Capital One 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41 Capital One Financial Corporation (COF)

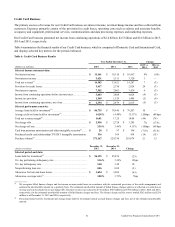

In addition to the allowance for loan and lease losses, we review and assess our estimate of probable losses related to binding

unfunded lending commitments, such as letters of credit and financial guarantees, and unfunded loan commitments on a quarterly

basis. The factors impacting our assessment generally align with those considered in our evaluation of the allowance for loan and

lease losses for the Commercial Banking business. Changes to the reserve for losses on unfunded lending commitments are recorded

through the provision for credit losses in the consolidated statements of income and to other liabilities on the consolidated balance

sheets.

Although we examine a variety of externally available data, as well as our internal loan performance data, to determine our

allowance for loan and lease losses and reserve for unfunded lending commitments, our estimation process is subject to risks and

uncertainties, including a reliance on historical loss and trend information that may not be representative of current conditions and

indicative of future performance. Accordingly, our actual credit loss experience may not be in line with our expectations. We

provide additional information on the methodologies and key assumptions used in determining our allowance for loan and lease

losses for each of our loan portfolio segments in “Note 1—Summary of Significant Accounting Policies.” We provide information

on the components of our allowance, disaggregated by impairment methodology, and changes in our allowance in “Note 6—

Allowance for Loan and Lease Losses.”

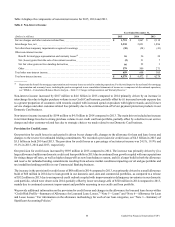

Finance Charge and Fee Reserves

Finance charges and fees on credit card loans, net of amounts that we consider uncollectible, are included in loan receivables and

revenue when the finance charges and fees are earned. We continue to accrue finance charges and fees on credit card loans until

the account is charged-off; however, when we do not expect full payment of billed finance charges and fees, we reduce the balance

of our credit card loan receivables by the amount of finance charges and fees billed but not expected to be collected and exclude

this amount from revenue. Total net revenue was reduced by $732 million, $645 million and $796 million in 2015, 2014 and 2013,

respectively, for the estimated uncollectible amount of billed finance charges and fees. The finance charge and fee reserve totaled

$262 million as of December 31, 2015, compared to $216 million as of December 31, 2014.

We review and assess the adequacy of the uncollectible finance charge and fee reserve on a quarterly basis. Our methodology for

estimating the uncollectible portion of billed finance charges and fees is consistent with the methodology we use to estimate the

allowance for incurred losses on the principal portion of our credit card loan receivables.

Asset Impairment

In addition to our loan portfolio, we review other assets for impairment on a regular basis in accordance with applicable impairment

accounting guidance. This process requires significant management judgment and involves various estimates and assumptions.

Our investment securities, goodwill and intangible assets represent a significant portion of our total assets excluding loans.

Accordingly, below we describe our process for assessing impairment of these assets and the key estimates and assumptions

involved in this process.

Investment Securities

We regularly review our investment securities for other-than-temporary impairment (“OTTI”) using both quantitative and

qualitative criteria. If we intend to sell a security in an unrealized loss position or it is more likely than not that we will be required

to sell the security prior to recovery of its amortized cost basis, the entire difference between the amortized cost basis of the security

and its fair value is recognized in income. If we do not intend to sell the security and it is not more likely than not that we will be

required to sell the security before recovery of our amortized cost, we evaluate other quantitative and qualitative criteria to determine

whether a credit loss exists. Our evaluation requires significant management judgment and a consideration of many factors,

including, but not limited to, the extent and duration of the impairment; the health of and specific prospects for the issuer, including

whether the issuer has failed to make scheduled interest or principal payments; recent events specific to the issuer and/or industry

to which the issuer belongs; the payment structure of the security; external credit ratings; the value of underlying collateral and

current market conditions. Quantitative criteria include assessing whether there has been an adverse change in expected future

cash flows. See “Note 4—Investment Securities” for additional information.

Goodwill and Intangible Assets

Goodwill resulting from business combinations prior to January 1, 2009 represents the excess of the purchase price over the fair

value of the net assets of businesses acquired. Goodwill resulting from business combinations after January 1, 2009, is generally