Capital One 2015 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

134 Capital One Financial Corporation (COF)

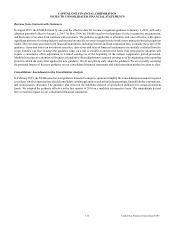

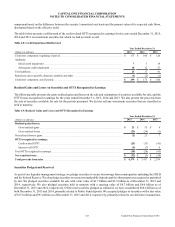

Accounting for Repurchase Transactions

In June 2014, the FASB issued guidance that requires repurchase-to-maturity transactions to be accounted for as secured borrowings

rather than sales. New disclosures are also required for certain transactions accounted for as secured borrowings and transfers

accounted for as sales when the transferor retains substantially all of the exposure to the economic return on the transferred financial

assets. Our adoption of the accounting guidance in the first quarter of 2015 did not have a significant impact on our financial

condition, results of operations or liquidity as the guidance is consistent with our current practice. As required by the new guidance,

the new disclosures were effective and have been provided beginning in the second quarter of 2015.

Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved

after the Requisite Service Period

In June 2014, the FASB issued guidance clarifying that a performance target contained within a share-based payment award that

affects vesting and can be achieved after the requisite service period has been completed is to be accounted for as a performance

condition. Accordingly, the grantor of such awards should recognize compensation cost in the period in which it becomes probable

that the performance target will be achieved. The amount of the compensation cost recognized should represent the cost attributable

to the requisite service period fulfilled. Our early adoption of this guidance in the first quarter of 2015 did not have a significant

impact on our financial condition, results of operations or liquidity as the guidance is consistent with our current practice.

Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity

In April 2014, the FASB issued guidance raising the threshold for a disposal to qualify as a discontinued operation. Under the new

guidance, a component of an entity or group of components that has been disposed by sale, disposed of other than by sale or is

classified as held for sale and that represents a strategic shift that has, or will have, a major effect on an entity’s operations and

financial results should be reported as discontinued operations. Our adoption of this guidance in the first quarter of 2015 did not

have any effect on our consolidated financial statements due to the prospective transition provisions.

Reclassification of Residential Real Estate Collateralized Consumer Mortgage Loans Upon Foreclosure

In January 2014, the FASB issued guidance clarifying when an entity should reclassify a consumer mortgage loan collateralized

by residential real estate to foreclosed property. Reclassification should occur when the creditor obtains legal title to the residential

real estate property or when the borrower conveys all interest in the residential real estate property to the creditor to satisfy that

loan through completion of a deed in lieu of foreclosure or through a similar legal agreement. An entity should not wait until a

redemption period, if any, has expired to reclassify a consumer mortgage loan to foreclosed property. Our adoption of this guidance

in the first quarter of 2015 did not have a significant impact on our financial condition, results of operations or liquidity as the

guidance is materially consistent with our current practice.

Recently Issued but Not Yet Adopted Accounting Standards

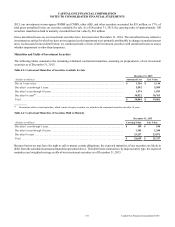

Recognition and Measurement of Financial Assets and Financial Liabilities

In January 2016, the FASB issued revised guidance for the recognition, measurement, presentation, and disclosure of financial

instruments. The main provisions of the guidance include, (i) most equity investments are to be measured at fair value and recorded

through net income, except those accounted for under the equity method of accounting, or those that do not have a readily

determinable fair value (for which a practical expedient can be elected); (ii) the use of the exit price notion is required when valuing

financial instruments for disclosure purposes; (iii) an entity shall present separately in other comprehensive income the portion of

the total change in the fair value of a liability under fair value option resulting from a change in the instrument-specific credit risk;

(iv) the determination of the need for a valuation allowance on a deferred tax asset related to an available-for-sale securities must

be made in combination with other deferred tax assets. The guidance eliminates the current classifications of equity securities as

trading or available-for-sale and will require separate presentation of financial assets and liabilities by category and form of the

financial assets on the face of the consolidated balance sheets or within the accompanying notes. The guidance also eliminates the

requirement to disclose the methods and significant assumptions used to estimate fair value of financial instruments measured at

amortized cost on the balance sheet. The guidance will be effective January 1, 2018. Early adoption is only permitted for the

requirement to present the portion of the total change in fair value attributable to a change in the instrument-specific credit risk in

other comprehensive income. We are currently assessing the potential impact of this new guidance on our consolidated financial

statements.