Capital One 2015 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

164 Capital One Financial Corporation (COF)

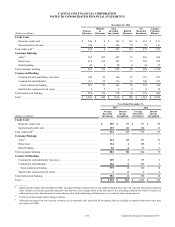

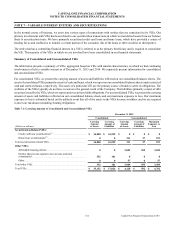

The table below presents the securitization-related VIEs in which we had continuing involvement as of December 31, 2015 and

2014.

Table 7.2: Continuing Involvement in Securitization-Related VIEs

Mortgage

(Dollars in millions)

Credit

Card

Option-

ARM

GreenPoint

HELOCs

GreenPoint

Manufactured

Housing

December 31, 2015:

Securities held by third-party investors . . . . . . . . . . . . . . . . . . $ 16,166 $ 1,754 $ 74 $ 789

Receivables in the trust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33,783 1,814 68 794

Cash balance of spread or reserve accounts . . . . . . . . . . . . . . 0 8 N/A 134

Retained interests. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes Yes Yes Yes

Servicing retained . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes Yes (1) No No (2)

Amortization event(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . No No No No

December 31, 2014:

Securities held by third-party investors . . . . . . . . . . . . . . . . . . $ 11,624 $ 2,026 $ 95 $ 887

Receivables in the trust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36,545 2,094 89 893

Cash balance of spread or reserve accounts . . . . . . . . . . . . . . 0 8 N/A 143

Retained interests. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes Yes Yes Yes

Servicing retained . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes Yes (1) No (1) No (2)

Amortization event(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . No No No No

__________

(1) We retained servicing of the outstanding balance for a portion of securitized mortgage receivables.

(2) The core servicing activities for the manufactured housing securitizations are completed by a third party.

(3) Amortization events vary according to each specific trust agreement but generally are triggered by declines in performance or credit metrics, such as net

charge-off rates or delinquency rates below certain predetermined thresholds. Generally, the occurrence of an amortization event changes the sequencing

and amount of trust-related cash flows to the benefit of senior noteholders.

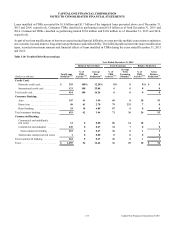

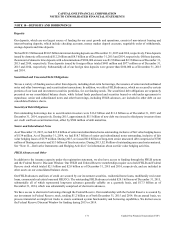

Credit Card Loan Securitizations

We hold certain retained interests in our credit card loan securitizations and continue to service the receivables in these trusts. As

of December 31, 2015 and 2014, we were deemed to be the primary beneficiary, and accordingly, all of these trusts have been

consolidated in our financial statements.

Mortgage Securitizations

Option-ARM Loans

We had previously securitized option-ARM loans by transferring the mortgage loans to securitization trusts that had issued

mortgage-backed securities to investors. The outstanding balance of debt securities held by third-party investors related to our

mortgage loan securitization trusts was $1.8 billion and $2.0 billion as of December 31, 2015 and 2014, respectively.

We continue to service a portion of the outstanding balance of securitized mortgage receivables. We also retain rights to future

cash flows arising from the receivables, the most significant being certificated interest-only bonds issued by the trusts. We generally

estimate the fair value of these retained interests based on the estimated present value of expected future cash flows from securitized

and sold receivables, using our best estimates of the key assumptions which include credit losses, prepayment speeds and discount

rates commensurate with the risks involved. For the trusts that we continue to service, we do not consolidate these entities because

we do not have the right to receive benefits nor the obligation to absorb losses that could potentially be significant to the trusts.

For the remaining trusts, for which we no longer service the underlying mortgage loans, we do not consolidate these entities since

we do not have the power to direct the activities that most significantly impact the economic performance of the trusts.

In connection with the securitization of certain option-ARM loans, a third party is obligated to advance a portion of any “negative

amortization” resulting from monthly payments that are less than the interest accrued for that payment period. We have an agreement