Capital One 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74 Capital One Financial Corporation (COF)

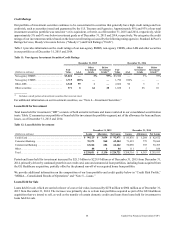

Liquidity Risk Management

We seek to mitigate liquidity risk strategically and tactically. From a strategic perspective, we have acquired and built deposit

gathering businesses and significantly reduced our loan to deposit ratio. From a tactical perspective, we have accumulated a sizable

liquidity reserve comprised of cash, high-quality, unencumbered securities, and committed collateralized credit lines. We also

continue to maintain access to the secured and unsecured markets through ongoing issuance. This combination of stable and

diversified funding sources and our stockpile of liquidity reserves enables us to maintain confidence in our liquidity position.

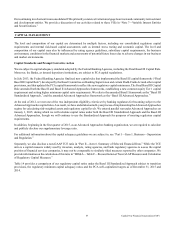

The Chief Risk Officer, in conjunction with the Chief Market and Liquidity Risk Officer, is responsible for the establishment of

liquidity risk management policies and standards for governance and monitoring of liquidity risk at a corporate level. The Chief

Financial Officer is accountable for the management of liquidity risk. We assess liquidity strength by evaluating several different

balance sheet metrics under severe stress scenarios to ensure we can withstand significant funding degradation in both idiosyncratic,

and market wide and combined liquidity stress scenarios. Management reports liquidity metrics to appropriate senior management

committees and our Board of Directors no less than quarterly. We continuously monitor market and economic conditions to evaluate

emerging stress conditions with assessment and appropriate action plans in accordance with our Contingency Funding Plan.

Market Risk Management

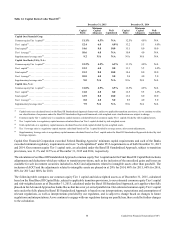

We recognize that interest rate and foreign exchange risk is inherent in the business of banking due to the nature of the assets and

liabilities of banks. Banks typically manage the trade-off between near-term earnings volatility and market value volatility by

targeting moderate levels of each. In addition to using industry accepted techniques to analyze and measure interest rate and foreign

exchange risk, we perform sensitivity analysis to identify our risk exposures under a broad range of scenarios. Investment securities

and derivatives are the main levers for the management of interest rate and foreign exchange risk.

The Chief Risk Officer, in conjunction with the Chief Market and Liquidity Risk Officer, is responsible for the establishment of

market risk management policies and standards and for governance and monitoring of market risk at a corporate level. The Chief

Financial Officer is accountable for the management of market risk. We manage market risk exposure, which is principally driven

by balance sheet interest rate risk, centrally and establish quantitative limits to control our exposure. Market risk is inherent in the

financial instruments associated with our business operations and activities, including loans, deposits, securities, short-term

borrowings, long-term debt and derivatives.

The market risk positions of our banking entities and our total company are calculated separately and in total and are reported in

comparison to pre-established limits to the Asset Liability Committee monthly and to the Risk Committee of the Board of Directors

no less than quarterly. Management is authorized to utilize financial instruments as outlined in our policy to actively manage

market risk exposure.

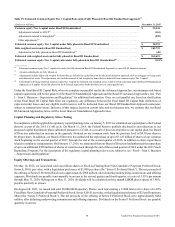

Operational Risk Management

We recognize the criticality of managing operational risk on a day-to-day basis and that there are heightened expectations from

our regulators and our customers. We have implemented appropriate operational risk management policies, standards, processes

and tools to enable the delivery of high quality and consistent customer experiences.

The Chief Operational Risk Officer is responsible for establishing and overseeing our Operational Risk Management Program.

The program establishes and enforces requirements and practices for assessing the operational risk profile, executing key control

processes for select operational risks, and reporting of operational risk results. These activities are executed in accordance with

Basel II Advanced Approaches requirements.

Reputation Risk Management

We recognize that reputation risk is of particular concern for financial institutions as a result of the aftermath of the financial crisis

and economic downturn, which has resulted in increased scrutiny and widespread regulatory changes. We manage both strategic

and tactical reputation issues and build our relationships with the government, media, consumer advocates, and other constituencies

to help strengthen the reputations of both our company and industry. Our actions include implementing pro-consumer practices

in our business and taking public positions in support of better consumer practices in our industry. The General Counsel is responsible

for managing our overall reputation risk program. Day-to-day activities are controlled by the frameworks set forth in our Reputation

Risk Management Policy and other risk management policies.