Capital One 2015 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

160 Capital One Financial Corporation (COF)

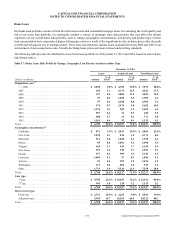

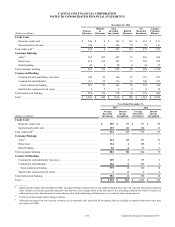

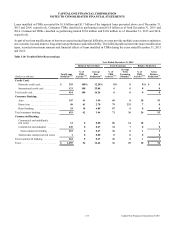

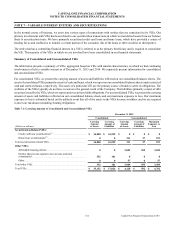

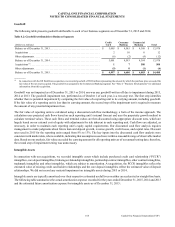

Components of Allowance for Loan and Lease Losses by Impairment Methodology

The table below presents the components of our allowance for loan and lease losses, by portfolio segment and impairment

methodology, and the recorded investment of the related loans as of December 31, 2015 and 2014.

Table 6.2: Components of Allowance for Loan and Lease Losses by Impairment Methodology

December 31, 2015

(Dollars in millions)

Credit

Card

Consumer

Banking

Commercial

Banking Other Total

Allowance for loan and lease losses:

Collectively evaluated(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,445 $ 778 $ 517 $ 4 $ 4,744

Asset-specific(2)(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 209 54 86 0 349

Acquired Loans(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 36 1 0 37

Total allowance for loan and lease losses(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,654 $ 868 $ 604 $ 4 $ 5,130

Loans held for investment:

Collectively evaluated(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 95,459 $ 51,113 $ 61,424 $ 88 $ 208,084

Asset-specific(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 666 699 884 0 2,249

Acquired Loans(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 18,560 958 0 19,518

Total loans held for investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 96,125 $ 70,372 $ 63,266 $ 88 $ 229,851

Allowance as a percentage of period-end loans held for investment . . . . . . . . . . . . . . . . . . . . 3.80% 1.23% 0.95% 4.94% 2.23%

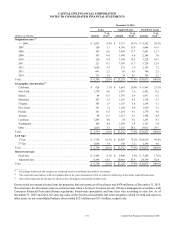

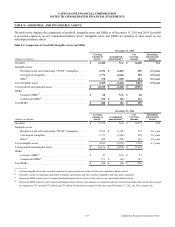

December 31, 2014

(Dollars in millions)

Credit

Card

Consumer

Banking

Commercial

Banking Other Total

Allowance for loan and lease losses:

Collectively evaluated(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,985 $ 710 $ 356 $ 5 $ 4,056

Asset-specific(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 219 42 39 0 300

Acquired Loans(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 27 0 0 27

Total allowance for loan and lease losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,204 $ 779 $ 395 $ 5 $ 4,383

Loans held for investment:

Collectively evaluated(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 85,161 $ 47,507 $ 50,328 $ 111 $ 183,107

Asset-specific(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 692 647 370 0 1,709

Acquired Loans(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 23,285 192 0 23,500

Total loans held for investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 85,876 $ 71,439 $ 50,890 $ 111 $ 208,316

Allowance as a percentage of period-end loans held for investment . . . . . . . . . . . . . . . . . . . . 3.73% 1.09% 0.78% 4.68% 2.10%

__________

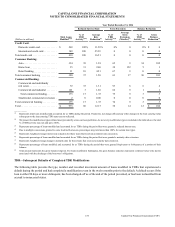

(1) The component of the allowance for loan and lease losses for credit card and other consumer loans that we collectively evaluate for impairment is based on

a statistical calculation supplemented by management judgment and interpretation. The component of the allowance for loan and lease losses for commercial

loans, which we collectively evaluate for impairment, is based on historical loss experience for loans with similar characteristics and consideration of credit

quality supplemented by management judgment and interpretation.

(2) The asset-specific component of the allowance for loan and lease losses for smaller-balance impaired loans is calculated on a pool basis using historical loss

experience for the respective class of assets. The asset-specific component of the allowance for loan and lease losses for larger-balance commercial loans is

individually calculated for each loan.

(3) Includes an allowance build of $39 million related to loans purchased in the GE Healthcare acquisition.

(4) The Acquired Loans component of the allowance for loan and lease losses is accounted for based on expected cash flows. See “Note 1—Summary of

Significant Accounting Policies” for details on these loans.