Capital One 2015 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 Capital One Financial Corporation (COF)

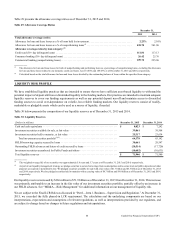

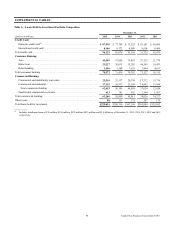

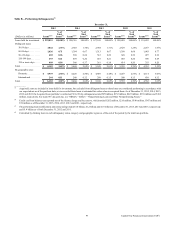

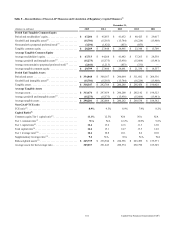

Table C—Nonperforming Loans and Other Nonperforming Assets

December 31,

(Dollars in millions) 2015 2014 2013 2012 2011

Nonperforming loans held for investment:(1)

Credit Card:

International credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 53 $ 70 $ 88 $ 100 $ —

Total credit card. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53 70 88 100 —

Consumer Banking:

Auto . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 219 197 194 149 106

Home loan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 311 330 376 422 456

Retail banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 22 41 71 90

Total consumer banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 558 549 611 642 652

Commercial Banking:

Commercial and multifamily real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 762 52 137 207

Commercial and industrial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 538 106 93 133 125

Total commercial lending . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 545 168 145 270 332

Small-ticket commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57 4 12 40

Total commercial banking. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 550 175 149 282 372

Other loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 915 19 30 35

Total nonperforming loans held for investment . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,170 $ 809 $ 867 $ 1,054 $ 1,059

Other nonperforming assets:

Foreclosed property(2)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 126 $ 139 $ 113 $ 204 $ 169

Other assets(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 198 183 160 109 95

Total nonperforming assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,494 $ 1,131 $ 1,140 $ 1,367 $ 1,323

Nonperforming loans as a percentage of loans held for investment . . . . . . . . . . . 0.51% 0.39% 0.44% 0.51% 0.78%

Nonperforming assets as a percentage of loans held for investment plus total

other nonperforming assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.65 0.54 0.58 0.66 0.97

__________

(1) The ratio of nonperforming loans as a percentage of total loans held for investment is calculated based on the nonperforming loans divided by the total

outstanding unpaid principal balance of loans held for investment. The denominator used in calculating the nonperforming asset ratios consists of total loans

held for investment and other nonperforming assets.

(2) Includes acquired REOs of $101 million as of both December 31, 2015 and 2014, $68 million, $167 million and $86 million as of December 31, 2013, 2012

and 2011, respectively.

(3) In 2013, we began including the net realizable value of auto loans that have been charged-off as a result of bankruptcy and repossessed assets obtained in

satisfaction of auto loans. Both of these amounts are included in other assets. Prior period amounts have been adjusted to conform to current period presentation.