Capital One 2015 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

171 Capital One Financial Corporation (COF)

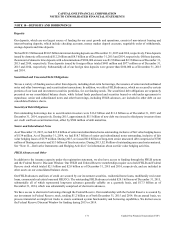

NOTE 10—DEPOSITS AND BORROWINGS

Deposits

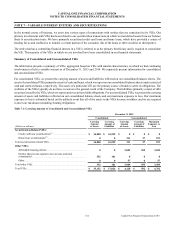

Our deposits, which are our largest source of funding for our asset growth and operations, consist of non-interest bearing and

interest-bearing deposits, which include checking accounts, money market deposit accounts, negotiable order of withdrawals,

savings deposits and time deposits.

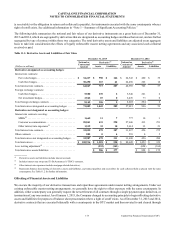

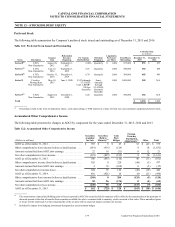

We had $191.9 billion and $180.5 billion in interest-bearing deposits as of December 31, 2015 and 2014, respectively. Time deposits

issued by domestic offices totaled $12.2 billion and $8.3 billion as of December 31, 2015 and 2014, respectively. Of these deposits,

the amount of domestic time deposits with a denomination of $100,000 or more was $1.9 billion and $2.3 billion as of December 31,

2015 and 2014, respectively. Time deposits issued by foreign offices totaled $843 million and $977 million as of December 31,

2015 and 2014, respectively. Substantially all of our foreign time deposits were greater than $100,000 as of December 31, 2015

and 2014.

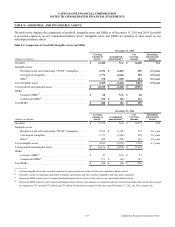

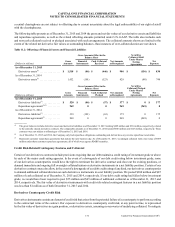

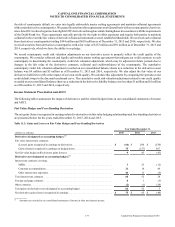

Securitized and Unsecured Debt Obligations

We use a variety of funding sources other than deposits, including short-term borrowings, the issuance of senior and subordinated

notes and other borrowings, and securitization transactions. In addition, we utilize FHLB advances, which are secured by certain

portions of our loan and investment securities portfolios, for our funding needs. The securitized debt obligations are separately

presented on our consolidated balance sheets, while federal funds purchased and securities loaned or sold under agreements to

repurchase, senior and subordinated notes and other borrowings, including FHLB advances, are included in other debt on our

consolidated balance sheets.

Securitized Debt Obligations

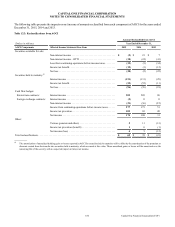

Our outstanding borrowings due to securitization investors were $16.2 billion and $11.6 billion as of December 31, 2015 and

December 31, 2014, respectively. During 2015, approximately $5.1 billion of new debt was issued to third-party investors from

our credit card loan securitization trust, offset by $500 million of debt maturities.

Senior and Subordinated Notes

As of December 31, 2015, we had $21.8 billion of senior and subordinated notes outstanding, inclusive of fair value hedging losses

of $134 million. As of December 31, 2014, we had $18.7 billion of senior and subordinated notes outstanding, inclusive of fair

value hedging losses of $179 million. During 2015, we issued $6.0 billion of long-term senior unsecured debt comprised of $700

million of floating-rate notes and $5.3 billion of fixed-rate notes. During 2015, $2.8 billion of outstanding unsecured notes matured.

See “Note 11—Derivative Instruments and Hedging Activities” for information about our fair value hedging activities.

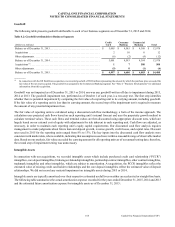

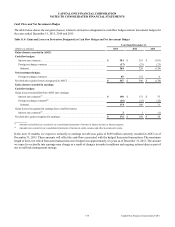

FHLB Advances and Other

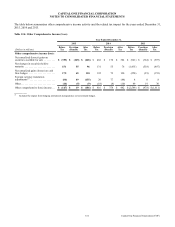

In addition to the issuance capacity under the registration statement, we also have access to funding through the FHLB system

and the Federal Reserve Discount Window. Our FHLB and Federal Reserve memberships require us to hold FHLB and Federal

Reserve stock which totaled $2.1 billion and $2.0 billion as of December 31, 2015 and 2014, respectively, and are included in

other assets on our consolidated balance sheets.

Our FHLB advances and lines of credit are secured by our investment securities, residential home loans, multifamily real estate

loans, commercial real estate loans and HELOCs. The outstanding FHLB advances totaled $20.1 billion as of December 31, 2015,

substantially all of which represented long-term advances generally callable on a quarterly basis, and $17.3 billion as of

December 31, 2014, which was substantially comprised of short-term advances.

We have access to short-term borrowings through the Federal Reserve. Our membership with the Federal Reserve is secured by

our investment in Federal Reserve stock, totaling $1.2 billion as of both December 31, 2015 and 2014. On an annual basis, we

process immaterial overnight test trades to ensure continued system functionality and borrowing capabilities. We did not access

the Federal Reserve Discount Window for funding during 2015 or 2014.