Capital One 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.105 Capital One Financial Corporation (COF)

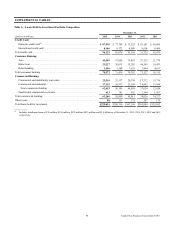

For Acquired Loans, the carrying value equals fair value upon acquisition adjusted for subsequent cash collections and yield

accreted to date.

CCB: Chevy Chase Bank, F.S.B., which was acquired by the Company in 2009.

COBNA: Capital One Bank (USA), National Association, one of our fully owned subsidiaries, which offers credit and debit card

products, other lending products and deposit products.

Collective trusts: An investment fund formed from the pooling of investments by investors.

Common equity Tier 1 capital: Common equity, related surplus and retained earnings less accumulated other comprehensive

income net of applicable phase-ins, less goodwill and intangibles net of associated deferred tax liabilities and applicable phase-

ins, less other deductions, as defined by regulators.

Company: Capital One Financial Corporation and its subsidiaries.

CONA: Capital One, National Association, one of our fully owned subsidiaries, which offers a broad spectrum of banking products

and financial services to consumers, small businesses and commercial clients.

Credit risk: The risk of loss from an obligor’s failure to meet the terms of any contract or otherwise fail to perform as agreed.

Derivative: A contract or agreement whose value is derived from changes in interest rates, foreign exchange rates, prices of

securities or commodities, credit worthiness for credit default swaps or financial or commodity indices.

Discontinued operations: The operating results of a component of an entity, as defined by ASC 205, that are removed from

continuing operations when that component has been disposed of or it is management’s intention to sell the component.

Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”): Regulatory reform legislation signed

into law on July 21, 2010. This law broadly affects the financial services industry and contains numerous provisions aimed at

strengthening the sound operation of the financial services sector.

Exchange Act: The Securities Exchange Act of 1934.

eXtensible Business Reporting Language (“XBRL”): A language for the electronic communication of business and financial

data.

Federal Banking Agencies: The Federal Reserve, Office of the Comptroller of the Currency and Federal Deposit Insurance

Corporation.

Federal Reserve: Board of Governors of the Federal Reserve System.

FICO score: A measure of consumer credit risk provided by credit bureaus, typically produced from statistical modeling software

created by Fair Isaac Corporation utilizing data collected by the credit bureaus.

Final Basel III Capital Rule: The Federal Baking Agencies issued a rule in July 2013 implementing the Basel III capital framework

developed by the Basel Committee as well as certain Dodd-Frank Act and other capital provisions.

Final LCR Rule: The Federal Banking Agencies issued final rules implementing the Basel III liquidity coverage ratio in the

United States.

Foreign currency derivative contracts: An agreement to exchange contractual amounts of one currency for another currency at

one or more future dates.

Foreign exchange contracts: Contracts that provide for the future receipt or delivery of foreign currency at previously agreed-

upon terms.

GreenPoint: Refers to our wholesale mortgage banking unit, GreenPoint Mortgage Funding, Inc. (“GreenPoint”), which was

closed in 2007.

GSE or Agency: A government-sponsored enterprise or agency is a financial services corporation created by the United States

Congress. Examples of U.S. government agencies include Federal National Mortgage Association (Fannie Mae), Federal Home

Loan Mortgage Corporation (Freddie Mac), Government National Mortgage Association (Ginnie Mae) and the Federal Home

Loan Banks.

Impairment: The condition when the carrying amount of an asset exceeds or is expected to exceed its fair value.