Capital One 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44 Capital One Financial Corporation (COF)

with prices from other sources and reviewing other control documentation. Additionally, when necessary, the CVG and TAV

challenge prices from third-party vendors to ensure reasonableness of prices through a pricing challenge process. This may include

a request for a transparency of the assumptions used by the third party.

The FVC, which includes representation from business areas, our Risk Management division and our Finance division, is a forum

for discussing fair market valuations, inputs, assumptions, methodologies, variance thresholds, valuation control environment and

material risks or concerns related to fair market valuations. Additionally, the FVC is empowered to resolve valuation disputes

between the primary valuation providers and the CVG. It provides guidance and oversight to ensure an appropriate valuation

control environment. The FVC regularly reviews and approves our valuation methodologies to ensure that our methodologies and

practices are consistent with industry standards and adhere to regulatory and accounting guidance. The Chief Financial Officer

determines when material issues or concerns regarding valuations shall be raised to the Audit Committee or other delegated

committee of the Board of Directors.

We have a model policy, established by an independent Model Risk Office, which governs the validation of models and related

supporting documentation to ensure the appropriate use of models for pricing. The Model Validation Group is part of the Model

Risk Office and validates all models and provides ongoing monitoring of their performance, including the validation and monitoring

of the performance of all valuation models.

Representation and Warranty Reserve

In connection with the sales of mortgage loans, certain subsidiaries entered into agreements containing varying representations

and warranties about, among other things, the ownership of the loan, the validity of the lien securing the loan, the loan’s compliance

with any applicable loan criteria established by the purchaser, including underwriting guidelines and the ongoing existence of

mortgage insurance, and the loan’s compliance with applicable federal, state and local laws. We may be required to repurchase

the mortgage loan, indemnify the investor or insurer, or reimburse the investor for losses incurred on the loan in the event of a

material breach of contractual representations or warranties.

We have established representation and warranty reserves for losses that we consider to be both probable and reasonably estimable

associated with the mortgage loans sold by each subsidiary, including both litigation and non-litigation liabilities. The reserve-

setting process relies heavily on estimates, which are inherently uncertain, and requires the application of judgment. In establishing

the representation and warranty reserves, we rely on historical data and consider a variety of factors, depending on the category

of purchaser. These factors include, but are not limited to, the historical relationship between loan losses and repurchase outcomes;

the percentage of current and future loan defaults that we anticipate will result in repurchase requests over the lifetime of the loans;

the percentage of those repurchase requests that we anticipate will result in actual repurchases; and estimated collateral valuations.

We evaluate these factors and update our loss forecast models on a quarterly basis to estimate our lifetime liability.

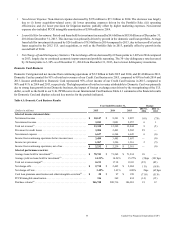

Our aggregate representation and warranty mortgage reserve, which we report as a component of other liabilities on our consolidated

balance sheets, totaled $610 million and $731 million as of December 31, 2015 and 2014, respectively. The adequacy of the reserve

and the ultimate amount of losses incurred by us or one of our subsidiaries will depend on, among other things, actual future

mortgage loan performance, the actual level of future repurchase and indemnification requests, the actual success rates of claimants,

developments in litigation, actual recoveries on the collateral and macroeconomic conditions (including unemployment levels and

housing prices).

As part of our business planning processes, we have considered various outcomes relating to the potential future representation

and warranty liabilities of our subsidiaries that are possible but do not rise to the level of being both probable and reasonably

estimable outcomes justifying an incremental accrual under applicable accounting standards. Our current best estimate of reasonably

possible future losses from representation and warranty claims beyond what was in our reserve as of December 31, 2015 is

approximately $1.6 billion, a decline from our estimate of $2.1 billion as of December 31, 2014. Notwithstanding our ongoing

attempts to estimate a reasonably possible amount of future losses beyond our current accrual levels based on current information,

it is possible that actual future losses will exceed both the current accrual level and our current estimate of the amount of reasonably

possible losses. This estimate involves considerable judgment, and reflects that there is still significant uncertainty regarding the

numerous factors that may impact the ultimate loss levels, including, but not limited to, anticipated litigation outcomes, future

repurchase and indemnification claim levels, ultimate repurchase and indemnification rates, future mortgage loan performance

levels, actual recoveries on the collateral and macroeconomic conditions (including unemployment levels and housing prices). In

light of the significant uncertainty as to the ultimate liability our subsidiaries may incur from these matters, an adverse outcome

in one or more of these matters could be material to our consolidated results of operations or cash flows for any particular reporting

period. See “Note 21—Commitments, Contingencies, Guarantees and Others” for additional information.