Capital One 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39 Capital One Financial Corporation (COF)

Business Outlook

We discuss below our current expectations regarding our total company performance and the performance of each of our business

segments over the near-term based on market conditions, the regulatory environment and our business strategies as of the time we

filed this Annual Report on Form 10-K. The statements contained in this section are based on our current expectations regarding

our outlook for our financial results and business strategies. Our expectations take into account, and should be read in conjunction

with, our expectations regarding economic trends and analysis of our business as discussed in “Part I—Item 1. Business” and “Part

II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Report. Certain

statements are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual

results could differ materially from those in our forward-looking statements. Except as otherwise disclosed, forward-looking

statements do not reflect: (i) any change in current dividend or repurchase strategies; (ii) the effect of any acquisitions, divestitures

or similar transactions that have not been previously disclosed; or (iii) any changes in laws, regulations or regulatory interpretations,

in each case after the date as of which such statements are made. See “Part I—Item 1. Business-Forward-Looking Statements” in

this Report for more information on the forward-looking statements included in this Report and “Part I—Item 1A. Risk Factors”

in this Report for factors that could materially influence our results.

Total Company Expectations

Our strategies and actions are designed to deliver and sustain strong returns and capital generation through the acquisition and

retention of franchise-enhancing customer relationships across our businesses. We believe that franchise-enhancing customer

relationships create and sustain significant long-term value through long and loyal customer relationships and a gradual build in

loan balances and revenues over time. Examples of franchise-enhancing customer relationships include rewards customers in our

Credit Card business, retail deposit customers in our Consumer Banking business and primary banking relationships with

commercial customers in our Commercial Banking business. We intend to grow these customer relationships by continuing to

invest in scalable infrastructure and operating platforms, so that we can meet the heightened risk management expectations facing

all banks and deliver a “brand-defining” customer experience that builds and sustains a valuable, long-term customer franchise.

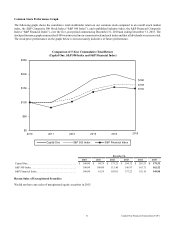

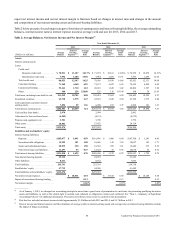

We delivered revenue growth and attractive risk-adjusted returns in 2015, highlighted by strong growth in our Domestic Card

business. In 2016, we expect full year growth in revenues, driven by loan growth. We expect some improvement in the full year

2016 efficiency ratio compared to 2015, with continuing improvement in 2017, excluding adjusting items.

We believe our actions have created a balance sheet with strong capital and liquidity. Pursuant to our approved 2015 capital plan,

we increased our quarterly common stock dividend from $0.30 per share to $0.40 per share starting in the second quarter of 2015.

We also expect to complete the repurchase of up to $3.125 billion of shares of our common stock pursuant to the 2015 Stock

Repurchase Program through the second quarter of 2016. The timing and exact amount of any common stock repurchases will

depend on various factors, including market conditions, opportunities for growth, and our capital position and amount of retained

earnings. The 2015 Stock Repurchase Program does not include specific price targets, may be executed through open market

purchases or privately negotiated transactions, including utilizing Rule 10b5-1 programs, and may be suspended at any time. See

“MD&A—Capital Management—Dividend Policy and Stock Purchases” for more information.

Business Segment Expectations

Credit Card: In our Domestic Card business, we expect the upward pressure on delinquencies and charge-offs as new loan balances

season and become a larger proportion of our overall portfolio will continue through 2016 and begin to moderate in 2017. We

continue to expect the full-year 2016 charge-off rate to be around four percent, with quarterly seasonal variability. Based on current

information and assuming relative stability in consumer behavior, the domestic economy, and competitive conditions, we expect

the full-year 2017 charge-off rate in the low four percent range, with quarterly seasonal variability. Loan growth coupled with our

expectations for a rising charge-off rate drove an allowance build in the fourth quarter, and we expect loan growth to drive allowance

additions going forward.

Consumer Banking: In our Consumer Banking business, we expect persistently low interest rates will continue to pressure returns

in our deposit businesses in 2016. We expect planned run-off from our acquired home loan portfolio to continue in 2016. We also

expect continued pressure on margins in our auto business due to the mix shift toward prime and continuing competitive pressure.

We expect these trends will negatively affect revenues in 2016.

Commercial Banking: Organic growth in our Commercial Banking business is slowing compared to prior years because of actions

we are taking in response to market conditions. While competition in the Commercial Banking business remains intense, pressuring