Capital One 2015 Annual Report Download - page 141

Download and view the complete annual report

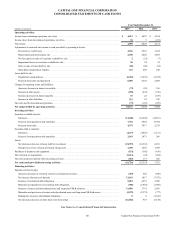

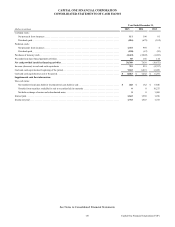

Please find page 141 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

122 Capital One Financial Corporation (COF)

value. Carrying value generally is equal to amortized cost. Investment securities transferred into the held to maturity category from

the available for sale category are recorded at fair value at the date of transfer. Any unrealized gains and losses at the transfer date

are thereafter included in AOCI. Such unrealized gains or losses are accreted over the remaining life of the security and are expected

to offset the amortization of the related premium or discount created upon the investment securities transfer into the held to maturity

category, with no expected impact on future net income.

Unamortized premiums, discounts and other basis adjustments are recognized in interest income over the contractual lives of the

securities using the effective interest method. We record purchases and sales of investment securities on a trade date basis. Realized

gains and losses from the sale of debt securities are computed using the first in first out method of identification, and are included

in non-interest income in our consolidated statements of income. If we intend to sell an available for sale security in an unrealized

loss position or it is more likely than not that we will be required to sell the security prior to recovery of its amortized cost basis,

the entire difference between the amortized cost basis of the security and its fair value is recognized in our consolidated statements

of income.

We regularly evaluate our securities whose values have declined below amortized cost to assess whether the decline in fair value

represents an other-than-temporary impairment (“OTTI”). Amortized cost reflects historical cost adjusted for amortization of

premiums, accretion of discounts and any previously recorded impairments. We discuss our assessment of and accounting for

OTTI in “Note 4—Investment Securities.” We discuss the techniques we use in determining the fair value of our investment

securities in “Note 19—Fair Value Measurement.”

Our investment portfolio also includes certain acquired debt securities that were deemed to be credit impaired at the acquisition

date, and therefore are accounted for in accordance with accounting guidance for purchased credit-impaired (“PCI”) loans and

debt securities. These securities are recorded at fair value at the acquisition date using the estimated cash flows we expect to collect

discounted by the prevailing market interest rate. The difference between the contractually required payments due and the

undiscounted cash flows we expect to collect at acquisition, considering the impact of prepayments, is referred to as the

nonaccretable difference. The nonaccretable difference reflects estimated future credit losses expected to be incurred over the life

of the security, and is neither accreted into income nor recorded on our consolidated balance sheet. The excess of the undiscounted

cash flows expected to be collected over the estimated fair value of credit-impaired debt securities at acquisition is referred to as

the accretable yield, which is accreted into interest income using an effective yield method over the remaining life of the security.

Decreases in expected cash flows attributable to credit result in the recognition of OTTI. Significant increases in expected cash

flows are recognized prospectively over the remaining life of the security as an adjustment to the accretable yield. See “Loans

Acquired” in this Note for further discussion of accounting guidance for purchased credit-impaired loans and debt securities.

Loans

Our loan portfolio consists of loans held for investment, including restricted loans underlying our consolidated securitization trusts,

and loans held for sale, and is divided into three portfolio segments: credit card, consumer banking and commercial banking loans.

Credit card loans consist of domestic and international credit card loans as well as installment loans. Consumer banking loans

consist of auto, home and retail banking loans. Commercial banking loans consist of commercial and multifamily real estate,

commercial and industrial, and small-ticket commercial real estate loans.

Loan Classification

Upon origination or purchase, we classify loans as held for investment or held for sale based on our investment strategy and

management’s intent and ability with regard to the loans which may change over time. The accounting and measurement framework

for loans differs depending on the loan classification, whether the loans are originated or purchased and whether purchased loans

are considered credit-impaired at the date of acquisition. The presentation within the consolidated statements of cash flows is based

on management’s intent at acquisition or origination. Cash flows related to unrestricted loans held for investment are included in

cash flows from investing activities on our consolidated statements of cash flows while cash flows from restricted loans for

securitization investors are included in cash flows from financing activities. The difference is due to the treatment of securitization

transactions as secured borrowings. Cash flows related to unrestricted loans held for sale are included in cash flows from operating

activities on our consolidated statements of cash flows.