Capital One 2015 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

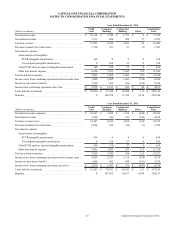

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

203 Capital One Financial Corporation (COF)

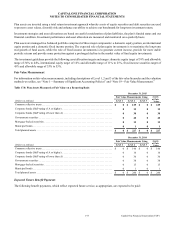

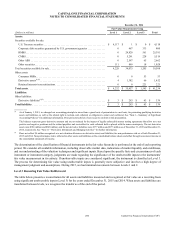

(Dollars in millions)

Fair Value at

December 31,

2014

Significant

Valuation

Techniques

Significant

Unobservable

Inputs Range

Weighted

Average

Assets:

Securities available for sale:

RMBS . . . . . . . . . . . . . . . . . . . . . . $ 561 Discounted cash flows

(3rd party pricing)

Yield

Constant prepayment rate

Default rate

Loss severity

0-18%

0-23%

0-15%

0-85%

6%

4%

5%

55%

CMBS . . . . . . . . . . . . . . . . . . . . . . 228 Discounted cash flows

(3rd party pricing)

Yield

Constant prepayment rate

1-4%

0-100%

1%

5%

Other ABS. . . . . . . . . . . . . . . . . . . 65 Discounted cash flows

(3rd party pricing)

Yield

Constant prepayment rate

Default rate

Loss severity

2-7%

0-3%

1-10%

30-88%

5%

2%

7%

71%

U.S. government guaranteed debt

and other securities . . . . . . . . . . . .

351 Discounted cash flows

(3rd party pricing)

Yield 1-4% 3%

Other assets:

Consumer MSRs . . . . . . . . . . . . . . 53 Discounted cash flows Total prepayment rate

Discount rate

Option-adjusted spread rate

Servicing cost ($ per loan)

12-27%

12%

435-1,500 bps

$93-$209

18%

12%

478 bps

$101

Derivative assets(1) . . . . . . . . . . . . 66 Discounted cash flows Swap rates 2-3% 2%

Retained interests in

securitization(2) . . . . . . . . . . . . . . .

221 Discounted cash flows Life of receivables (months)

Constant prepayment rate

Discount rate

Default rate

Loss severity

25-72

2-13%

4-9%

2-8%

19-95%

N/A

Liabilities:

Derivative liabilities(1). . . . . . . . . . $ 43 Discounted cash flows Swap rates 2-3% 2%

__________

(1) All Level 3 derivative assets and liabilities are presented on a gross basis and are not reduced by the impact of legally enforceable master netting agreements

that allow us to net positive and negative positions and the related payables and receivables for cash collateral held or placed with the same counterparty.

(2) Due to the nature of the various mortgage securitization structures in which we have retained interests, it is not meaningful to present a consolidated weighted

average for the significant unobservable inputs.

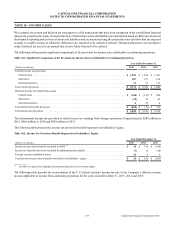

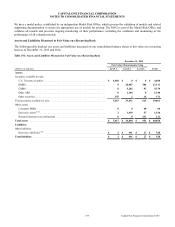

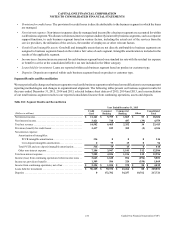

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

We are required to measure and recognize certain other assets at fair value on a nonrecurring basis on the consolidated balance

sheets. These assets are not measured at fair value on an ongoing basis but are subject to fair value adjustments in certain

circumstances (for example, from the application of lower of cost or market accounting or when we evaluate for impairment). The

following table presents the carrying amount of the assets measured at fair value on a nonrecurring basis and still held as of

December 31, 2015 and 2014, and for which a nonrecurring fair value measurement was recorded during the years then ended:

Table 19.4: Nonrecurring Fair Value Measurements Related to Assets Still Held at Period End

December 31, 2015

Estimated Fair Value Hierarchy

Total

(Dollars in millions) Level 1 Level 2 Level 3

Loans held for investment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0 $ 0 $ 362 $ 362

Loans held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 149 0 149

Other assets(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 92 92

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0 $ 149 $ 454 $ 603