Capital One 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69 Capital One Financial Corporation (COF)

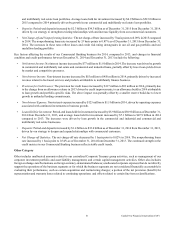

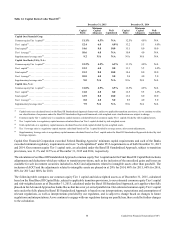

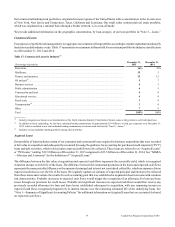

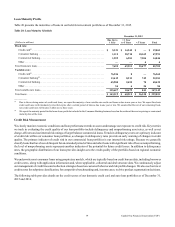

Table 15: Estimated Common Equity Tier 1 Capital Ratio under Fully Phased-In Basel III Standardized Approach(1)

(Dollars in millions) December 31, 2015

Common equity Tier 1 capital under Basel III Standardized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 29,544

Adjustments related to AOCI(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (363)

Adjustments related to intangibles(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (590)

Other adjustments(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —

Estimated common equity Tier 1 capital under fully phased-in Basel III Standardized . . . . . . . . . . . . . . . . . . . . . . . $ 28,591

Risk-weighted assets under Basel III Standardized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 265,739

Adjustments for fully phased-in Basel III Standardized(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (48)

Estimated risk-weighted assets under fully phased-in Basel III Standardized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 265,691

Estimated common equity Tier 1 capital ratio under fully phased-in Basel III Standardized(4) . . . . . . . . . . . . . . . . . 10.8%

__________

(1) Estimated common equity Tier 1 capital ratio under the fully phased-in Basel III Standardized Approach is a non-GAAP financial measure.

(2) Assumes adjustments are fully phased-in.

(3) Adjustments include higher risk weights for items that are included in capital based on the threshold deduction approach, such as mortgage servicing assets

and deferred tax assets. The adjustments also include removal of risk weights for items that are deducted from common equity Tier 1 capital.

(4) Calculated by dividing estimated common equity Tier 1 capital by estimated risk-weighted assets, which are both calculated under the Basel III Standardized

Approach, as it applies when fully phased-in for Advanced Approaches banks that have not yet exited parallel run.

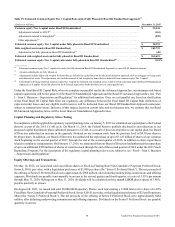

Under the Final Basel III Capital Rule, when we complete our parallel run for the Advanced Approaches, our minimum risk-based

capital requirement will be the greater of the Basel III Standardized Approach and the Basel III Advanced Approaches. See “Part

I—Item 1. Business—Supervision and Regulation” for additional information. Once we exit parallel run, based on clarification

of the Final Basel III Capital Rule from our regulators, any difference between the Final Basel III Capital Rule definitions of

expected credit losses and our eligible credit reserves will be deducted from our Basel III Standardized Approach numerator,

subject to transition provisions. Inclusive of this impact, based on current rules and our business mix, we estimate that our Basel

III Advanced Approaches ratios will be lower than our Standardized Approach ratios.

Capital Planning and Regulatory Stress Testing

In compliance with the applicable regulatory capital planning rules, on January 5, 2015 we submitted our capital plan to the Federal

Reserve as part of the 2015 CCAR cycle. On March 11, 2015, the Federal Reserve publicly disclosed its non-objection to our

proposed capital distribution plans submitted pursuant to CCAR. As a result of this non-objection to our capital plan, the Board

of Directors authorized an increase in the quarterly dividend on our common stock from the previous level of $0.30 per share to

$0.40 per share. In addition, our Board of Directors has authorized the repurchase of up to $3.125 billion of shares of our common

stock beginning in the second quarter of 2015 through the end of the second quarter of 2016, in addition to share repurchases

related to employee compensation. On February 17, 2016, we announced that our Board of Directors had authorized the repurchase

of up to an additional $300 million of shares of common stock through the end of the second quarter of 2016 under the 2015 Stock

Repurchase Program. For the description of the regulatory capital planning rules we are subject to, see “Part I—Item 1. Business

—Supervision and Regulation.”

Equity Offerings and Transactions

On May 14, 2015, we issued and sold one million shares of Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock,

Series E, $0.01 par value, with a liquidation preference of $1,000 per share (the “Series E Preferred Stock”). The net proceeds of

the offering of Series E Preferred Stock were approximately $988 million, after deducting underwriting commissions and offering

expenses. Dividends are payable semi-annually in arrears in the second quarter and fourth quarter, at a rate of 5.55% per annum

through May 31, 2020. Subsequent to May 31, 2020, dividends will be calculated as three month LIBOR plus a spread of 3.80%,

payable quarterly in arrears.

On August 24, 2015, we issued and sold 20,000,000 Depositary Shares, each representing a 1/40th interest in a share of 6.20%

Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series F, $0.01 par value, with a liquidation preference of $25 per Depositary

Share (the “Series F Preferred Stock”). The net proceeds of the offering of Series F Preferred Stock were approximately $484

million, after deducting underwriting commissions and offering expenses. Dividends on the Series F Preferred Stock are payable

quarterly in arrears.