Capital One 2015 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

201 Capital One Financial Corporation (COF)

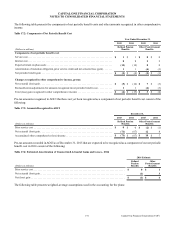

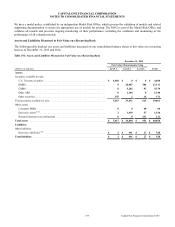

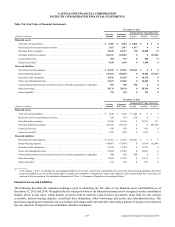

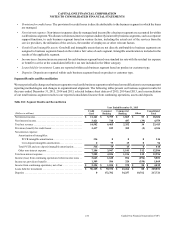

Table 19.2: Level 3 Recurring Fair Value Rollforward

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

Year Ended December 31, 2015

Total Gains (Losses)

(Realized/Unrealized)

Net Unrealized

Gains (Losses)

Included in Net

Income Related to

Assets and

Liabilities

Still Held as of

Dcember 31, 2015(3)

(Dollars in millions)

Balance,

January 1,

2015

Included

in Net

Income(1)

Included

in

OCI Purchases Sales Issuances Settlements

Transfers

Into

Level 3(2)

Transfers

Out of

Level 3(2)

Balance,

December

31, 2015

Assets:

Securities available for sale:

Corporate debt securities

guaranteed by U.S.

government agencies . . . . $ 333 $ (1) $ 6 $ 0 $(226) $ 0 $ (12) $ 0 $ (100) $ 0 $ 0

RMBS . . . . . . . . . . . . . . . 561 35 (3) 0 0 0 (63) 343 (369) 504 36

CMBS . . . . . . . . . . . . . . . 228 0 (1) 138 0 0 (52) 0 (216) 97 0

Other ABS . . . . . . . . . . . . 65 1 (2) 0 (20) 0 0 0 (44) 0 0

Other securities . . . . . . . . 18 0 0 4 0 0 (8) 0 0 14 0

Total securities available

for sale . . . . . . . . . . . . . . . 1,205 35 0 142 (246) 0 (135) 343 (729) 615 36

Other assets:

Consumer MSRs . . . . . . . 53 (1) 0 0 0 22 (6) 0 0 68 (1)

Derivative assets(4) . . . . . . 66 14 0 0 0 49 (59) 0 (13) 57 14

Retained interest in

securitizations . . . . . . . . . 221 (10) 0 0 0 0 0 0 0 211 (10)

Liabilities:

Other liabilities:

Derivative liabilities(4) . . . $ (43) $ (9) $ 0 $ 0 $ 0 $ (20) $ 36 $ 0 $ 9 $ (27) $ (9)

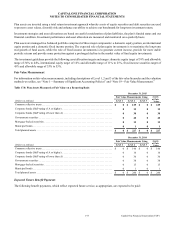

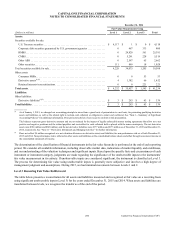

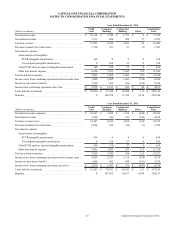

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

Year Ended December 31, 2014

Total Gains (Losses)

(Realized/Unrealized)

Net Unrealized

Gains (Losses)

Included in Net

Income Related to

Assets and Liabilities

Still Held as of

December 31, 2014(3)

(Dollars in millions)

Balance,

January 1,

2014

Included

in Net

Income(1)

Included

in

OCI Purchases Sales Issuances Settlements

Transfers

Into

Level 3(2)

Transfers

Out of

Level 3(2)

Balance,

December

31, 2014

Assets:

Securities available for sale:

Corporate debt securities

guaranteed by U.S.

government agencies . . . . $ 927 $ (5) $ 20 $ 0 $(248) $ 0 $ (63) $ 64 $ (362) $ 333 $ 0

RMBS . . . . . . . . . . . . . . . 1,304 65 39 1,022 0 0 (171) 259 (1,957) 561 64

CMBS . . . . . . . . . . . . . . . 739 0 3 192 0 0 (75) 66 (697) 228 0

Other ABS . . . . . . . . . . . . 343 5 12 0 0 0 (3) 75 (367) 65 5

Other securities . . . . . . . . 17 (1) 0 0 0 0 (8) 10 0 18 0

Total securities available

for sale . . . . . . . . . . . . . . . 3,330 64 74 1,214 (248) 0 (320) 474 (3,383) 1,205 69

Other assets:

Consumer MSRs . . . . . . . 69 (27) 0 0 0 15 (4) 0 0 53 (27)

Derivative assets(4) . . . . . . 50 20 0 0 0 20 (21) 0 (3) 66 19

Retained interest in

securitization . . . . . . . . . . 199 22 0 0 0 0 0 0 0 221 22

Liabilities:

Other liabilities:

Derivative liabilities(4) . . . $ (38) $ (20) $ 0 $ 0 $ 0 $ (15) $ 29 $ 0 $ 1 $ (43) $ (20)

__________

(1) Gains (losses) related to Level 3 Consumer MSRs, derivative assets and derivative liabilities, and retained interests in securitizations are reported in other

non-interest income, which is a component of non-interest income, in our consolidated statements of income.

(2) During the years ended December 31, 2015 and 2014, the transfers into Level 3 were primarily driven by less consistency among vendor pricing on individual

securities, while the transfers out of Level 3 for 2015 and 2014 were primarily driven by greater consistency among multiple pricing sources.