Capital One 2015 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

189 Capital One Financial Corporation (COF)

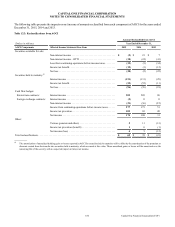

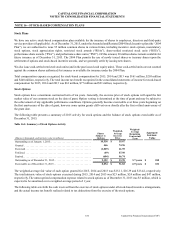

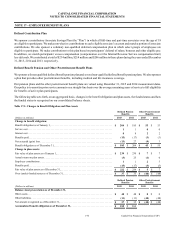

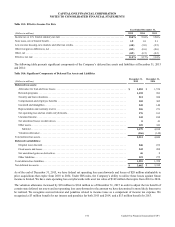

There were no PSAs granted in 2015. The weighted-average grant date fair value of PSAs granted during 2014 and 2013 was

$70.96 and $56.32, respectively. The total fair value of PSAs that vested during 2015, 2014 and 2013 was $30 million, $33 million

and $16 million, respectively. The unrecognized compensation expense related to unvested PSAs as of December 31, 2015 was

$0.3 million, which is expected to be amortized over a weighted-average period of 0.1 years.

The weighted-average grant date fair value of PSUs granted during 2015, 2014 and 2013 was $65.98, $68.66 and $52.05,

respectively. The total fair value of performance share units that vested on the vesting date was $74 million, $20 million and $10

million in 2015, 2014 and 2013, respectively. The unrecognized compensation expense related to unvested performance share

units as of December 31, 2015 was $28 million, which is expected to be amortized over a weighted-average period of 1 year.

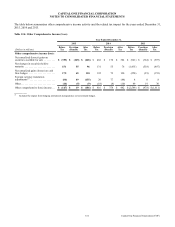

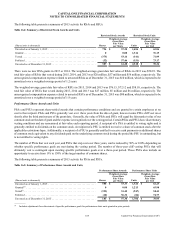

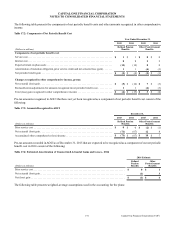

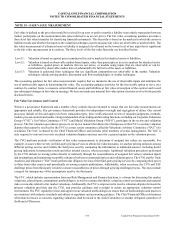

Cash-Settled Units

Cash-settled units are recorded as liabilities and marked-to-market on a quarterly basis. Cash-settled units are settled with a cash

payment for each unit vested that is equal to the average fair market value of our common stock for the 15 or 20 trading days

preceding the vesting date. Cash-settled units generally vest over three years beginning on the first anniversary of the date of grant,

however some cash-settled units cliff vest shortly before the one year anniversary of the grant date or on or shortly after the third

anniversary of the grant date. Cash-settled units vesting during 2015, 2014 and 2013 resulted in cash payments to associates of

$70 million, $72 million and $74 million, respectively. We expect to recognize the unrecognized compensation cost for unvested

cash-settled units of $1 million, as of December 31, 2015, based on the closing price of our common stock as of that date, over a

weighted-average period of 0.1 years.

Associate Stock Purchase Plan

We maintain an Associate Stock Purchase Plan (the “Purchase Plan”) which is a compensatory plan under the accounting guidance

for stock-based compensation. We recognized $16 million, $13 million and $11 million in compensation expense for 2015, 2014

and 2013, respectively, under the Purchase Plan.

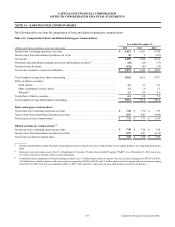

Under the Purchase Plan, eligible associates are permitted to contribute between 1% and 15% of their base salary through payroll

deductions. The amounts contributed are applied to the purchase of our unissued common or treasury stock at 85% of the current

market price. Shares may also be acquired on the open market. Dividends for active participants are automatically reinvested in

additional shares of common stock. Of the 18 million total authorized shares as of December 31, 2015, 7 million shares were

available for issuance.

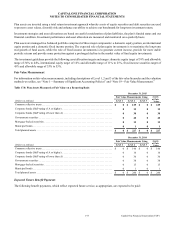

Dividend Reinvestment and Stock Purchase Plan

In 2002, we implemented our Dividend Reinvestment and Stock Purchase Plan (the “2002 DRP”), which allows participating

stockholders to purchase additional shares of our common stock through automatic reinvestment of dividends or optional cash

investments. Of the 8 million total authorized shares as of December 31, 2015, 7 million shares were available for issuance under

the 2002 DRP.