Capital One 2015 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

166 Capital One Financial Corporation (COF)

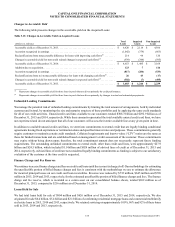

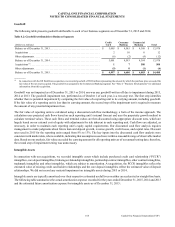

We account for certain of our investments in qualified affordable housing projects using the proportional amortization method if

certain criteria are met. The proportional amortization method amortizes the cost of the investment over the period in which the

investor expects to receive tax credits and other tax benefits, and the resulting amortization is recognized as a component of income

tax expense attributable to continuing operations. For the years ended December 31, 2015 and 2014, we recognized amortization

of $337 million and $305 million, respectively, and tax credits of $382 million and $336 million, respectively, associated with

these investments within income tax provision. The carrying value of our investments in these qualified affordable housing projects

was $3.5 billion and $3.2 billion as of December 31, 2015 and 2014, respectively. We are periodically required to provide additional

financial or other support during the period of the investments. We had a recorded liability of $1.3 billion for these unfunded

commitments as of December 31, 2015, which is expected to be paid from 2016 to 2019.

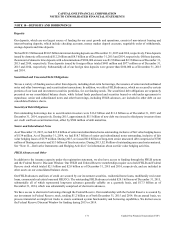

For those investment funds considered to be VIEs, we are not required to consolidate them if we do not have the power to direct

the activities that most significantly impact the economic performance of those entities. We record our interests in these

unconsolidated VIEs in loans held for investment, other assets and other liabilities on our consolidated balance sheets. Our interests

consisted of assets of approximately $3.9 billion and $3.5 billion as of December 31, 2015 and 2014, respectively. Our maximum

exposure to these entities is limited to our variable interests in the entities of $3.9 billion and $3.5 billion as of December 31, 2015

and 2014, respectively. The creditors of the VIEs have no recourse to our general credit and we do not provide additional financial

or other support other than during the period that we are contractually required to provide. The total assets of the unconsolidated

VIE investment funds were $11.4 billion and $10.2 billion as of December 31, 2015 and 2014, respectively.

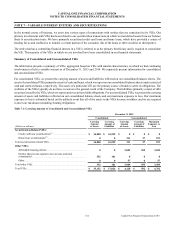

Entities that Provide Capital to Low-Income and Rural Communities

We hold variable interests in entities (“Investor Entities”) that invest in community development entities (“CDEs”) that provide

debt financing to businesses and non-profit entities in low-income and rural communities. Variable interests in the CDEs held by

the consolidated Investor Entities are also our variable interests. The activities of the Investor Entities are financed with a

combination of invested equity capital and debt. The activities of the CDEs are financed solely with invested equity capital. We

receive federal and state tax credits for these investments. We consolidate the VIEs in which we have the power to direct the

activities that most significantly impact the VIE’s economic performance and where we have the obligation to absorb losses or

right to receive benefits that could be potentially significant to the VIE. We have also consolidated other investments and CDEs

that are not considered to be VIEs, but where we hold a controlling financial interest. The assets of the VIEs that we consolidated,

which totaled approximately $352 million and $374 million as of December 31, 2015 and 2014, respectively, are reflected on our

consolidated balance sheets in cash, loans held for investment, interest receivable and other assets. The liabilities are reflected in

other liabilities. The creditors of the VIEs have no recourse to our general credit. We have not provided additional financial or

other support other than during the period that we are contractually required to provide.

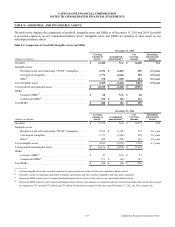

Other

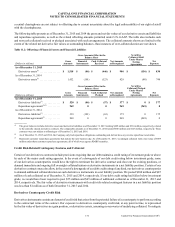

Other VIEs include a variable interest that we hold in a trust that has a royalty interest in certain oil and gas properties. The activities

of the trust are financed solely with debt. The total assets of the trust were $120 million and $159 million as of December 31, 2015

and 2014, respectively. We were not required to consolidate the trust because we do not have the power to direct the activities that

most significantly impact the trust’s economic performance. Our maximum exposure to this entity is limited to our retained interest

of $57 million and $74 million as of December 31, 2015 and 2014, respectively. The creditors of the trust have no recourse to our

general credit. We have not provided additional financial or other support other than during the period that we are contractually

required to provide.