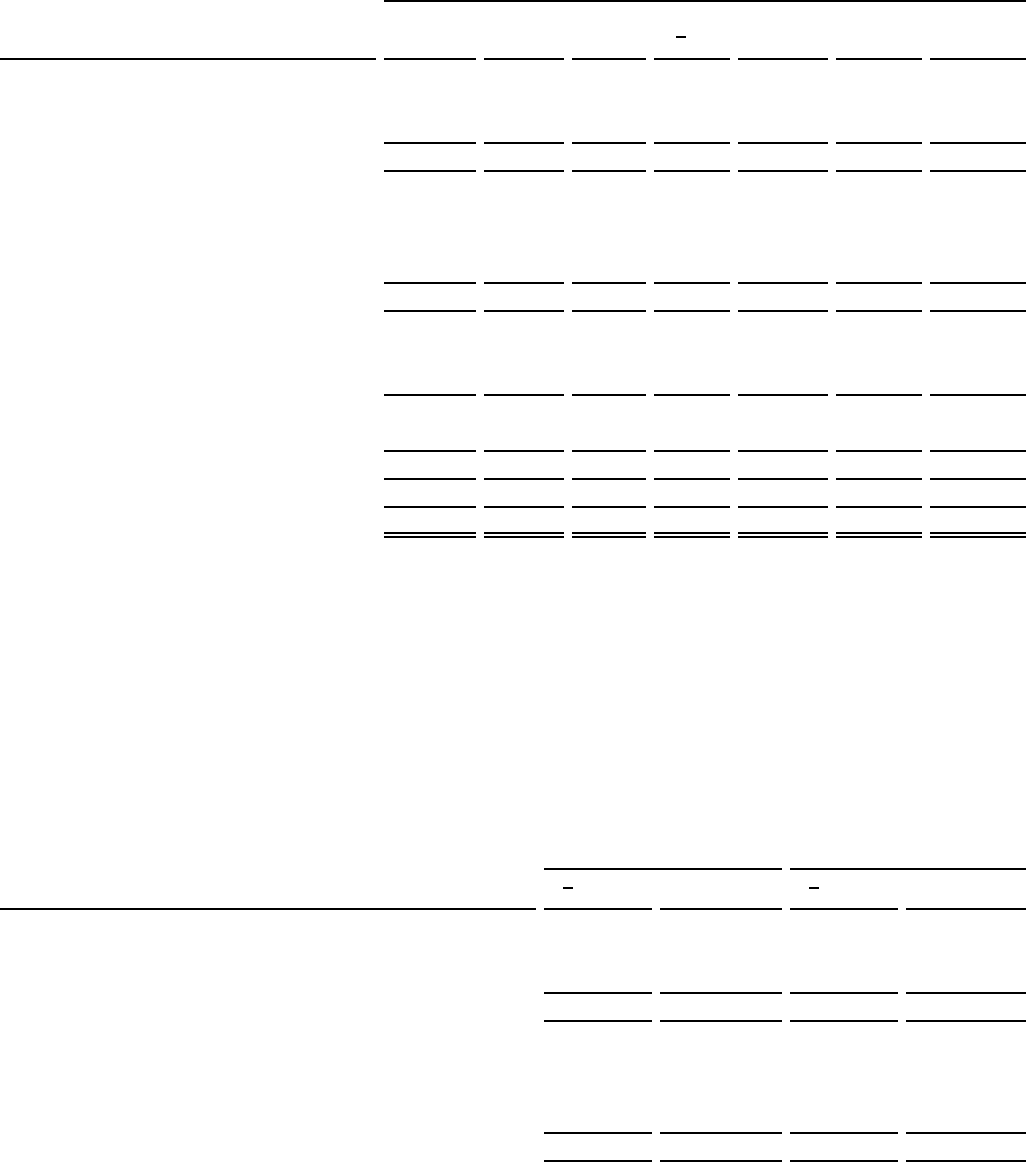

December 31, 2014

(Dollars in millions) Current

30-59

Days

60-89

Days

> 90

Days

Total

Delinquent

Loans

Acquired

Loans

Total

Loans

Credit Card:

Domestic credit card(1). . . . . . . . . . . . . . . . . . . . $ 75,143 $ 790 $ 567 $ 1,181 $ 2,538 $ 23 $ 77,704

International credit card. . . . . . . . . . . . . . . . . . . 7,878 114 69 111 294 0 8,172

Total credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . 83,021 904 636 1,292 2,832 23 85,876

Consumer Banking:

Auto . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35,142 1,751 734 197 2,682 0 37,824

Home loan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,492 57 27 218 302 23,241 30,035

Retail banking . . . . . . . . . . . . . . . . . . . . . . . . . . 3,496 17 7 16 40 44 3,580

Total consumer banking . . . . . . . . . . . . . . . . . . . . . 45,130 1,825 768 431 3,024 23,285 71,439

Commercial Banking:

Commercial and multifamily real estate . . . . . . 22,974 74 7 36 117 46 23,137

Commercial and industrial . . . . . . . . . . . . . . . . 26,753 29 10 34 73 146 26,972

Total commercial lending . . . . . . . . . . . . . . . . 49,727 103 17 70 190 192 50,109

Small-ticket commercial real estate. . . . . . . . . . 771 6 1 3 10 0 781

Total commercial banking . . . . . . . . . . . . . . . . . . . 50,498 109 18 73 200 192 50,890

Other loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97 3 2 9 14 0 111

Total loans(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 178,746 $ 2,841 $ 1,424 $ 1,805 $ 6,070 $ 23,500 $ 208,316

% of Total loans . . . . . . . . . . . . . . . . . . . . . . . . . . . 85.81% 1.36% 0.68% 0.87% 2.91% 11.28% 100.00%

__________

(1) Includes installment loans of $16 million and $144 million as of December 31, 2015 and 2014, respectively.

(2) Includes loans acquired in the GE Healthcare acquisition. At acquisition date of December 1, 2015, we recorded $8.2 billion of loans held for investment,

of which $7.4 billion accounted for based on amortized cost and $847 million accounted for based on expected cash flows to be collected. See “Note 2—

Business Developments” for additional information about the GE Healthcare acquisition.

(3) Loans, as presented, are net of unearned income, unamortized premiums and discounts, and unamortized deferred fees and costs totaling $989 million and

$1.1 billion as of December 31, 2015 and 2014, respectively.

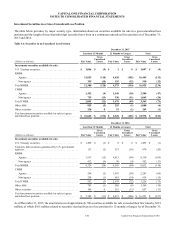

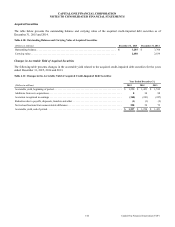

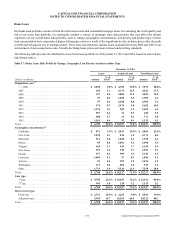

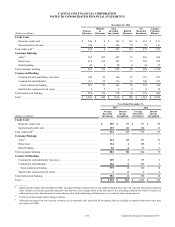

Table 5.2 presents the outstanding balance of loans 90 days or more past due that continue to accrue interest and loans classified

as nonperforming as of December 31, 2015 and 2014.

Table 5.2: 90+ Day Delinquent Loans Accruing Interest and Nonperforming Loans(1)

December 31, 2015 December 31, 2014

(Dollars in millions)

> 90 Days

and Accruing

Nonperforming

Loans

> 90 Days

and Accruing

Nonperforming

Loans

Credit Card:

Domestic credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,421 $ 0 $ 1,181 $ 0

International credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79 53 73 70

Total credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,500 53 1,254 70

Consumer Banking:

Auto. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 219 0 197

Home loan. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 311 0 330

Retail banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 28 1 22

Total consumer banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 558 1 549